AUTHOR : BABLI

DATE : 9/12/23

In today’s digital world, online transactions are more common than ever before. E-commerce businesses, service providers, and even subscription-based platforms rely heavily on smooth and secure payment systems. One of the most integral parts of these systems is Payment Gateway Credit Card Processing[1]. This article explores the ins and outs of this critical service, explaining how it works, its benefits, and why businesses need it.

What is Payment Gateway Credit Card Processing?

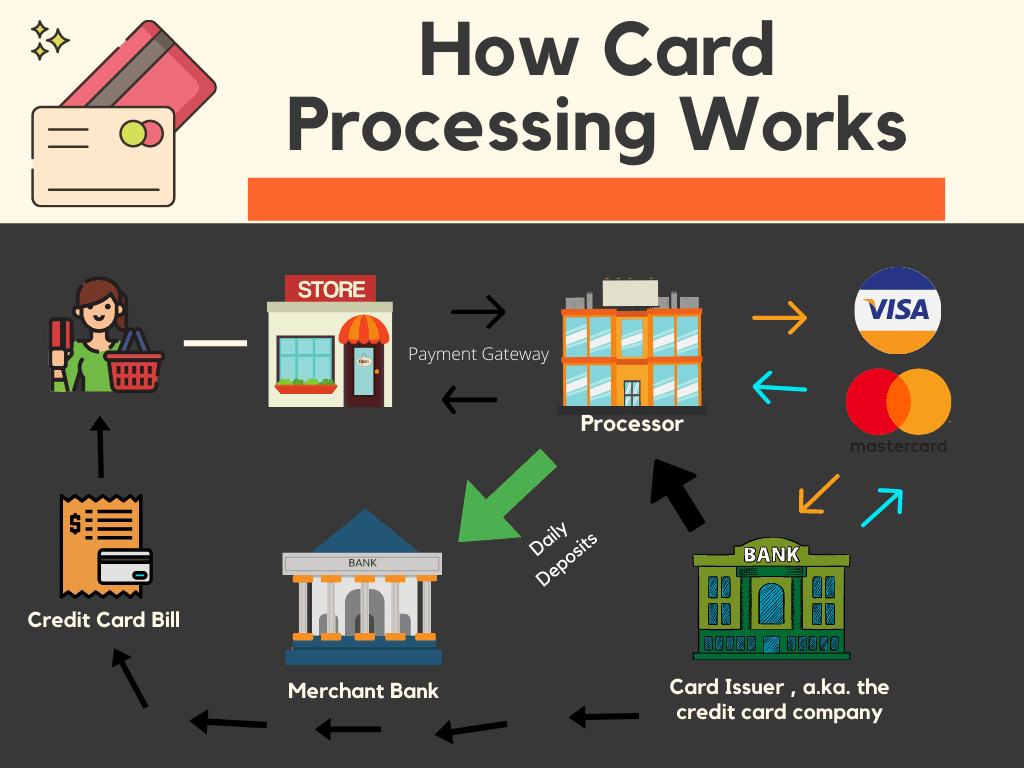

Payment Gateway[2] Credit Card Processing is the mechanism by which payments[3] made using credit cards are authorized and processed in an online or physical setting. This process connects the merchant’s business website or point of sale system to the financial networks that manage the flow of money between buyers and sellers.

In simpler terms, when a customer purchases a product or service online, their credit card[4] details are securely transmitted via a payment gateway[5], which then communicates with the necessary financial institutions (banks, credit card companies, etc.) to approve or decline the transaction. If approved, the funds are transferred from the customer’s account to the merchant’s account.

Importance of Credit Card Processing for Businesses

Streamlining Transactions

Efficient transactions are the lifeblood of any business. Gateway Credit Card Processing plays a pivotal role in streamlining payment procedures, ensuring a swift and hassle-free experience for both customers and businesses alike.

Enhancing Customer Experience

In a world where convenience is key, offering diverse payment options is crucial for a positive customer experience. Credit card processing not only provides convenience but also instills confidence in customers, leading to increased satisfaction and loyalty.

