AUTHOR : JASMINE

DATE : 1/11/2023

Introduction

Payment gateways[1] are an essential part of modern e-commerce[2] and online transactions. They play a significant role in ensuring secure and efficient electronic payments[3]. In this article, we’ll delve into what payments[4] are, how they function, their benefits, types, security aspects, popular providers, integration methods, mobile payment, challenges, considerations for choosing the right one, and associated fees. By the end of this comprehensive guide, you’ll have a thorough understanding of payment gateways[5].

What is a Payment Gateway?

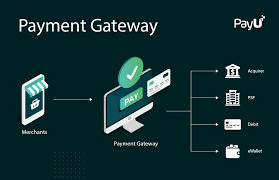

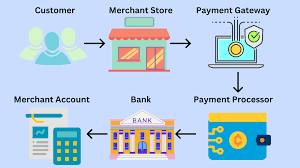

A payment processor is a technology-based service that facilitates online transactions by acting as an intermediary between an e-commerce website and the financial institution that processes the payment. In simpler terms, it’s the virtual equivalent of a physical point-of-sale terminal you’d find in a brick-and-mortar store.

How It Works?

Payment work seamlessly to process online When a customer makes a purchase on an e-commerce website, the payment encrypts the transaction details and sends it to the payment processor, which then forwards the information to the customer’s bank. If the funds are available, the bank approves the transaction and confirms the payment to the website, allowing the purchase to go through.

Benefits of Using Payment

Security: Payments provide robust security measures, encrypting sensitive data and ensuring that customer information remains safe.

Convenience: They offer a convenient way to pay, reducing the need for physical cash.

Global Reach: Payment gateways enable businesses to cater to a global audience by accepting various methods.

Types of Payment Gateways

Hosted Payment Gateways: Customers are redirected to a secure payment page hosted by the provider.

Integrated Payment Gateways: Payment processing occurs directly on the e-commerce website.

Security in P. Gateways

Security is paramount in payment . They use encryption, SSL certificates, and other security features to protect sensitive customer data. Choosing a secure gateway is crucial to maintaining customer trust.

Popular Payment Providers

Some well-known payment gateway providers include PayPal, Stripe, Square, and Authorize.Net. Each has its features and benefits, catering to different business needs.

Integration of Payment Gateways

Payment gateways can be integrated into e-commerce websites through APIs and plugins. The integration process varies based on the chosen gateway and the platform used for the website.

Mobile Payment ?

With the increasing use of mobile devices for online shopping, mobile payment have gained prominence. These gateways are optimized for mobile transactions, providing a seamless experience for users.

Challenges in Using Gateways

Challenges in using payment gateways include technical issues, compliance with regulations, and the risk of fraudulent transactions. Businesses need to be prepared to tackle these challenges effectively.

Choosing the Right Payment ?

Selecting the right payment depends on several factors, including the nature of the business, the target audience, geographical location, and the desired level of customization and control.

Fees Associated with ?

Payment providers charge fees for their services. These fees may include setup fees, transaction fees, and monthly fees. It’s essential to understand the cost structure .

Conclusion

Payment are the backbone of online transactions, ensuring that payments are processed securely and efficiently. They offer numerous benefits, including security, convenience, and global reach. Choosing the right is crucial for the success of an e-commerce business.

FAQs on Payment Gateways

- What pivotal role does a play in the dynamic world of e-commerce?

A payment gateway facilitates online transactions by connecting the e-commerce website to the financial institution that processes ensuring secure and efficient transactions. - Are payment secure?

Yes, payment use encryption and security features to protect sensitive customer data, making them secure for online transactions. - How do I choose the right payment for my business?

Consider factors like the nature of your business, target audience, geographical location, and cost structure when choosing a payment . - What types of payment are available?

There are two primary types of payment gateways: hostedgateways and integrated . - Which are some popular payment providers?

Popular gateway providers include PayPal, Stripe, Square, and Authorize.Net, each with its features and benefits.

Get In Touch