AUTHOR: DARCY SHARMA

DATE :1/11/23

Introduction

In the ever-evolving landscape of banking and finance, efficient payment processing is the lifeblood that keeps the industry running smoothly. Banks play a pivotal role in handling a vast array of financial transactions daily, including payments, transfers, and settlements. This article delves into the intricacies of payment processing for banks, shedding light on its significance, challenges, and the evolving technologies that are transforming this crucial sector.

Understanding the Importance of Payment Processing

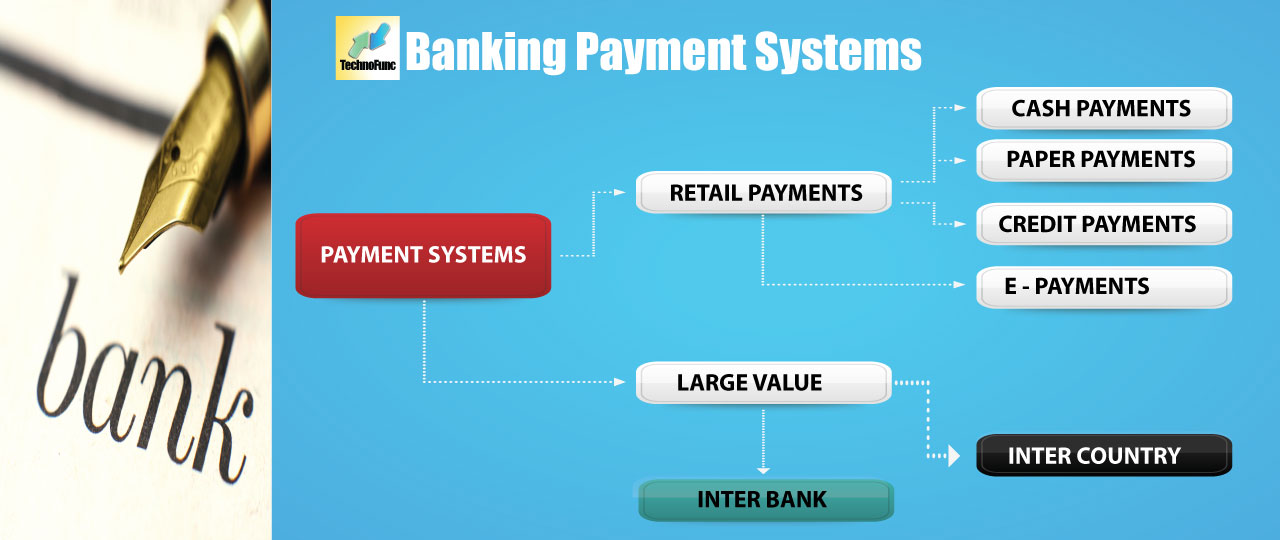

The Backbone of Banking Operations

Payment processing is the backbone of banking operations. It encompasses the systems and procedures that enable customers to make payments, transfer funds, and settle financial obligations. This function ensures that funds are moved securely and swiftly, providing the foundation for various banking services.

Customer Expectations

Banks face increasing pressure to meet customer expectations in terms of payment processing. In today’s fast-paced world, customers demand seamless, real-time, and secure transactions. Meeting these expectations is crucial for customer satisfaction and retaining a competitive edge in the market.

Challenges in Payment Processing

Security Concerns

One of the primary challenges in payment processing is ensuring the security[1] of transactions. With the constant threat of cyberattacks and fraud[2], banks must employ robust security measures to protect sensitive customer data and financial assets.

Regulatory Compliance

The financial industry is heavily regulated, and banks must navigate a complex web of regulations and compliance requirements. Failure to meet these standards can result in severe penalties, making compliance a top priority.

Technological Advancements

The world of technology[4] is evolving at an astonishing pace, and banks must keep up. Implementing new payment processing technologies while ensuring a seamless transition[3] from legacy systems can be a challenging task.

Evolution of Payment Processing Technologies

Blockchain and Cryptocurrencies

Blockchain technology has emerged as a game-changer in the world of payment processing. Its decentralized and secure nature offers a new way of conducting transactions, while cryptocurrencies like Bitcoin have gained popularity as digital[5] assets.

Mobile Payments

Mobile payment platforms, such as Apple Pay and Google Pay, have become ubiquitous. They allow customers to make payments using their smartphones, revolutionizing the way people conduct transactions.

Streamlining Payment Processing

Automation and Artificial Intelligence

To streamline payment processing, banks are increasingly turning to automation and artificial intelligence. These technologies can reduce errors, enhance efficiency, and provide valuable insights for decision-making.

Real-Time Processing

Real-time payment processing is becoming the industry standard. It allows for instant fund transfers and provides customers with the convenience they expect in the digital age.

