AUTHOR : PUMPKIN KORE

DATE : 01/11/2023

In today’s digital age, online businesses have proliferated, offering goods and services worldwide. However, to succeed in the highly competitive e-commerce landscape, efficient payment processing is paramount. This article explores the ins and outs of payment processing for online businesses, from its importance to the challenges it poses, and offers valuable insights into optimizing the payment experience for your customers.

Why Payment Processing is Vital

Smooth payment[1] processing is crucial for online businesses for several reasons. Primarily, it profoundly influences the overall user encounter.Customers demand a seamless, hassle-free checkout process, and a well-implemented payment system can significantly reduce cart abandonment rates.

Types of Payment Methods

Online businesses should offer a variety of payment options to cater to their diverse customer base. Credit and also debit cards, digital wallets, bank transfers, and also cryptocurrencies[2] are some of the popular payment methods available. Providing multiple choices enhances customer convenience.

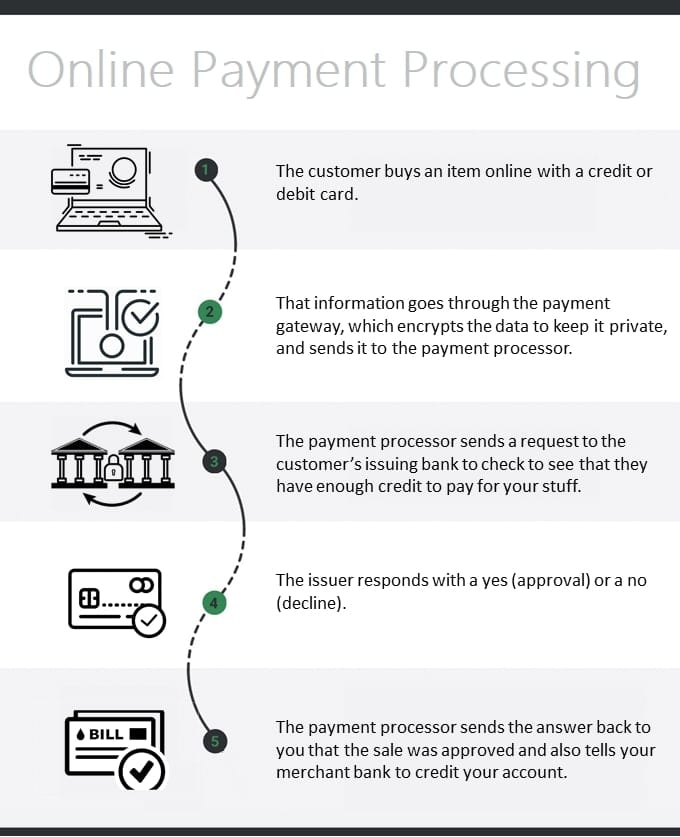

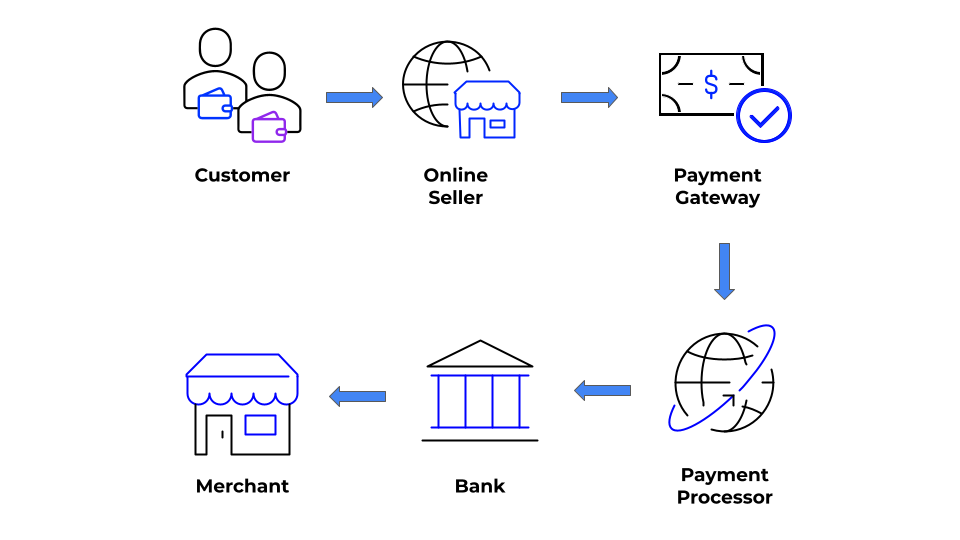

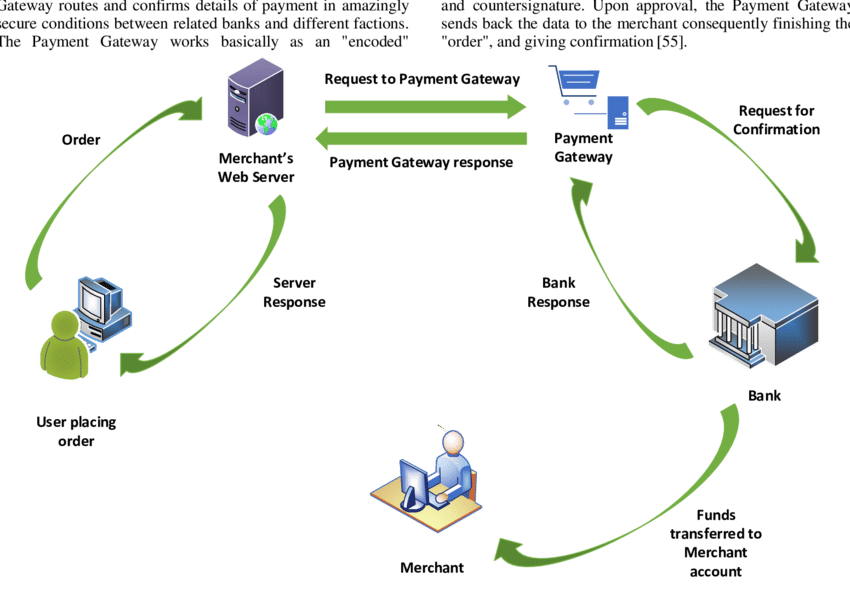

Setting Up Payment Gateways

Payment gateways serve as intermediaries connecting customers, merchants, and the financial establishments in a seamless transaction[3] process. It’s essential to choose a reliable payment gateway provider and also integrate it into your website or app.

Benefits of a Seamless Checkout Process

A seamless checkout process ensures higher conversion rates and customer satisfaction. Streamlined[4], user-friendly interfaces with clear instructions can significantly improve the customer experience.

Security Measures in Payment Processing

Ensuring the security of customer data is paramount. Implementing encryption and also compliance with industry standards like PCI DSS is vital to protect against fraud and data breaches.

Mobile-Friendly Payment Solutions

With the rise of mobile shopping, your payment process should be mobile-optimized. Responsive design and mobile-friendly interfaces make it easier for customers to make purchases from their smartphones.[5]

International Payment Processing

For businesses with a global reach, supporting international payments is crucial. Understanding currency conversion, cross-border fees, and also compliance with local regulations are essential considerations.

Reducing Cart Abandonment

High cart abandonment rates can be a significant issue for online businesses. Strategies like offering guest checkout, transparent pricing, and also providing various payment options can help reduce cart abandonment.

Integrating Subscription Payments

Subscription-based models are increasingly popular. Integrating recurring payment options can provide a steady stream of income for businesses.

Customer Trust and Transparency

Transparency in pricing, refund policies, and also clear terms and also conditions build trust with your customers. Payment processing should align with these principles.

Challenges in Payment Processing

Online businesses face challenges like fraud, payment disputes, and compliance with ever-evolving regulations. Staying updated and implementing fraud prevention measures is vital.

Payment Processing Best Practices

