AUTHOR NIKKY RAI

DATE 11/11/2023

Introduction

In today’s fast-paced business environment, simplicity is often the key to success. When it comes to financial transactions, businesses are constantly seeking ways to streamline processes and also enhance customer satisfaction. One such crucial aspect is credit card processing, a fundamental element for businesses engaging in electronic transactions. In this article, we will delve into the world of simple credit card processing, exploring its basics, advantages, challenges, and also future trends.

The Basics of Simple Credit Card Processing

Transaction Flow

Credit card processing involves a series of steps that seamlessly facilitate the transfer of funds from a customer’s account to the merchant’s. Understand also ing this flow is essential for businesses aiming to implement efficient payment systems.

Parties Involved

Several entities play a role in credit card processing, including the cardholder, merchant, acquiring bank, issuing bank, and also payment processor. Each entity contributes to the secure and also swift completion of a transaction.

Types of Credit Card Processing

Businesses can choose between various types of credit card processing, such as point-of-sale (POS) systems, mobile processing, and also online payment gateways. The choice depends on the nature of the business and also its unique requirements.

Advantages of Simple

Increased Sales

Businesses that offer simple and convenient credit card tend to witness a boost in sales. Customers are more likely to make impulse purchases when the payment process is quick and also hassle-free.

Customer Convenience

Simplicity in translates to enhanced convenience for customers. Whether in-store or online, a smooth transaction experience contributes to overall customer satisfaction and also loyalty.

Security Features

Modern solutions come equipped with robust security features, protecting both businesses and also customers from fraudulent activities. Encryption, tokenization, and also multi-factor authentication are among the security measures implemented.

How to Set Up Simple

Choosing a Payment Processor

Choosing the most suitable payment processor is a pivotal and also unique decision that holds critical importance for businesses in ensuring seamless financial transactions.Factors such as transaction fees, supported card types, and also integration capabilities should be carefully evaluated.

Integrating Payment Gateway

Integrating a secure payment gateway is essential for online transactions. This ensures that customer data is encrypted and also transmitted safely during the payment process.

Security Measures

Implementing additional security measures, such as fraud detection systems and also regular security audits, adds an extra layer of protection to systems.

Common Challenges and also Solutions

Transaction Fees

Businesses often face challenges related to transaction fees. Exploring different payment processors and also understand also ing their fee structures can help mitigate this issue.

Chargebacks

Chargebacks can impact businesses negatively. Adopting preventive measures and also maintaining clear communication with customers can reduce the occurrence of chargebacks.

Integration Issues

Technical glitches during integration can disrupt the system. Thorough testing and also seeking professional assistance can help address integration issues effectively.

Future Trends in Credit Card Processing

Contactless Payments

The rise of contactless payments using NFC technology is transforming the way transactions occur. Businesses should consider adopting contactless payment options to cater to evolving consumer preferences.

Blockchain Technology

Blockchain is making waves in the financial industry, offering secure and also transparent transactions. Exploring blockchain-based solutions can position businesses at the forefront of innovation.

Biometric Authentication

Biometric authentication, such as fingerprint or facial recognition, adds an extra layer of security to credit card transactions. The integration of biometric features is expected to become more prevalent in the future.

Impact on Small Businesses

Affordability

Simple solutions are often more affordable for small businesses, providing them with cost-effective ways to accept electronic payments.

Competing with Larger Businesses

Efficient enables small businesses to compete on a level playing field with larger counterparts, as they can offer the same level of convenience to customers.

Building Trust with Customers

Implementing secure solutions helps small businesses build trust with customers, fostering long-term relationships and also positive brand also perception.

Tips for Choosing the Right Solution

Cost Considerations

While cost is a significant factor, businesses should also consider the overall value offered by a processing solution, including security features and also customer support.

Scalability

Choosing a scalable solution ensures that the credit card processing system can adapt to the growing needs of the business without major disruptions.

Customer Support

Reliable customer support is crucial for resolving issues promptly and also maintaining(1)smooth credit card processing(2) operations.

