AUTHIOR : PUMPKIN KORE

DATE : 31/10/2023

Payment processing apps, often referred to as mobile payment apps, are “program.” applications designed to “simplify.” the electronic transfer of funds. They enable users to make payments, receive money, and manage financial transactions through a digital platform. These apps serve as a bridge between customers, “retailers.” and also financial organizations.”

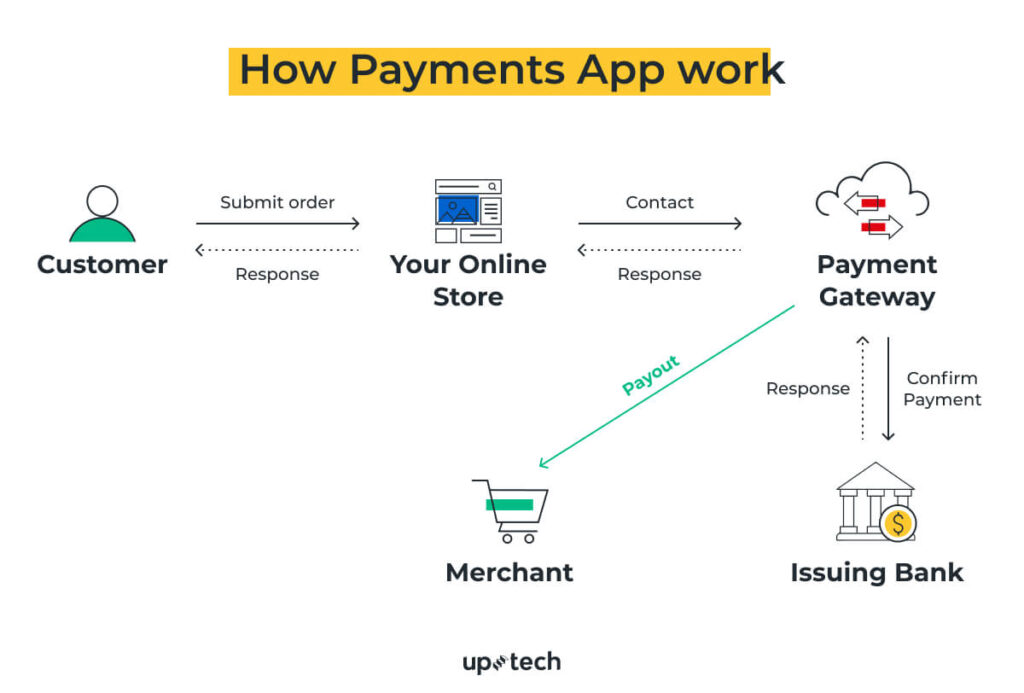

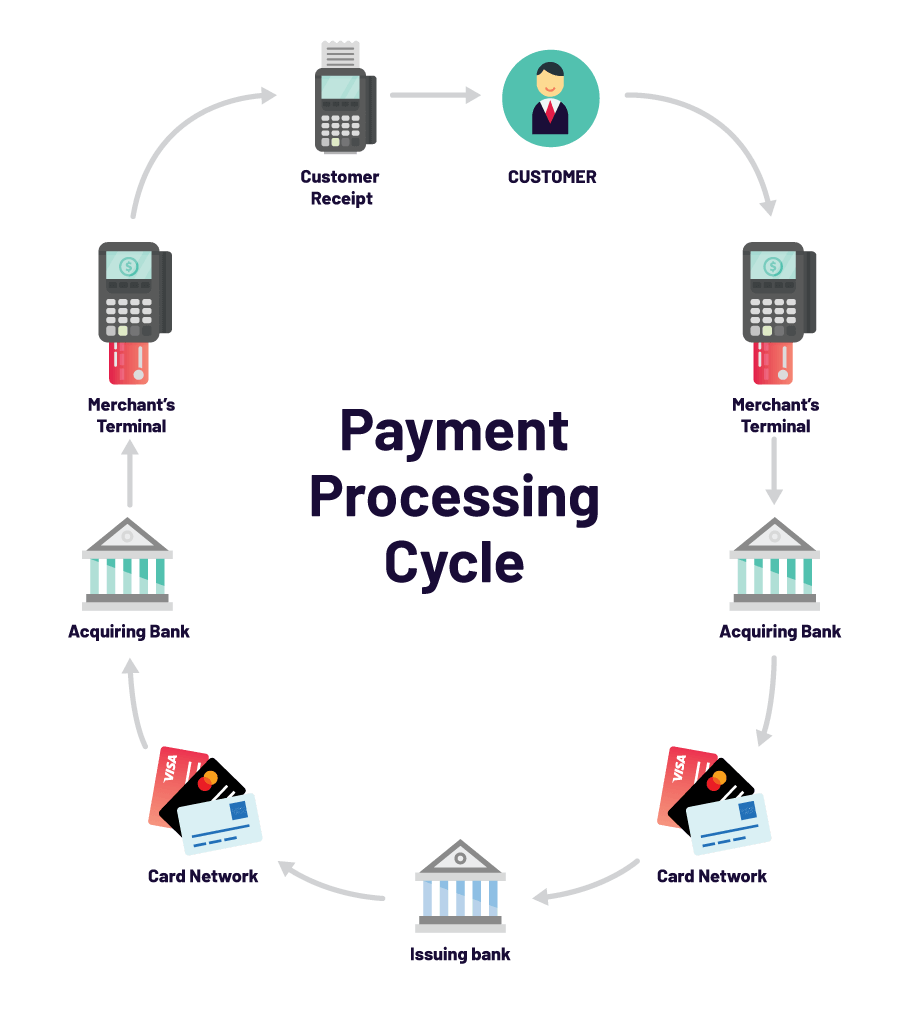

How Do They Work?

