AUTHOR : KYLIE SCOTT

DATE : 31/10/23

In today’s fast-paced business[1] landscape, the payment processing industry has emerged as a lucrative sector, offering vast potential for entrepreneurs and also investors[2]. This article delves into the intricacies of the payment[3] processing business, shedding light on its profitability and exploring the opportunities for those seeking to buy a payment processing business.

Introduction: Navigating the Payment Processing Landscape

The payment processing industry plays a pivotal[4] role in facilitating financial transactions for businesses and also consumers. From online payments to credit card processing, this sector is dynamic and ever-evolving. As technology advances, the payment processing landscape continues to expand, offering a wealth of opportunities for savvy entrepreneurs.

The Lucrative Nature of Payment Processing Businesses

Payment processing businesses are known for their profitability. They generate revenue through various channels, including transaction[5] fees, monthly subscriptions, and also value-added services. These revenue streams make them an attractive investment option.

Why Consider Buying a Payment Processing Business

Investing in an established payment processing business can be more advantageous than starting from scratch. You inherit an existing customer base, infrastructure, and revenue streams. This can significantly reduce the time and effort required to establish a foothold in the market.

Identifying the Right Business to Acquire

Choosing the right payment processing business to acquire is crucial. Consider factors such as the company’s reputation, financial performance, and growth potential. Conducting a thorough market analysis is essential for arriving at an informed decision.

Due Diligence: A Crucial Step in the Acquisition Process

Prior to concluding a transaction, meticulous due diligence becomes imperative. Examine the business’s financial records, contracts, and client relationships. It’s crucial to ensure there are no hidden liabilities that could pose challenges in the future.

Navigating Regulatory and Compliance Challenges

The payment processing industry is highly regulated. Ensure that the business you plan to acquire complies with all relevant laws and also regulations. Non-compliance can result in fines and legal issues that could impact profitability.

The Influence of Technology: Keeping Pace with Innovation

Technology is at the heart of payment processing. To remain competitive, you must stay up to date with the latest advancements in payment technology. Consider the business’s technology infrastructure and its ability to adapt to changing industry trends.

Customer Base and Retention Strategies

A robust customer base is a valuable asset. Assess the company’s approaches to acquiring and retaining customers. Analyze both customer acquisition and retention strategies .A loyal client base can contribute significantly to your success.

Streamlining Operations for Efficiency

Operational efficiency is key to profitability. Assess the current operational processes and identify areas where improvements can be made. Streamlining operations can reduce costs and also enhance service delivery.

Marketing and Growth Strategies

A well-thought-out marketing strategy can drive growth. Explore the business’s current marketing efforts and consider how you can expand its reach and attract new clients.

Financial Aspects of Acquiring a Payment Processing Business

Understand the financial aspects of the acquisition, including the purchase price, financing options, and potential ROI. A clear financial plan is essential for a successful acquisition.

Potential Risks and How to Mitigate Them

Every business venture carries risks. Identify potential risks, such as changing industry regulations or market competition, and develop strategies to mitigate them.

Success Stories: Real-Life Case Studies

Learning from success stories can provide valuable insights. Explore case studies of individuals who have successfully acquired payment processing businesses and achieved remarkable results.

The Future of Payment Processing

The payment processing industry is evolving rapidly. Stay informed about emerging trends and technologies that could shape the future of this industry.

Conclusion: Your Path to a Profitable Business Venture

In conclusion, the payment processing business presents a wealth of opportunities for entrepreneurs seeking a profitable venture. By conducting thorough research, making informed decisions, and implementing effective strategies, you can unlock the potential of this thriving industry.

