AUTHOR : SELINA GIL

DATE : 13/11/23

I. Introduction

A. Definition of High-Risk Payment Processors

In the intricate world of e-commerce, Shopify has emerged as a powerhouse for businesses seeking a convenient and user-friendly platform. However, one challenge that often perplexes Shopify store owners is the selection of payment processors, especially when considering the category of high-risk options.

B. The Importance of Payment Processing for Shopify Stores

Before delving into the specifics of high-risk payment processors, it’s crucial to understand the pivotal role payment processing plays in the success of Shopify stores. A seamless and secure payment process not only enhances customer trust but also directly impacts the bottom line.

II. Identifying High-Risk Payment Processors

A. Criteria for High-Risk Designation

To navigate the terrain of high-risk payment processors, it’s essential to comprehend the criteria that lead to their classification. Factors such as the nature of the business, processing history, and chargeback rates often contribute to a processor being labeled as high risk.

B. Common Characteristics of High-Risk Processors

Exploring the common characteristics of high-risk processors sheds light on what sets them apart. This section will delve into the specific features that make a payment processor fall into the high-risk category.

III. Risks Associated with High-Risk Payment Processors

A. Chargebacks and Fraud

One of the primary concerns with high-risk payment processors is the elevated risk of chargebacks and fraudulent activities. Unraveling the reasons behind this risk and understanding preventive measures is crucial for Shopify store owners.

B. Legal and Compliance Issues

High-risk payment processors often come with a complex web of legal and compliance issues. Store owners need to be well-versed in these intricacies to avoid potential legal pitfalls.

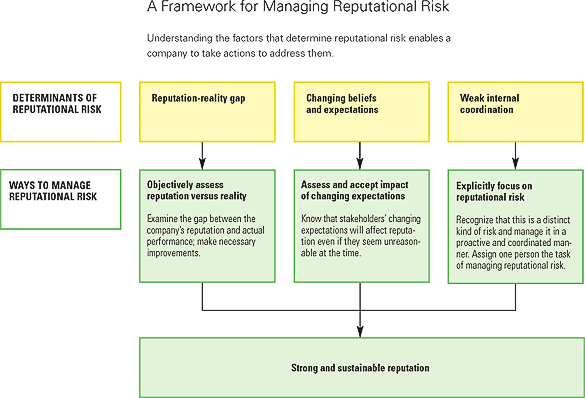

C. Impact on Business Reputation

The association with high-risk payment processors can have a lasting impact on a business’s reputation. Managing this risk and implementing damage control measures is vital for sustaining a positive image in the market.

IV. Choosing the Right Payment Processor

As a Shopify store owner, the ultimate goal is to choose a payment processor that aligns with the business’s needs while mitigating risks. This section will provide actionable insights and tips for making an informed decision.

VI. Exploring Alternatives to High-Risk Processors

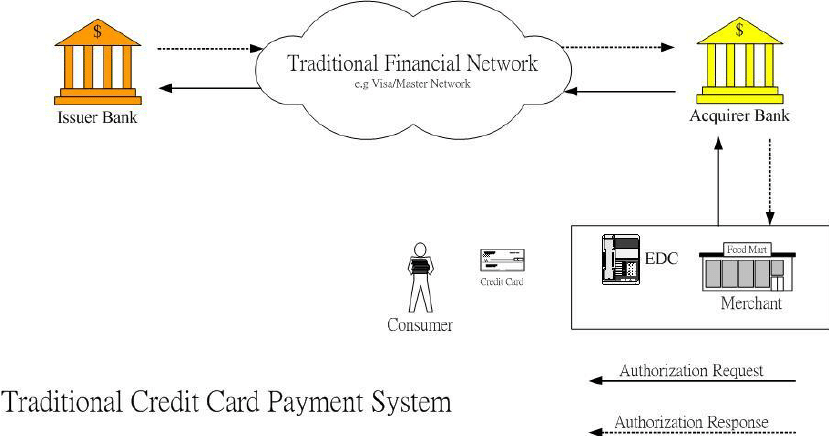

A. Traditional Payment Processors

While high-risk payment processors have their place, exploring alternatives within the realm of traditional processors is essential. This section will highlight popular options known for their reliability and lower risk factors.

B. Assessing Integration with Shopify

Understanding how different payment processors integrate with Shopify is crucial for a seamless online shopping experience. Tips and insights on integration will be discussed, ensuring compatibility with the platform

VII. Balancing Risk and Reward

A. Weighing the Costs and Benefits

Every payment processor comes with its own set of costs and benefits. This section will guide Shopify store owners on how to conduct a cost-benefit analysis, helping them make a balanced decision.

B. Customer Feedback and Reviews

Real-world experiences of other Shopify store owners can provide valuable insights. This part will emphasize the importance of customer feedback and reviews when evaluating payment processors

VIII. Future-Proofing Your Payment Process

A. Adapting to Industry Changes

The e-commerce[1] landscape is dynamic, and payment processing is no exception. This section will discuss strategies to future-proof your payment process, ensuring adaptability to evolving industry trends.

B. Scaling Your Business with the Right Processor

As your Shopify store grows, your payment processing needs may change. This section will offer guidance on selecting a processor that can scale with your business, preventing disruptions[2] as you expand.

IX. Case Studies: Success Stories and Cautionary Tales

A. Learning from Others’ Experiences

Real-world[3] examples provide valuable lessons. This section will delve into case studies, showcasing both success stories and cautionary tales related to payment processor choices on Shopify.

XI. Best Practices for High-Risk Payment Processor Integration

A. Transparent Communication with Customers

Maintaining open and transparent communication[4] with customers is key when utilizing high-risk payment processors. This section will outline best practices for setting clear expectations and minimizing customer concerns.

B. Regular Monitoring and Adjustment

High-risk environments require proactive measures. This part will delve into the importance[5] of regular monitoring and adjustment of your payment processing strategy to address emerging issues promptly

V. Conclusion

In the dynamic landscape of e-commerce, the choice of a payment processor can significantly influence a Shopify store’s success. Understanding the nuances of high-risk payment processors equips store owners to make informed decisions, balancing risk and reward.

FAQs

- Q: Are all high-risk payment processors bad for my Shopify store?

Not necessarily. It depends on the nature of your business and your risk tolerance. Some high-risk processors specialize in certain industries and may be a perfect fit for your needs. - Q: How can I minimize the risk of chargebacks with a high-risk payment processor?

Implement robust fraud prevention measures, communicate clearly with customers, and provide excellent customer service to minimize the chances of chargebacks. - Q: Will using a high-risk payment processor affect my Shopify store’s search engine rankings? While payment processor choice itself may not directly impact rankings, the overall customer experience, including payment security, can indirectly influence SEO.

- Q: What legal considerations should I keep in mind when using a high-risk payment processor? Ensure compliance with all applicable laws and regulations in your industry and geographic location. Consult with legal professionals to navigate any potential legal challenges.

- Q: Can I switch payment processors easily if I find my current one isn’t suitable?

Yes, but the process may involve some technical adjustments to your Shopify store. It’s crucial to plan the transition carefully to avoid disruptions to your business