AUTHOR : MICKEY JORDAN

DATE : 08/12/2023

Introduction

In the rapidly evolving digital economy, online payment processing[1] companies play a crucial role in enabling businesses to securely and efficiently manage transactions. Whether you’re an eCommerce merchant, a subscription-based service, or a freelance professional accepting payments[2] online, these companies provide the infrastructure that allows businesses to process payments safely and swiftly.

What Are Online Payment Processing Companies?

Online payment[3] processing companies are service providers that handle electronic transactions between buyers and sellers over the internet. They enable the movement of funds from a customer’s bank or digital wallet[4] directly into the merchant’s account.. These companies act as intermediaries, ensuring that payments are processed securely And that both the customer and merchant[5] receive prompt transaction confirmation.

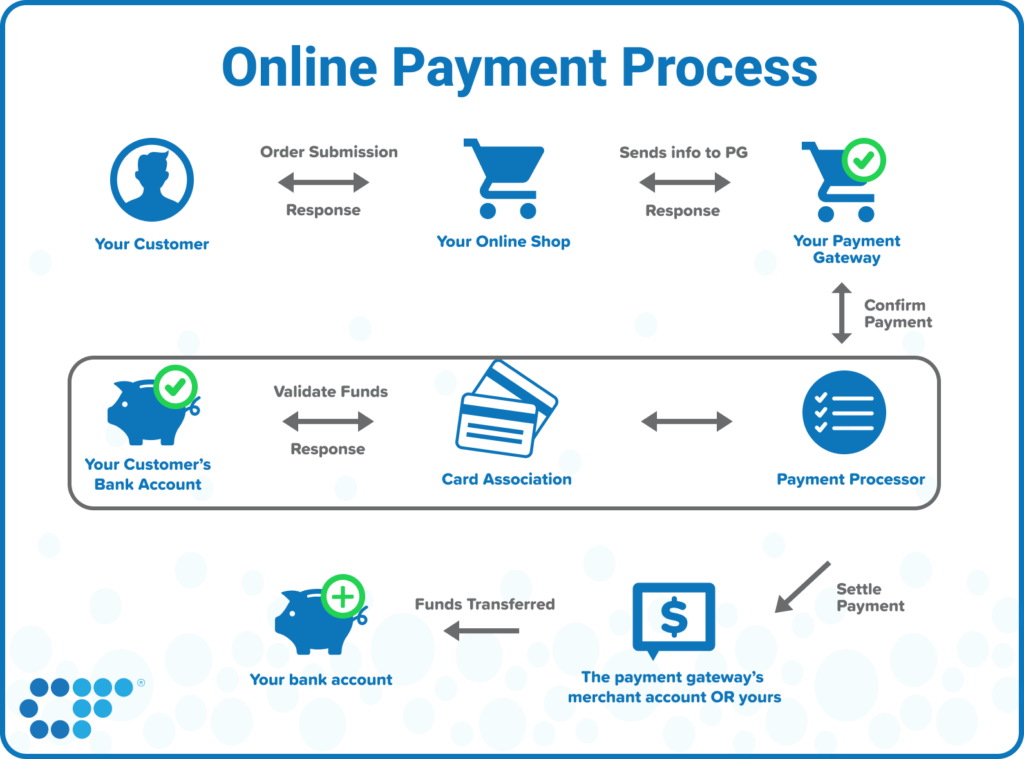

How Does Online Payment Processing Work?

Online payment processing involves multiple steps, all of which occur within a few seconds to minutes. Here’s an easy-to-understand summary of how the process works:

- Payment Authorization: When a customer makes a purchase, the payment processing company verifies the payment details (credit card, debit card, digital wallet, etc.) provided by the buyer.

- Transaction Approval or Denial: The payment processor sends the information to the customer’s bank (issuer) or payment provider to check whether the buyer has sufficient funds or credit. If all the details are verified, the transaction is authorized.

- Fund Transfer: Once the payment is approved, the funds are transferred from the buyer’s account to the merchant’s account through a secure connection.

