AUTHOR : RUBBY PATEL

DATE : 9/12/23

Introduction

Selecting the right online payment processor[1] is essential for the success of any small business. It can impact your sales, customer satisfaction, and even your business’s ability to scale. The right payment processor allows you to accept payments securely, efficiently, and affordably, while also offering features that fit your business’s needs.

What is an Online Payment Processor?

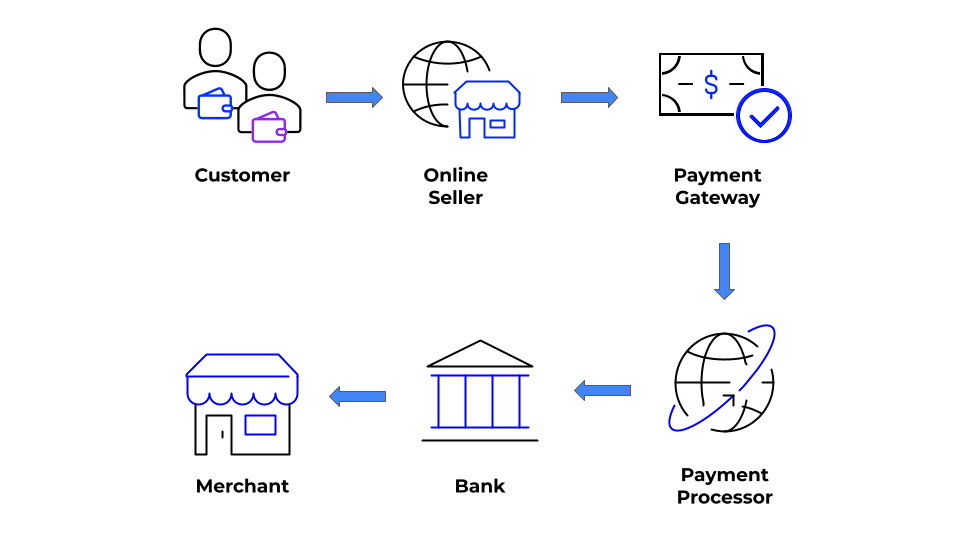

An online payment processor is a platform that allows businesses to securely receive payments[2] from customers over internet. This can include payments made through credit cards, debit cards, digital wallets[3], and even bank transfers. Payment processors typically offer a range of services including payment gateway integrations, fraud prevention tools, invoicing, recurring billing, and customer management tools.

For small businesses[4], finding the right processor is essential because it affects everything from payment speed to transaction costs and the ability to grow.

Essential features to consider when choosing an online payment processor.

Before diving into specific payment processors, it’s essential to understand the key features to look for:

- Ease of Use: The payment system[5] should offer an intuitive interface that is simple for both you and your customers to navigate. It should integrate easily with your website, POS system, or ecommerce platform.

- Security: Ensure that the processor complies with PCI-DSS standards, ensuring secure and encrypted transactions to protect customer data.

- Low Transaction Fees: The best payment processors for small businesses offer competitive and transparent pricing. Always be aware of hidden fees, like monthly fees or chargeback fees.

- Payment Methods: Consider whether the processor supports a variety of payment methods like credit and debit cards, PayPal, Apple Pay, Google Pay, ACH payments, etc.

- Customer Support: A responsive and reliable support system is crucial when technical issues arise or when you need guidance.

- Scalability: As your business grows, you need a payment processor that can accommodate increasing transaction volumes without substantial hikes in fees.

Top Online Payment Processors for Small Businesses in 2024

1. Square

Best For: Small businesses with physical and online sales.

Square is one of the most popular and widely used online payment processors, especially among small businesses. It is recognized for its user-friendly interface, cost-effectiveness, and comprehensive set of features. Square offers both point-of-sale (POS) hardware and software, making it ideal for businesses that sell both online and offline.

Features:

- Free basic POS software with an easy-to-use interface.

- No monthly fees—pay only per transaction.

- Supports payments via credit and debit cards, mobile wallets, and invoices.

- Integration with major ecommerce platforms like WooCommerce, Shopify, and BigCommerce.

- Comprehensive tools for advanced reporting, inventory tracking, and employee management.

- Strong customer support, including 24/7 access.

Pricing:

- Transaction fees: 2.6% + 10¢ per in-person transaction, 2.9% + 30¢ for online transactions.

2. PayPal

Best For: Businesses looking for an internationally recognized and trusted payment processor.

PayPal is one of the oldest and most trusted online payment processors. It’s particularly good for small businesses that deal with international customers due to its global reach and ease of use. PayPal can easily be integrated into your website, allowing for quick and secure payments.

Features:

- Supports payments through credit cards, debit cards, as well as PayPal accounts.

- Easy to integrate with most ecommerce platforms.

- Strong buyer and seller protection.

- Multiple currency support for international transactions.

- Advanced reporting tools and invoicing.

Pricing:

- Transaction fees: 2.9% + 30¢ per transaction for domestic payments, 4.4% + a fixed fee for international payments.

3. Stripe

Best For: Businesses that want a highly customizable payment processor.

Stripe is well-suited for businesses that want to create a highly customized payment experience. It provides a developer-friendly platform with powerful API tools that allow you to tailor payment solutions to your specific business needs. It’s particularly popular among tech-savvy businesses and online-only stores.

Features:

- Provides a wide variety of payment methods, including credit cards, ACH payments, Apple Pay, Google Pay, and more.

- Global support in over 40 countries.

- Subscription and recurring billing options.

- Advanced fraud protection with Stripe Radar.

- Developer-friendly tools for building custom payment solutions.

Pricing:

- Transaction fees: 2.9% + 30¢ per transaction for online payments.

Conclusion

Choosing the best online payment processor for your small business depends on your specific needs, such as your business model, the volume of transactions, and whether you operate internationally. Square and PayPal are solid, straightforward options, while Stripe and Authorize.Net provide more advanced and customizable solutions for businesses with more complex needs.

FAQs

1. Which payment processor has the lowest fees?

Square and PayPal are great options for businesses that want to avoid monthly fees. However, Square’s per-transaction fees are typically lower for in-person transactions, while PayPal can be more affordable for international transactions.

2. Is it possible to integrate more than one payment processor for my business?

Yes, many small businesses use multiple payment processors to offer their customers more options. However, managing multiple processors can become complex, so it’s essential to streamline your payment systems as much as possible.

3. Is it safe to use online payment processors?

Yes, reputable payment processors like Square, PayPal, Stripe, and others use advanced encryption and security protocols to protect your customers’ payment data. Always choose a processor that complies with PCI-DSS standards.

4. Which payment processor is best for international payments?

PayPal and Stripe are both excellent choices for international payments, with support for multiple currencies and global reach.

5. What is the best payment processor for recurring billing?

Stripe, Authorize.Net, and Square all offer recurring billing features, making them great options for businesses with subscription-based services.