AUTHOR : ISTELLA ISSO

DATE : 31/10/23

In today’s fast-paced digital world, payment processing has become an integral part of our lives. From buying groceries online to subscribing to streaming services, we rely on payment processing systems to make seamless transactions. But have you ever wondered how these systems work behind the scenes? This article will delve into the intricacies of payment processing architecture,casting off light on the technology that ensures your payments are swift, secure, and hassle-free.

Introduction

Payment processing architecture is the backbone of modern commerce. It ensures that when you click “Buy Now” or swipe your credit card, the transaction flows seamlessly from your bank to the merchant’s account. The complexity of payment processing is often hidden from consumers, but understanding it can help you appreciate the technology that makes your daily transactions possible.

The Fundamentals of Payment Processing

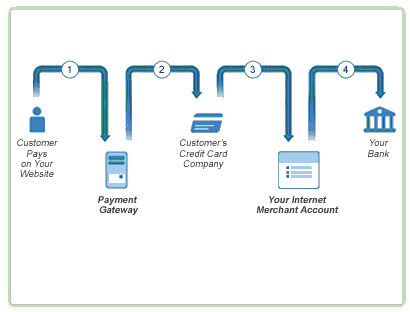

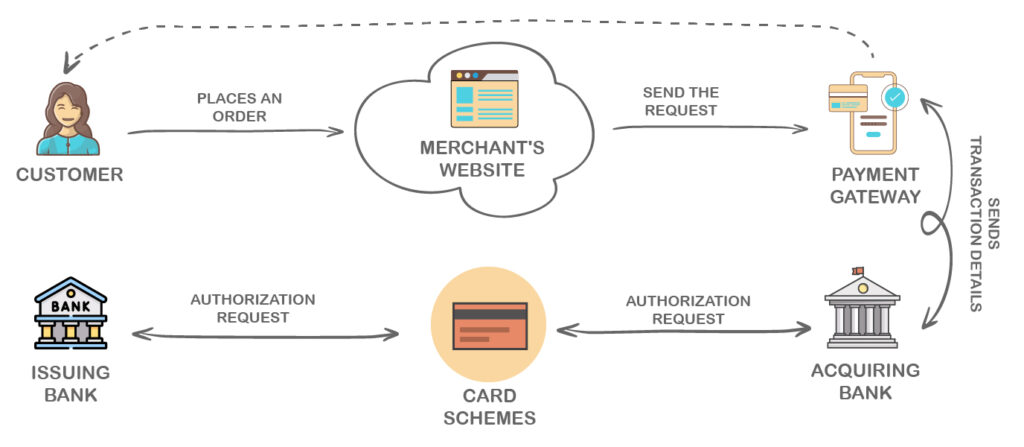

Understanding Payment Gateways

Payment gateways are like digital cashiers. They handle the interaction between the customer, the merchant, and also the financial institutions. They encrypt the data and send it through a secure channel for processing.

Merchant Accounts: The Connectors

Merchant account[1]s act as middlemen between payment portals and also a merchant[2]‘s bank. They are ess ential for businesses to receive payments securely.

The Payment Processing Flow

Payment handling ntails three key steps:

Authorization

During this phase, the payment gateway checks if the client’s payment[4] method is valid and has satisfactory[3] funds.

Clearing

In the settling[5]phase, thedeal data is sent to the issuing bank and also the vendor bank. The issuing bank confirms the transaction, and the merchant bank holds the funds.

Settlement

In the settlement phase, the funds are transferred from the issuing bank to the retailer’s account.

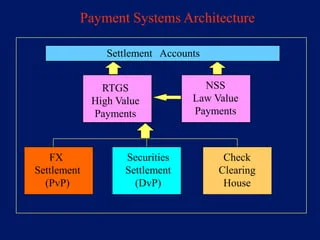

Types of Payment Processing Architectures

Traditional Architecture

The traditional architecture uses on-premises hardware also is slowly being phased out in favor of more agile solutions.

Modern Cloud-Based Architecture

Cloud-based architectures offer flexibility and al scalability, making them popular for businesses of all sizes.

Security in Payment Processing

Encryption and Tokenization

Data security is paramount in payment processing. Encryption also tokenizing techniques ensure that sensitive information remains safe.

Fraud Detection

Advanced algorithms also machine learning are employed to detect and prevent fraudulent transactions.

Challenges in Payment Processing

Compliance and Regulations

Payment processing must adhere to strict regulations to ensure consumer protection and also prevent money laundering.

Emerging Technologies

Keeping up with the latest technologies is a challenge, but it’s necessary to stay competitive.

The Future of Payment Processing

Blockchain Integration

Blockchain technology is being explored for its potential to make payment processing even more secure and transparent.

Contactless Payments

Contactless payments are becoming increasingly popular, especially in a post-pandemic world.

Payment Processing for E-commerce

Shopping Cart Integration

Integrating payment processing into e-commerce platforms is crucial for a seamless shopping experience.

Customer Experience

User-friendly interfaces also quick payment options are essential for e-commerce success.

Mobile Payment Processing

Mobile wallets have revolutionized how we make payments using our smartphones.

QR Code Payments

QR codes simplify payments, also their usage is on the rise.

The Role of APIs in Payment Processing

APIs (Application Programming Interfaces) enable different systems to communicate, enhancing the payment process.

Payment Processing in a Global Economy

Currency Conversion

Cross-border transactions often involve currency conversion, which adds complexity to payment processing.

Cross-Border Transactions

Global businesses rely on efficient payment processing to navigate international markets.

The Importance of User Experience

A smooth payment process contributes to an excellent customer experience, which can drive customer loyalty.

The Future of Payment Processing

The future of payment processing holds exciting prospects, as technology continues to evolve. Here are a couple of trends to watch for:

Blockchain Integration

Blockchain technology, originally developed for cryptocurrencies like Bitcoin, is gaining traction in the payment processing industry. Its decentralized and immutable ledger system offers enhanced security, transparency, and reduced transaction costs. Blockchain can streamline the payment process, especially for international transactions, by eliminating intermediaries and providing an auditable record of transactions.

This technology ensures trust and accountability by creating a tamper-proof digital ledger that all parties can access. As blockchain integration becomes more widespread, it has the potential to revolutionize how we perceive and perform financial transactions.

Contactless Payments

Contactless payments have seen a significant surge in popularity, primarily due to their hygienic advantages during the COVID-19 pandemic. These payments, facilitated through near-field communication (NFC) technology, allow users to make transactions by simply tapping their cards or smartphones on compatible terminals.

The ease and speed of contactless payments have made them a preferred choice for both consumers and merchants. With the ongoing development of wearable devices and the Internet of Things (IoT), contactless payments are expected to expand their reach and offer even more convenience in everyday transactions.

Conclusion

Payment processing architecture is a vital component of the digital economy. As technology advances, we can expect even more innovative solutions and enhanced security in the world of payments. Understanding how it works empowers businesses and consumers alike.

FAQs

Q1. What is a payment gateway? A payment gateway is a service that securely transmits payment information between a customer, a merchant, and the respective financial institutions.

Q2. Why is data security crucial in payment processing? Data security is vital to protect sensitive customer information and prevent fraudulent activities.

Q3. How do mobile wallets work? Mobile wallets store payment information on a mobile device and use it to facilitate transactions.

Q4. Are contactless payments safe? Contactless payments are considered safe and often include multiple security features.

Q5. What role do APIs play in payment processing? APIs allow different software systems to communicate and exchange data, making payment processing more efficient and versatile.