Key Players in Online Payment Processing

Online payment processing involves various stakeholders that work together to complete the transaction. These include:

- Payment Gateway: A software application that securely transmits the payment details between the buyer, merchant, and their respective financial institutions.

- Payment Processor: The company that handles the transaction by connecting the payment gateway, the merchant’s bank, and the customer’s bank.

- Issuer Bank: The customer’s bank or financial institution that provides the buyer’s credit or debit card.

Types of Online Payment Processing Solutions

Different businesses have unique needs when it comes to online payment processing. There are various types of payment solutions, each catering to different business models and transaction volumes. Below are the primary types:

1. Hosted Payment Gateways

These are third-party solutions that redirect customers to an external payment page hosted by the payment processor. Examples include PayPal and Stripe. Hosted gateways are easy to set up, provide an added layer of security, and reduce the merchant’s PCI compliance requirements.

2. Integrated Payment Gateways

These gateways allow merchants to accept payments directly on their websites or mobile apps without redirecting customers to a third-party page. Integrated gateways provide a smoother user experience and can be customized to match a merchant’s branding.

3. Mobile Payment Solutions

With the rise of smartphones, mobile payment processing has become a major component of online payments. Companies like Apple Pay, Google Pay, and Samsung Pay offer simple, secure, and fast ways for customers to pay using their mobile devices. These solutions integrate well with POS systems and online stores.

Benefits of Using Online Payment Processing Companies

1. Security

Payment processors provide advanced encryption technologies to safeguard sensitive payment information, ensuring that transactions are secure and compliant with regulations like the Payment Card Industry Data Security Standard (PCI DSS).

2. Global Reach

With online payment processing, businesses can accept payments from customers worldwide. This is particularly important for eCommerce companies looking to expand into international markets. Numerous payment processors provide support for multiple currencies and a range of international payment options.

3. Speed and Convenience

Transactions are processed in real-time, allowing merchants to receive payment confirmations almost instantly. This efficiency reduces the need for manual processing and speeds up the sales cycle.

Choosing the Right Online Payment Processing Company

Selecting the right payment processor depends on several factors, including your business type, transaction volume, and geographic reach. Here are several key elements to keep in mind:

1. Transaction Fees

Different payment processors charge varying fees based on the payment method, transaction volume, and type of service provided. Some companies charge flat-rate fees, while others use a tiered pricing structure. Understanding your business’s needs will help you determine the most cost-effective option.

2. Security Features

When selecting a payment processor, prioritizing security is essential. Ensure that the provider complies with PCI DSS standards and uses advanced encryption techniques to protect customer data.

3. Customer Support

Reliable customer support is essential, especially in the case of payment disputes or technical issues. Seek out payment processors that provide round-the-clock assistance through phone, email, or live chat.

Conclusion

Online payment processing companies are vital to modern business operations, enabling secure, fast, and efficient transactions across the globe. By understanding the types of services offered, the benefits of using these companies, and how to choose the right provider, businesses can ensure that they are offering the best possible payment experience to their customers. Whether you’re running a small online store or a large-scale enterprise, partnering with the right payment processor is essential to building trust, improving cash flow, and scaling your operations effectively.

FAQs

1. How does a payment gateway differ from a payment processor?

A payment gateway is the system that securely transmits payment information from the customer to the payment processor. A payment processor, on the other hand, is responsible for managing the transaction and communicating with banks to ensure funds are transferred.

2. How do payment processors make money?

Payment processors typically charge merchants a percentage of each transaction, plus a flat fee. Additional fees may apply for international transactions, chargebacks, or specific payment methods.

3. Is online payment processing secure?

Yes, most payment processors use robust security protocols like SSL encryption and tokenization to protect sensitive data. Additionally, many processors comply with PCI DSS standards, ensuring that payment information is handled securely.

4. Can I use multiple payment processors?

Yes, many businesses use more than one payment processor to cater to different customer preferences. For instance, you might use PayPal for international transactions and Stripe for domestic payments.

5. How long does it take to receive funds from an online payment processor?

The settlement period varies by provider, but it usually takes between 1-3 business days for funds to be transferred into your merchant account after a successful transaction.