Understanding Gateway Credit Card Processing

Definition and Functionality

Gateway Credit Card Processing acts as the bridge between a merchant’s website and the financial institutions involved in the transaction. It securely authorizes and processes credit card payments, encrypting sensitive information to safeguard against potential cyber threats.

Key Players in the Industry

Several reputable companies dominate the Gateway Credit Card Processing industry, each offering unique features and services. Understanding the key players is essential for businesses seeking the most suitable solution for their needs.

Advantages of Using Gateway Credit Card Processing

Security Features

Security is paramount in online transactions. Gateway Credit Card Processing employs advanced encryption and authentication measures, ensuring that sensitive data remains confidential and protected from unauthorized access.

Global Accessibility

One of the significant advantages of gateway processing is its global accessibility. Businesses can accept payments from customers around the world, expanding their reach and tapping into international markets.

Integration with E-commerce Platforms

seamlessly integrates with various e-commerce platforms, providing a user-friendly experience for both merchants and customers. This integration enhances the overall efficiency of online businesses.

How to Choose the Right Service

Security Measures

When selecting a gateway credit card processing service, prioritizing security measures is non-negotiable. Ensuring compliance with industry standards and regulations, such as PCI DSS, is vital for protecting sensitive customer information.

Transaction Fees

Different gateway providers impose varying transaction fees. Businesses must carefully evaluate these fees, considering their budget and transaction volume, to choose a provider that aligns with their financial goals.

Integration Options

The compatibility of a gateway with existing systems and e-commerce platforms is crucial. Choosing a provider that offers seamless integration ensures a smooth transition and reduces the risk of technical glitches.

Future Trends in Credit Card Processing

Emerging Technologies

The landscape of credit card processing is continually evolving. Businesses should stay abreast of emerging technologies, such as blockchain and biometrics, that have the potential to further enhance the security and efficiency of transactions.

Shifting Consumer Behavior

Changes in consumer behavior, such as the increasing preference for contactless payments, influence the future of credit card processing. Adapting to these trends ensures that businesses remain relevant and cater to the evolving needs of their customer base.

Case Studies: Successful Implementation of Gateway Credit Card Processing

Highlighting real-world examples of businesses that have successfully implemented provides valuable insights for those considering adopting this technology. Case studies illustrate the tangible benefits and positive outcomes experienced by businesses across various industries.

The Role of Mobile Devices in

Mobile Payment Solutions

With the increasing reliance on smartphones, businesses must adapt their credit card processing to accommodate mobile payment solutions. Mobile-friendly gateways cater to the preferences of a tech-savvy consumer base.

Contactless Transactions

Contactless transactions, facilitated by mobile devices, have become the norm in many regions. Businesses that embrace this trend not only offer a convenient payment option but also align themselves with evolving consumer preferences.

Conclusion

In conclusion, has emerged as a game-changer in the world of online transactions. Its role in enhancing security, streamlining processes, and adapting to evolving consumer preferences makes it a valuable asset for businesses of all sizes. As technology continues to advance, staying informed about the latest trends and best practices in credit card processing is essential for businesses to thrive in the digital landscape.

FAQs

- Is gateway credit card processing secure?

- Yes, gateway credit card processing employs advanced security measures, including encryption and authentication, to ensure the confidentiality and integrity of transactions.

- How can businesses choose the right gateway provider?

- Businesses should consider factors such as security measures, transaction fees, and integration options when selecting a gateway credit card processing service.

- What are the common challenges businesses may face in credit card processing?

- Technical glitches and security concerns are common challenges, but proactive measures and contingency plans can address these issues effectively.

- How can small businesses benefit from gateway credit card processing?

- Gateway credit card processing enables small businesses to expand their reach, enhance customer experience, and streamline transactions in the digital marketplace.

- What is the future of credit card processing, and how can businesses prepare?

- The future involves emerging technologies like blockchain and adapting to shifting consumer behavior, and businesses should stay informed and agile to remain competitive.

Get In Touch