Case Studies: Success Stories of Simple Credit Card Processing

Small Business A

Implementing(3) a user-friendly credit card processing system helped Small Business A increase its sales by 20% within the first six months. The seamless paymen(4) experience contributed to positive customer reviews and also repeat business.

E-commerce Store B

E-commerce Store B integrated a secure online payment gateway,(5) reducing instances of chargebacks and also fraudulent transactions. This not only protected the business but also enhanced customer trust.

Conclusion

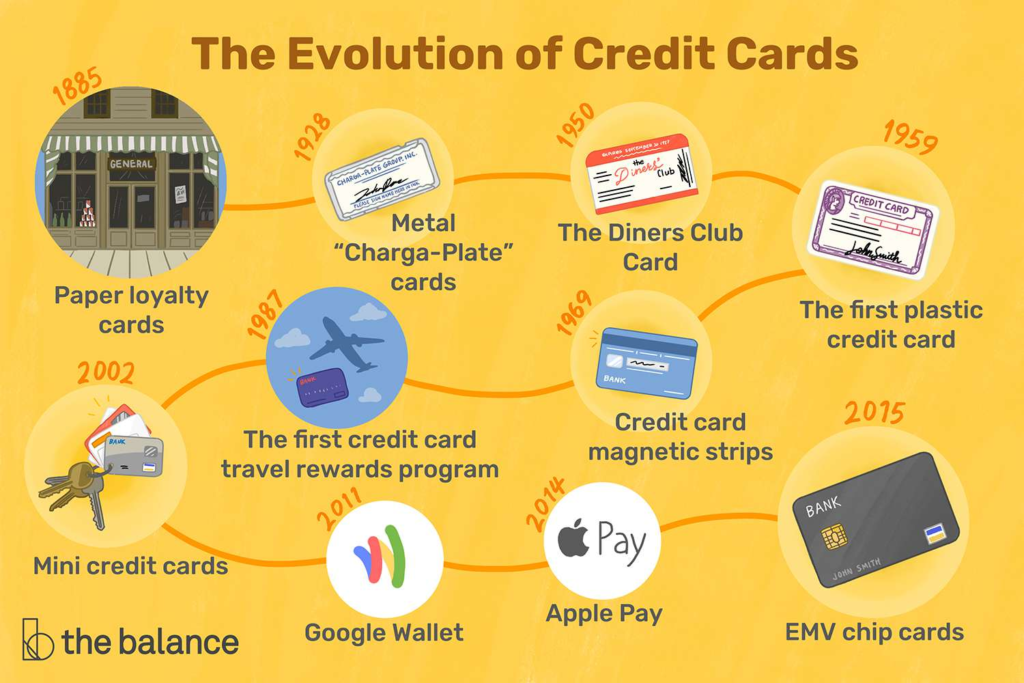

In conclusion, simple credit card processing is the backbone of modern business transactions. From its humble beginnings to the incorporation of cutting-edge technologies, credit card processing has evolved to meet the demand also s of businesses and consumers alike. As we look to the future, continued advancements in technology, security measures, and regulatory compliance will further enhance the efficiency and reliability of credit card processing systems.

Frequently Asked Questions (FAQs)

- Is it necessary for small businesses to invest in credit card processing?

- Absolutely. Credit card processing enhances customer convenience and boosts sales, making it a valuable investment for small businesses.

- In navigating the realm of payment processors, the question arises: How can I discern and select the ideal payment processor tailored specifically to the unique needs of my business?

- When contemplating the choice of a payment processor, it is essential to consider an array of factors, including transaction fees, security features, and the quality of customer support. Choose a processor that aligns with your business needs.

- What measures can businesses take to prevent chargebacks?

- Clear communication, transparent policies, and thorough documentation of transactions can help prevent chargebacks.

- Are contactless payments safe?

- Yes, contactless payments are secure. They use encryption and tokenization to protect sensitive information.

- How can businesses stay updated on industry regulations?

- Regularly review industry publications, participate in forums, and consult legal professionals to stay informed about evolving regulations.