AUTHOR : SELENA GIL

DATE : 29/11/2023

Introduction

In the dynamic landscape of online transactions, the role of payment process[1] services cannot be overstated. This article dives into the intricacies of these services, exploring their evolution, significance, and the impact they have on businesses and consumers alike.

Understanding Payment Process Services

The Foundation: What Are Payment Process Services?

In the digital realm, act as intermediaries between buyers and sellers, facilitating secure and efficient financial transactions[2].

Evolution Over Time

The evolution of payment process services[3] from traditional to digital methods, highlighting key milestones and technological advancements.

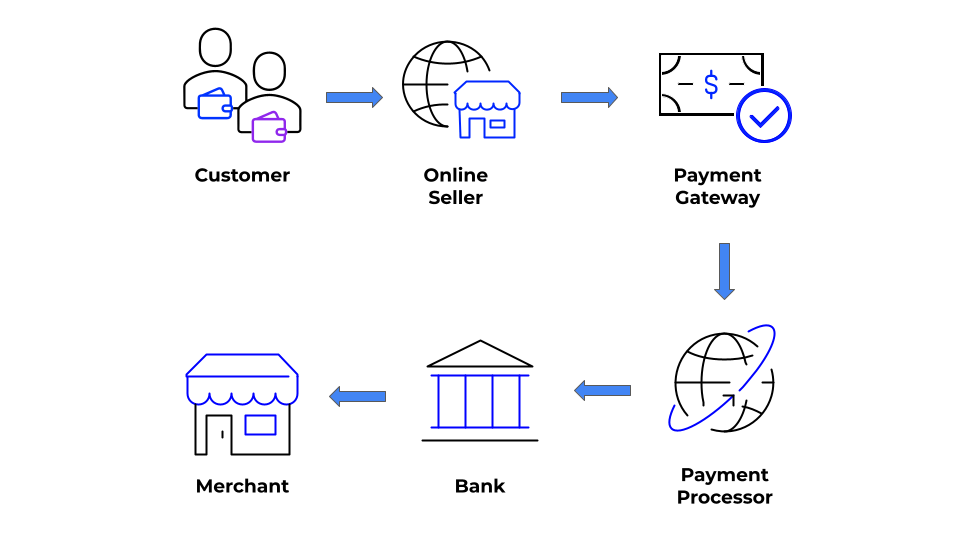

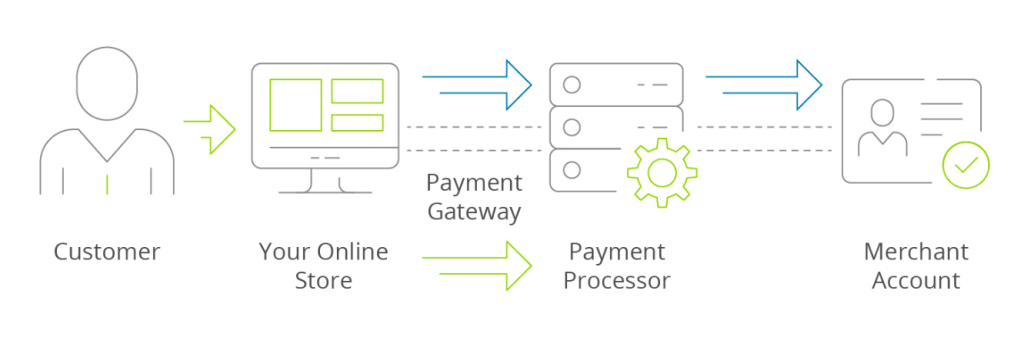

Key Components of Payment Process Services

An in-depth exploration of the core elements that make up a , including encryption, authorization, and settlement.

The Significance of Efficient Payment Processes

Boosting Business Operations

How streamlined payment processes[4] contribute to the overall efficiency of businesses, saving time and resources.

Enhancing Customer Experience

The impact of seamless payment[5] experiences on customer satisfaction and loyalty.