Implement best practices like real-time transaction monitoring, automatic payment retries, and clear communication with customers to ensure a smooth payment process.

Choosing the Right Payment Processor

Making the right choice of payment processor stands as a pivotal and crucial determination.

Factors to consider include transaction fees, ease of integration, and also the level of support provided.

The Future of Online Payment Processing

The payment processing landscape is continually evolving. Trends like contactless payments, biometric authentication, and also the use of artificial intelligence in fraud detection are shaping the future of online payments.

The Future of Online Payment Processing

As we step into the future, the landscape of online payment processing continues to evolve, driven by technological advancements and also shifting consumer preferences. Here are a few noteworthy trends and also advancements deserving of your attention:

- Contactless Payments: The COVID-19 pandemic accelerated the adoption of contactless payments as consumers sought touch-free payment options. Near Field Communication (NFC) technology allows customers to make payments simply by tapping their cards or mobile devices at the point of sale. This pattern is anticipated to endure and continue expanding.

- Biometric Authentication: Many smartphones and also devices now come equipped with biometric features like fingerprint recognition and facial scanning. These technologies provide an additional layer of security and convenience, making it easier for customers to make payments securely.

- AI and Machine Learning: Artificial intelligence and machine learning are being harnessed for fraud detection and prevention. These technologies can analyze vast amounts of data in real-time, identifying suspicious activities and protecting both businesses and consumers from fraudulent transactions.

- Cryptocurrencies: While still in the early stages, cryptocurrencies like Bitcoin and Ethereum are gaining acceptance as payment methods. Some businesses now offer the option to pay with digital currencies, and this trend is expected to continue as cryptocurrencies become more mainstream.

conclusion.

payment processing is the lifeblood of any online business. A seamless, secure, and user-friendly payment experience is essential for customer satisfaction and business success. By staying updated with the latest trends and also best practices, online businesses can navigate the complexities of payment processing effectively.

FAQs

- What are the common types of payment methods for online businesses?

- Credit and debit cards, digital wallets, bank transfers, and cryptocurrencies are common payment methods.

- How can businesses reduce cart abandonment during the checkout process?

- Businesses can reduce cart abandonment by offering guest checkout, transparent pricing, and various payment options.

- What is the role of payment gateways in online payment processing?

- Payment gateways act as intermediaries between customers, merchants, and financial institutions, facilitating secure transactions.

- Why is security crucial in payment processing for online businesses?

- Security is essential to protect customer data and prevent fraud and data breaches.

- What are the emerging trends in online payment processing?

- Emerging trends include contactless payments, biometric authentication, and the use of AI in fraud detection.