AUTHOR: SAYYED NUZAT

DATE: 04-09-2023

In today’s digital age, businesses are constantly seeking ways to simplify payment processing while ensuring the utmost security for their customers. One of the solutions gaining immense popularity is a white-label payment gateway. But what exactly is a white-label payment gateway, and how does its pricing structure work? In this comprehensive guide, we will delve into the world of private label payment gateways[1], demystify their pricing models, and also explore the benefits they offer businesses.

1. What is a white-label payment gateway?

A white-label payment gateway[2] is a third-party payment processing[3] solution that allows businesses to accept payments through various channels, such as websites, mobile apps, or point-of-sale terminals. What makes it ‘white label’ is that it can be rebranded and customized to match the business’s branding, creating a seamless and trusted payment experience[4] for customers.

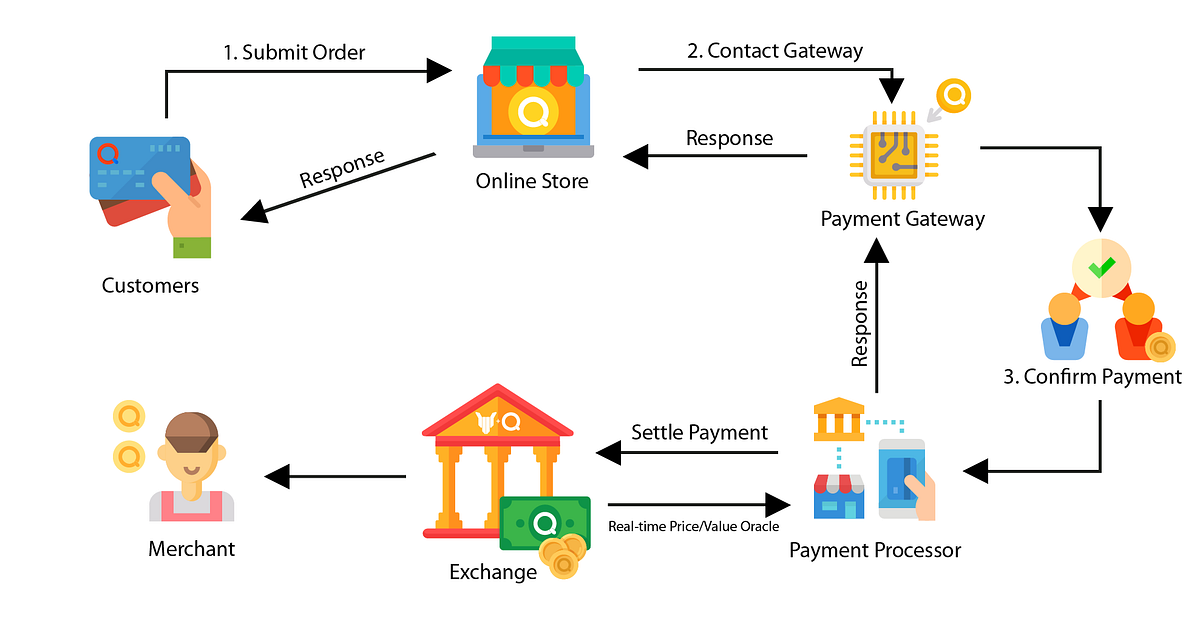

2. How Does a White Label Payment Gateway Work?

White-label payment gateways[5] facilitate secure transactions by encrypting sensitive customer data and routing payment information between the merchant, the customer, and also the payment processor. This ensures that payments are processed swiftly and securely.

3. Advantages of White Label Payment Gateways

3.1. Custom Branding

White-label payment gateways empower[1] businesses to maintain brand consistency throughout the payment process. This builds trust and reinforces the brand’s image.

3.2. Enhanced Security

Security is paramount in online transactions.[2] White-label payment gateways offer advanced security features, including fraud prevention tools and PCI DSS compliance, to safeguard customer data.

3.3. Cost Efficiency

By opting for a private label solution, businesses can often reduce the operational costs associated with developing and maintaining their payment infrastructure.

4. Factors Influencing White Label Payment Gateway Pricing

Several factors play a crucial role in determining the pricing of white-label payment portals.

4.1. Transaction Volume

The number of transactions processed[3] through the gateway affects pricing. High-volume businesses may negotiate lower rates.

4.2. Customization Level

The extent to which the gateway is customized[4] can impact pricing. Extensive branding and customization may incur additional costs.

4.3. Additional Features

The inclusion of extra features, such as subscription billing or international currency support, can influence pricing.

5. Different Pricing Models

White-label payment portals offer various pricing models to cater to diverse business needs.

5.1. Monthly Subscription

Businesses pay a fixed monthly fee, irrespective of transaction volumes. Suitable for predictable transaction patterns.

5.2. Pay-Per-Transaction

A fee is charged for each transaction processed. Ideal for businesses with fluctuating sales volumes.

5.3. Tiered Pricing

Pricing tiers are based on transaction volume or customization level, while also offering flexibility to businesses.

6. Choosing the Right White Label Payment Gateway Pricing Plan

Selecting the appropriate pricing plan requires assessing your business’s specific needs, transaction volumes, and growth projections. It’s crucial to strike a balance between cost efficiency and necessary features.

7. Integration and Setup Costs

Apart from subscription fees, businesses should consider one-time integration and setup costs when budgeting for a white-label payment gateway.

8. Case Study: A Real-world Example

Explore a case study showcasing how a business benefited from implementing a private label payment gateway and also optimizing its pricing strategy.

9. Common Misconceptions about Pricing

Addressing common misconceptions and pitfalls can help businesses make informed decisions when selecting a white-label payment gateway.

10. The Future of White Label Payment Gateways

As technology evolves, private label payment gateways are expected to incorporate more innovative features to meet the demands of modern businesses.

11. Tips for Negotiating a Competitive Price

Learn valuable negotiation strategies to secure the best pricing deal for your private label payment gateway.

12. Conclusion

In conclusion, understanding white-label payment gateway pricing is essential for businesses aiming to streamline their payment processes while enhancing customer trust. By carefully evaluating the factors influencing pricing and also choosing the right pricing model, businesses can unlock the full potential of this versatile payment solution.

FAQs

- Is a white-label payment gateway suitable for small businesses?

- Absolutely! White-label payment gateways can be tailored to suit businesses of all sizes.

- Are there any hidden fees associated with white-label payment gateways?

- Transparency is key. Ensure you thoroughly review the pricing agreement to avoid surprises.

- Can I switch between different pricing models if my business needs a change?

- Many providers offer flexibility, allowing you to adjust your pricing plan as your business evolves.

- What security measures are in place to protect customer data?

- White-label payment gateways employ encryption, tokenization, and fraud prevention measures to safeguard data.