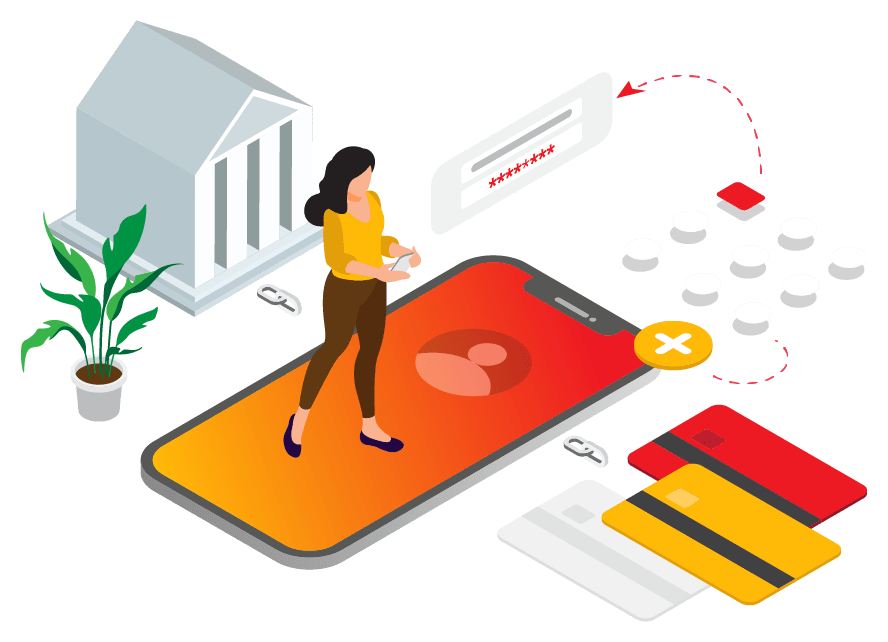

Security Measures in Payment Processes

Exploring the robust security measures integrated into to safeguard sensitive financial information.

Challenges in Payment Processing

Frauds and Security Threats

An analysis of common challenges faced by payment process services, with a focus on fraud prevention and security measures.

Regulatory Compliance

The complex landscape of regulations governing payment processes and the importance of compliance for businesses.

Technological Challenges

Addressing the challenges posed by rapidly advancing technology in the payment processing domain.

Choosing the Right Payment Process Service

Factors to Consider

Guidance on selecting the most suitable for businesses, considering factors like scalability, integration, and cost.

Industry-Specific Solutions

Highlighting how payment process services tailor their offerings to meet the unique needs of various industries.

Future-Ready Solutions

Exploring trends and innovations shaping the future of from blockchain technology to contactless payments.

Benefits of Effective Payment Processing Services

Cost Efficiency

Examining how streamlined payment processes contribute to cost savings for businesses.

Global Reach

The role of enabling businesses to expand their reach to a global audience.

Data Analytics for Business Growth

How payment process services leverage data analytics to provide valuable insights for business growth.

Contactless Payments

Delving into the rise of contactless payments and how they are reshaping the way consumers interact with payment process services, emphasizing speed and convenience.

Mobile Wallets and Apps

Exploring the growing popularity of mobile wallets and apps, offering users a seamless and integrated payment experience on their smartphones.

Cryptocurrency Integration

Analyzing the role of cryptocurrencies in and how someare adapting to include digital currencies as a legitimate payment method.

Biometric Authentication

Examining the use of biometric data, such as fingerprints or facial recognition, as an additional layer of security in payment processes.

AI and Machine Learning

Discussing how artificial intelligence and machine learning algorithms are being employed to detect and prevent fraudulent activities in real-time.

Tokenization

Explaining the concept of tokenization and its role in enhancing the security of sensitive payment data.

Cross-Border Transactions

Highlighting the challenges and solutions associated with payment process services in facilitating seamless cross-border transactions for businesses operating on a global scale.

Cultural Considerations

Acknowledging the importance of cultural nuances in and how services need to adapt to different cultural expectations and preferences.

Importance of Customer Support

Stressing the significance of robust customer support in and its impact on customer trust and satisfaction.

User-Friendly Interfaces

Exploring the role of user-friendly interfaces in and how a seamless user experience contributes to overall customer satisfaction.

Decentralized Finance (DeFi)

Unpacking the concept of DeFi and its potential to revolutionize traditional financial offering a decentralized alternative for payment processes.

Smart Contracts

Exploring the role of smart contracts in , automating and executing contractual agreements without the need for intermediaries.

Internet of Things (IoT) Integration

Discussing how the Internet of Things is influencing payment processes, especially in scenarios where devices seamlessly transact with each other.

Carbon Footprint Reduction

Addressing the environmental impact of payment processes and how some are adopting sustainable practices to reduce their carbon footprint.

Social Responsibility

Examining how are incorporating social responsibility initiatives, contributing to societal well-being beyond their transactional role

Conclusion

In conclusion, are the backbone of modern transactions, offering efficiency, security, and adaptability to businesses worldwide. Embracing the right is not just a choice; it’s a strategic move towards sustainable growth in the digital era.

FAQs

Are payment processing services only for online businesses?

While they are crucial for online transactions, they have applications in various industries, including retail and finance.

How do payment processing services protect against fraud?

Robust encryption, two-factor authentication, and continuous monitoring are some measures employed to safeguard against fraud.

Is it necessary for small businesses to invest in payment processing services?

Yes, even small businesses benefit from the efficiency and security provided by enhancing their credibility.

What role does blockchain play in payment processing services?

Blockchain adds an extra layer of security and transparency to payment processes, reducing the risk of fraud.

Can payment processing services handle high transaction volumes?

Yes, many are designed to scale with the growing needs of businesses, ensuring smooth operations.