Payment processing apps utilize secure and “coded.” connections to transfer data between the payer and payee. They link the user’s bank account, credit card, or other payment methods to the app, ensuring seamless transactions. The app communicates with the merchant’s point-of-sale system confirming and also completing the deal swiftly.

Benefits of PPA

Convenience and Accessibility

One of the primary advantages of payment processing apps is the convenience they offer. Individuals have the”adaptability.”to initiate payments at their convenience [1]from any location, all through the use of their mobile devices. Whether it’s paying for groceries,”dividing.”a bill, or shopping online, these apps simplify financial transactions.

Enhanced Security

Payment processing apps employ robust security measures to protect user data. Encryption, two-factor authentication[2], and real-time fraud detection systems are among the features that ensure your transactions are safe and also secure.

Streamlined Transactions

These apps streamline the PPA, reducing the need for physical cash or credit cards. This not only accelerates the payment process but also reduces the risk of errors and fraud.

Features to Look For

Multiple Payment Options

A good payment processing app should support various payment methods, including credit and also debit cards, digital wallets, and even emerging payment technologies like QR codes[3] also digital currency.

User-Friendly Interface

An intuitive, user-friendly interface is vital for both customers and merchants. The app should be easy to navigate, ensuring a smooth and hassle-free payment experience.

Reporting and Analytics

Payment processing apps often provide valuable perceptions into exchange history, helping businesses[4] make informed decisions about their funds and also customer behavior.

Industry Applications

E-commerce

In the world of online shopping, PPA play a crucial role. They provide a secure and also efficient way for consumers to make acquisition[5] and for businesses to accept payments.

Restaurants and Food Delivery

Restaurants and food delivery services rely on PPA to offer customers the convenience of mobile payments. These apps are particularly useful for splitting bills when dining out with friends.

Small Businesses

Small businesses benefit from the affordability and also flexibility of PPA. They enable entrepreneurs to accept payments without the need for expensive hardware.

Top PPA

PayPal

PayPal is a well-established PPA known for its ubiquitous approval and user-friendly interface. It offers both personal and business accounts, making it suitable for a variety of users.

Square

Square is popular among small businesses, providing a range of services beyond payment processing, including point-of-sale solutions and inventory management.

Stripe

Stripe is a favorite among e-commerce businesses for its customizable payment solutions and powerful developer tools.

Apple Pay

Apple Pay is known for its seamless integration with Apple devices, allowing users to make payments with their iPhones, iPads, and Macs securely.

Choosing the Right PPA

Consider Your Business Needs

When selecting a payment processing app, consider your specific business requirements. Different apps cater to different industries and business sizes.

Compare Fees and Pricing

Pay attention to the fees and pricing structures of each app. Some charge a flat rate per transaction, while others use a tiered pricing model.

Read User Reviews

Before making a decision, read reviews and seek recommendations from other users. Their experiences can provide valuable insights.

Setting Up a PPA

Registration and Verification

To commence, you will be required to begin the registration and authentication process for your account.. This process may require providing personal and business information.

Integrating with Your Platform

Integrating the app with your website or point-of-sale system is a crucial step. Ensure a seamless connection to provide customers with a smooth payment experience.

Customizing Your Settings

Customize your app settings to match your business marketing and preferences, such as receipt formatting and notifications.

Security Measures

Encryption and Data Protection

Payment processing apps use encryption to secure data during conveyance and they store sensitive information in compliance with industry standards.

Two-Factor Authentication

Implementing two-factor authentication adds an extra layer of security to your account, reducing the risk of unauthorized access.

Fraud Detection

Real-time fraud detection systems monitor transactions for suspicious activity, providing an additional safeguard.

The Future of PPA

Emerging Technologies

Payment processing apps are continuously evolving. Expect to see the integration of emerging technologies like biometric authentication and artificial intelligence.

The Rise of Cryptocurrency Payments

As cryptocurrencies gain popularity, more payment processing apps are likely to support digital currencies as a payment method.

Enhanced Personalization

Apps will become more personalized, offering tailored recommendations and rewards to users based on their transaction history.

Conclusion

Payment processing apps have transformed the way we handle transactions, making them faster, more secure, and highly accessible. As technology continues to advance, these apps will only become more integral to our financial lives.

For further information and to discover the best payment processing apps for your needs, explore our FAQs below.

FAQs

- What are the advantages of using a payment processing app over traditional payment methods? Payment processing apps offer greater convenience, enhanced security, and streamlined transactions compared to traditional methods.

- Is it safe to link my bank account or credit card to a payment processing app? Yes, payment processing apps employ robust security measures to safeguard your financial information.

- Can I use payment processing apps for international transactions? Many payment processing apps support international transactions, but it’s essential to check their specific capabilities and fees for such transactions.

- What steps should I take to select the most suitable payment processing app for my business? To select the best app, consider your business needs, compare fees, and read user reviews to gather insights.

- What does the future hold for payment processing apps? The future promises emerging technologies, cryptocurrency integration, and improved customization to offer an even more sophisticated payment experience