Frequently Asked Questions

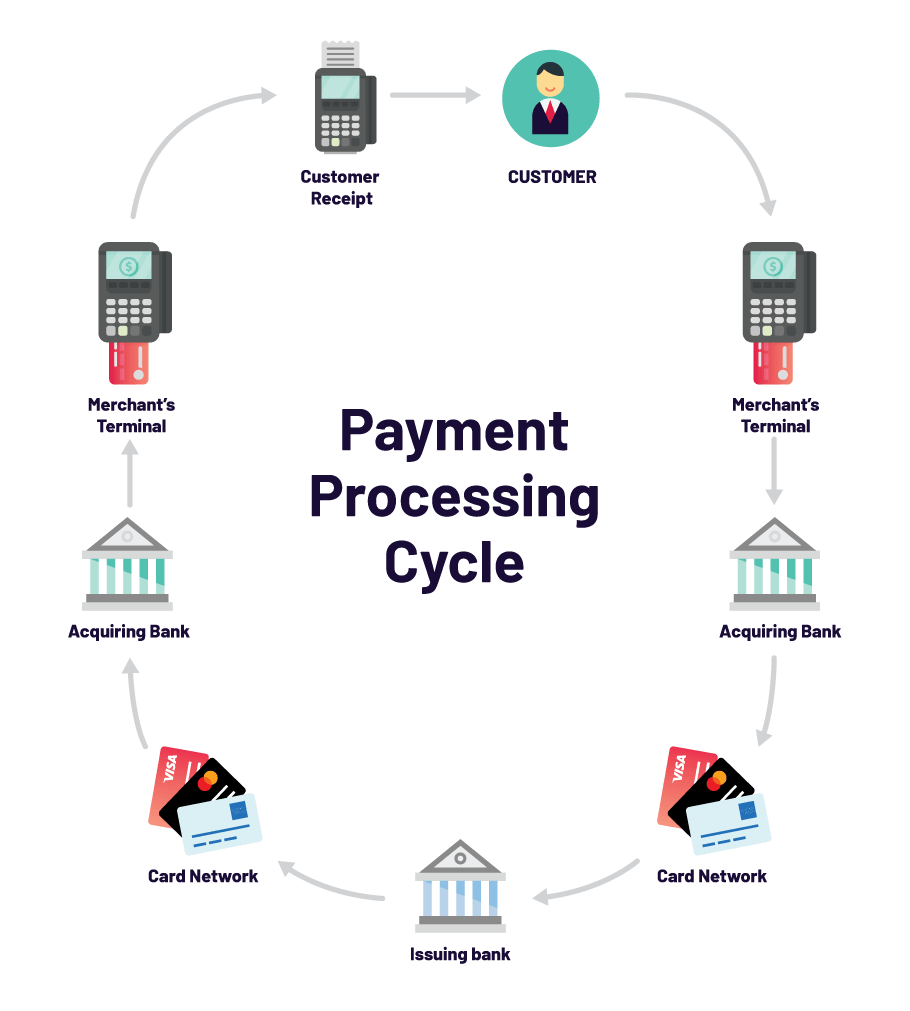

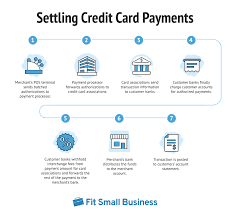

- What is payment processing, and how does it work? Payment processing involves the handling of financial transactions, including credit card payments, online transfers, and more. It ensures the secure and efficient transfer of funds between customers and businesses.

- Are payment processing businesses recession-proof? While payment processing businesses are relatively resilient, economic downturns can still affect transaction volumes. However, they often recover quickly due to their essential role in commerce.

- What are the key regulatory challenges in the payment processing industry? Regulatory challenges in payment processing typically revolve around data security, fraud prevention, and compliance with anti-money laundering and know-your-customer regulations.

- Is it necessary to have a background in finance to buy a payment processing business? While a financial background can be beneficial, it’s not a strict requirement. Partnering with experts and conducting thorough due diligence can help bridge knowledge gaps.

- How can I stay updated on industry trends in payment processing? To stay informed, consider subscribing to industry publications, attending conferences, and joining professional networks focused on payment processing.