AUTHOR : SELENA GIL

DATE : 13/11/23

Introduction

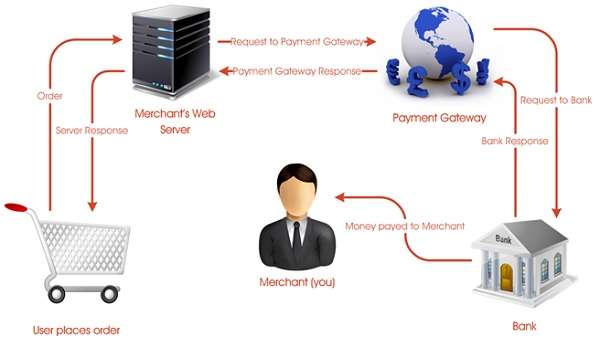

In the fast-paced world of online commerce, seamless transactions are the lifeblood of success. Ecommerce payment processors play a pivotal role in ensuring these transactions are not only smooth but also secure. In this article, we’ll dive into the intricacies of ecommerce payment processors, exploring their types, popular options, and how to choose the right one for your business.

Types of Ecommerce Payment Processors

Ecommerce payment processors come in various forms, each with its unique set of advantages and disadvantages. Understanding these types is crucial for any business looking to establish a robust online payment system.

Traditional Merchant Accounts

Traditional merchant accounts involve partnerships with banks, allowing businesses to accept credit and debit card payments. While offering stability, they often come with higher fees.

Payment Service Providers (PSPs)

PSPs act as intermediaries between merchants and banks, simplifying the payment process. They are known for their user-friendly interfaces but may have higher transaction fees.

Digital Wallets

Digital wallets like PayPal and Apple Pay store users’ payment information, streamlining the checkout process. They are popular for their convenience but may pose security concerns for some users.

Popular Ecommerce Payment Processors

When it comes to choosing the right ecommerce payment processor, several names stand out in the digital landscape.

1. PayPal

As a pioneer in online payments, PayPal offers a secure and widely recognized platform.

Recognized for its user-friendly interface and widespread acceptance, it has established a reputation for ease of use.

2. Stripe

Stripe caters to developers and businesses of all sizes, providing customizable solutions. Its transparent fee structure and robust security make it a preferred choice.

3. Square

Square is synonymous with simplicity, making it ideal for small businesses. Its point-of-sale options and flat-rate pricing appeal to many entrepreneurs.

4. Amazon Pay

Leveraging the trust associated with the Amazon brand, Amazon Pay allows users to make purchases using their Amazon account credentials.

Selecting the Ideal Payment Processor for Your Busines

Selecting the ideal payment processor involves a careful evaluation of various factors to align with your business needs.

Factors to Consider:

- Transaction Fees

- Security Features

- Integration Options

- User Experience

Making the Decision

Choosing the appropriate ecommerce payment processor holds the potential to revolutionize the dynamics of your business.. Consider your specific requirements, customer preferences, and the nature of your products or services.

Navigating the Ecommerce Payment Processor Landscape: Making Informed Choices for Your Business

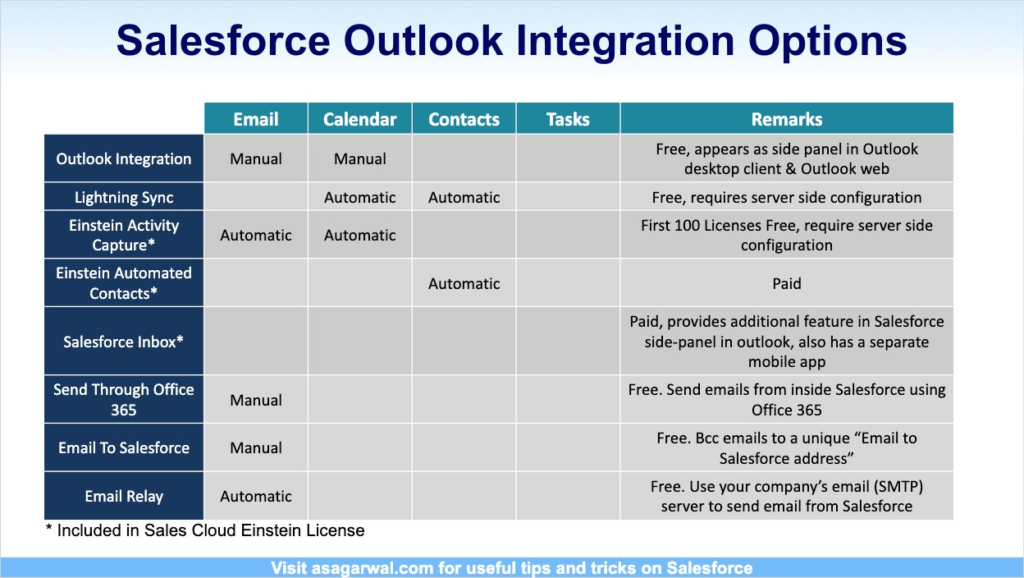

5. Integration Options

When selecting an ecommerce payment processor, seamless integration with your existing platform is crucial. Consider processors that offer easy-to-use APIs or plugins compatible with your ecommerce software.This guarantees a seamless setup process, minimizing any potential disruptions to the operational flow of your business