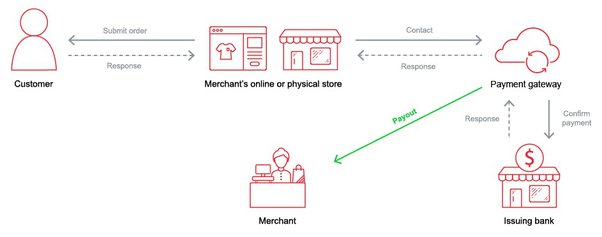

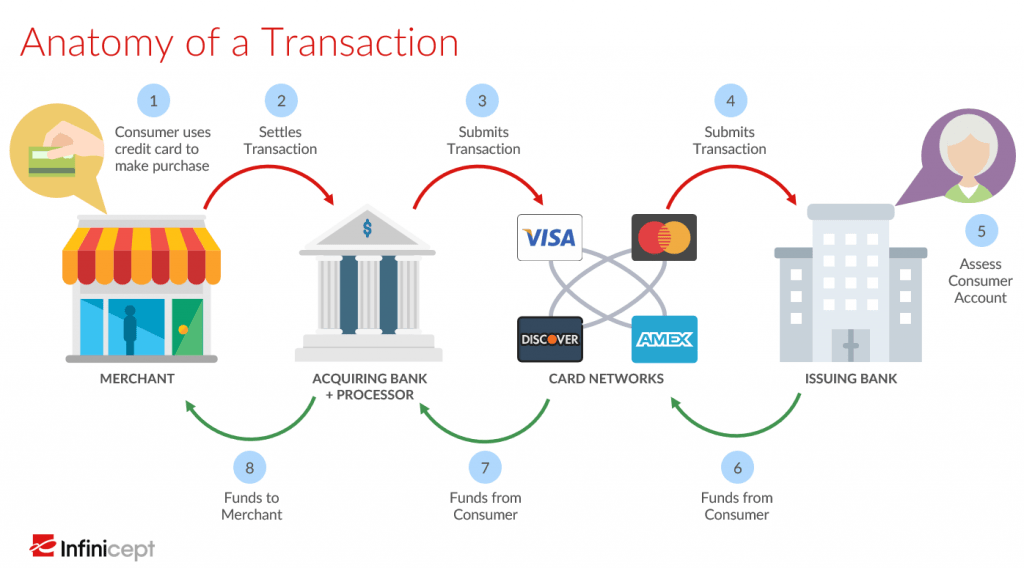

The Role of Financial Institutions

Banks, as financial intermediaries, play a pivotal role in payment processing. They serve as custodians of customer funds and facilitate the movement of money between various parties. This involves collaborating with other financial institutions, such as central banks, to ensure the smooth flow of transactions within the broader financial system.

Interbank Settlements

Interbank settlements are a crucial component of payment processing. These transactions involve the exchange of funds between banks, enabling them to balance their accounts and settle their obligations to one another. Technologies like the Real-Time Gross Settlement (RTGS) system have revolutionized interbank settlements by providing instantaneous and secure fund transfers.

Cross-Border Payments

In an increasingly globalized world, cross-border payments are on the rise. Banks are tasked with ensuring that these transactions are not only efficient but also compliant with international regulations. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) network is a widely used system for cross-border payments, but emerging technologies like Ripple’s XRP offer faster and cheaper alternatives.

The Future of Payment Processing

As technology continues to advance, the future of payment processing for banks looks promising. Here are some trends to watch:

Contactless Payments

Contactless payments have gained popularity, especially in the wake of the COVID-19 pandemic. With a simple tap or wave of a card or smartphone, customers can make payments quickly and securely, reducing the need for physical cash.

Biometric Authentication

To enhance security, banks are increasingly turning to biometric authentication methods, such as fingerprint recognition and facial recognition.

These innovative solutions offer an extra shield against fraudulent activities, significantly bolstering security measures.

Conclusion

In the dynamic world of banking, payment processing stands as a vital function that ensures the seamless flow of financial transactions. While challenges persist, innovative technologies and strategies are continuously transforming this landscape. Banks must adapt to these changes to meet customer expectations, ensure security, and remain competitive.

Frequently Asked Questions

1. How important is payment processing for banks?

Payment processing is of utmost importance for banks as it forms the foundation of their operations. It enables customers to make payments, transfer funds, and settle financial obligations securely and swiftly.

2. What are the main challenges in payment processing?

The main challenges in payment processing for banks include security concerns, regulatory compliance, and keeping up with technological advancements.

3. How do banks ensure the security of payment processing?

Banks employ robust security measures to protect sensitive customer data and financial assets, including encryption, multi-factor authentication, and continuous monitoring.

4. What role does blockchain technology play in payment processing?

Blockchain technology offers secure, decentralized transaction methods and has the potential to revolutionize payment processing by increasing transparency and reducing the risk of fraud.

5. Why is real-time processing becoming increasingly popular?

Real-time payment processing is gaining popularity because it provides customers with instant fund transfers, aligning with the demands of the digital age and enhancing overall convenience.