6. Security Protocols

Ensuring security is of utmost importance in the digital era, particularly when dealing with confidential financial information Opt for payment processors that adhere to industry-standard security protocols, such as PCI DSS compliance. This This not only ensures the safeguarding of your customers but also fosters confidence and credibility in your brand

User Experience Matters

7. Streamlined Checkout Process

A favorable user encounter holds the power to notably influence your conversion rates. Opt for a payment processing solution that offers an uncomplicated checkout procedure, diminishing the number of steps users must undertake to finalize a purchase

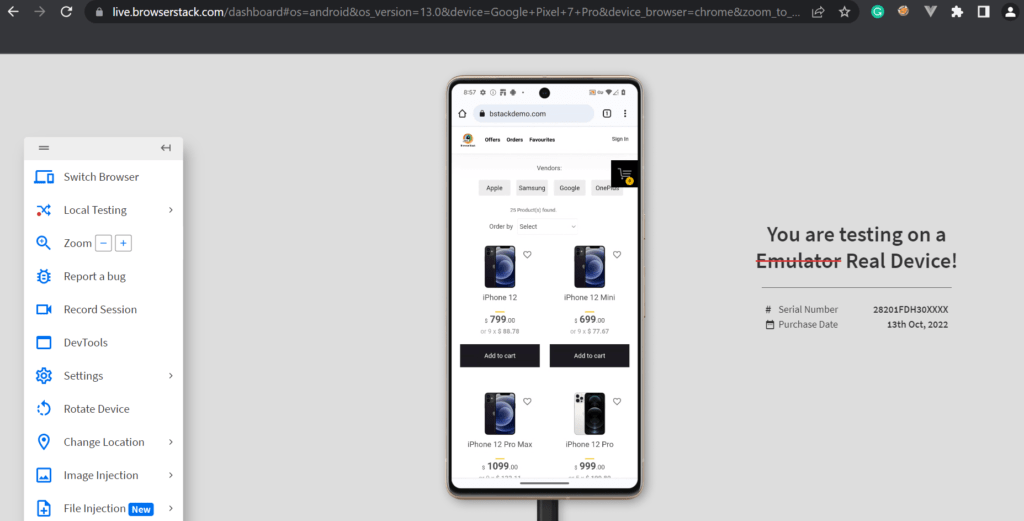

8. Mobile Compatibility

With the increasing prevalence of mobile shopping, ensuring your chosen payment processor is mobile-friendly is non-negotiable. A responsive and intuitive mobile interface enhances the user experience and expands your reach to a broader audience

9 Emerging Trends in Payment Processors

As technology evolves, so do ecommerce payment processors. Stay abreast of emerging trends, such as the integration of artificial intelligence for fraud detection and biometric authentication[1] for enhanced security. Embracing these innovations can future-proof your payment processing system.

10. Overcoming Payment Processing Challenges

11 Chargebacks and Disputes

Addressing chargebacks[2] and disputes is an inevitable aspect of online commerce. Familiarize yourself with your chosen processor’s dispute resolution process and implement strategies to minimize chargeback occurrences.

12 Currency and Global Transactions

For businesses catering to an international audience, navigating different currencies and ensuring a smooth global transaction process is crucial. Choose a payment processor with robust capabilities for handling diverse currencies and international[3] transactions [3].

13 Customer Support

Efficient customer assistance has the potential to be a game-changer in navigating unexpected challenges.. Prioritize payment processors that offer responsive customer support, guiding you through technical issues or addressing[4] concerns promptly.

14. Evaluating the Total Cost of Ownership

While contemplating transaction expenses is undeniably crucial, it holds equal significance to assess the comprehensive cost of ownership Factor in setup fees, monthly subscriptions, and any additional costs associated with specific features. A comprehensive[5] cost analysis ensures transparency in your financial planning.

Conclusion

In the constantly evolving landscape of online commerce, a dependable payment processor isn’t merely a convenience—it stands as an indispensable requirement. Understanding the nuances of different types, exploring popular options, and making informed decisions can elevate your online business and contribute to customer satisfaction.

FAQs

1. Are digital wallets safe for online transactions?

Yes, digital wallets employ advanced encryption and authentication measures, ensuring secure online transactions.

2. How do transaction fees vary among payment processors?

Transaction fees vary based on the type of payment processor and the services they offer. Traditional merchant accounts may have higher fees compared to PSPs or digital wallets.

3. Can I use multiple payment processors for my e-commerce store?

Yes, depending on your business needs, you can integrate multiple payment processors to offer diverse payment options to your customers.

4. What steps can I take to enhance the security of online transactions?

Implementing secure payment gateways, using HTTPS, and regularly updating security protocols can enhance the security of online transactions.

5. Is it necessary to consider mobile compatibility when choosing a payment processor?

Absolutely. With the rise of mobile commerce, ensuring that your chosen payment processor is mobile-friendly is essential for reaching a broader audience.