AUTHOR : HANIYA SMITH

DATE : 13/10/2023

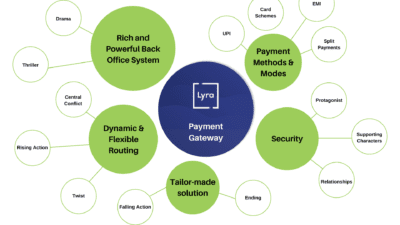

The payment gateway industry[1] has become a vital component of the modern economy, facilitating online transactions for businesses and consumers alike. As e-commerce continues to expand globally, understanding the intricacies of this industry is crucial for anyone involved in online commerce. This article delves into the key aspects of the payment gateway[2] industry, highlighting its significance, major players, technological advancements, and the challenges it faces.

Understanding Payment Gateways

What is a Payment Gateway?

A payment[3] gateway is a technology that allows merchants to accept online payments securely. It acts as an intermediary connecting the merchant’s online platform to the financial institution responsible for processing the transaction. Upon a customer completing a purchase, the payment gateway[4] secures their payment details through encryption and transmits this information to the payment processor[5] for verification and approval. Once the transaction is authorized, the gateway confirms the payment to the merchant and notifies the customer.

Importance of the Payment Gateway Industry

The payment gateway industry plays a crucial role in enabling businesses to conduct online transactions. With the rapid growth of e-commerce, payment gateways have become essential for businesses looking to expand their market reach. They not only facilitate secure transactions but also enhance the overall customer experience by providing various payment options and seamless checkout processes.

Key Players in the Payment Gateway Industry

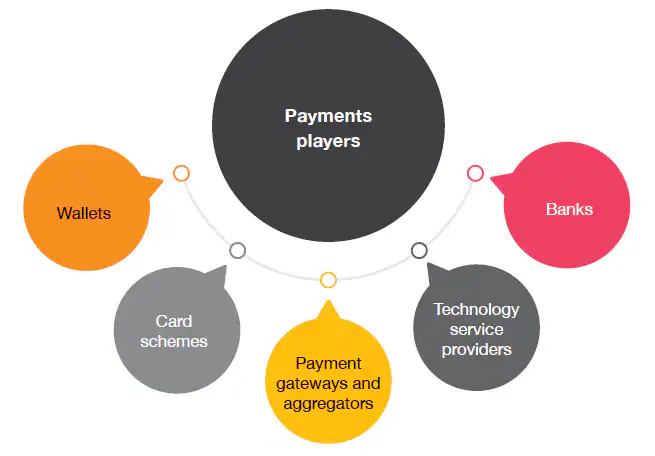

1. Traditional Banks

Many established banks have entered the payment gateway industry by offering payment processing solutions to their business clients. These banks leverage their existing infrastructure and reputation for security to attract businesses. Examples include JPMorgan Chase and Bank of America, which provide integrated payment solutions that help businesses manage their finances effectively.

2. Payment Service Providers (PSPs)

Payment service providers are specialized companies that offer a wide range of payment processing services. These providers focus on simplifying the payment process for businesses and consumers. Leading players in this sector include PayPal, Stripe, and Square. These companies have revolutionized the way payments are processed, offering user-friendly interfaces and robust security features.

3. Fintech Startups

The rise of fintech has introduced a wave of innovation into the payment gateway industry. Startups such as Adyen, Razor pay, and Mollie have emerged, offering unique payment solutions tailored to specific market needs. These companies often focus on niche markets or innovative technologies, such as mobile payments and cryptocurrency processing, providing alternatives to traditional payment methods.

Technological Advancements in the Payment Gateway Industry

1. Mobile Payments

With the proliferation of smartphones, mobile payments have gained immense popularity. The payment gateway industry has adapted by developing solutions that enable consumers to make purchases through mobile applications and websites. This trend has accelerated during the COVID-19 pandemic, as more consumers prefer contactless payment methods.

2. Blockchain Technology

Blockchain technology is making inroads into the payment gateway industry, offering secure and transparent transaction methods. By allowing direct peer-to-peer transactions without intermediaries, blockchain can reduce transaction fees and processing times. Some payment gateways are now integrating cryptocurrency support, enabling merchants to accept digital currencies alongside traditional payment methods.

3. Artificial Intelligence and Machine Learning

Artificial intelligence (AI) and machine learning (ML) are transforming fraud detection and prevention in the payment gateway industry. By analyzing transaction data in real-time, these technologies can identify suspicious patterns and flag potentially fraudulent activities. This enhances security for both merchants and customers, fostering greater trust in online transactions.

Trends Shaping the Payment Gateway Industry

1. Increased Demand for Seamless Integration

Businesses are increasingly seeking payment gateways that integrate easily with their existing software solutions. The ability to connect payment gateways with e-commerce platforms, accounting software, and customer relationship management (CRM) systems is becoming a key requirement. The Payment processing. is responding by providing robust APIs and plugins that simplify this integration process.

2. Subscription-Based Services

The rise of subscription-based business models is driving demand for payment gateways that can handle recurring payments and automated billing. This trend is particularly prevalent in industries such as software as a service (SaaS), media streaming, and e-commerce. Payment gateways must evolve to accommodate these models, offering features that streamline subscription management for businesses.

3. Enhanced Focus on User Experience

User experience (UX) is a significant consideration in the payment gateway industry. As competition intensifies, payment gateways that prioritize UX are more likely to attract and retain customers. This includes providing fast transaction processing, clear interfaces, and a variety of payment options to enhance the overall customer journey.

Challenges Facing the Payment Gateway Industry

1. Security Risks

Despite advancements in technology, the payment gateway industry continues to face challenges related to security. Cybercriminals continually innovate their tactics to take advantage of weaknesses in payment systems. Payment gateways must continually invest in security measures, such as encryption and fraud detection, to protect sensitive financial information.

2. Regulatory Compliance

Navigating the complex regulatory landscape is a significant challenge for payment gateways. Different countries and regions have varying regulations regarding data protection, anti-money laundering, and consumer rights. Compliance can be costly and time-consuming, particularly for smaller providers trying to establish themselves in the payment gateway industry.

3. Market Competition

The rapid growth of the payment gateway industry has led to increased competition among providers. With numerous options available, businesses must differentiate themselves by offering unique features, competitive pricing, and exceptional customer service. This competitive landscape can be challenging, especially for newer entrants trying to gain market share.

Conclusion

The payment gateway industry is essential to the growth of e-commerce and digital transactions. As technology evolves and consumer preferences shift, payment gateways must adapt to meet the demands of businesses and consumers alike. Understanding the dynamics of this industry—its key players, technological advancements, and emerging trends—enables stakeholders to navigate the complex landscape effectively. With security, innovation, and user experience at the forefront, the payment gateway industry is poised for continued growth and transformation, playing a crucial role in shaping the future of commerce.

FAQs

1. What is the payment gateway industry?

The payment gateway industry encompasses companies and technologies that facilitate online payment processing, enabling secure transactions between consumers and merchants.

2. How does a payment gateway work?

A payment gateway encrypts payment information during a transaction, sends it to the payment processor for authorization, and relays the approval or denial back to the merchant and customer.

3. Why is security important in the payment gateway industry?

Security is critical to protect sensitive financial information from fraud and data breaches, ensuring consumer trust and regulatory compliance.

4. What are some current trends in the payment gateway industry?

Current trends include the rise of mobile payments, integration of blockchain technology, increased demand for seamless integration, subscription-based services, and a focus on user experience.

5. What challenges do payment gateway providers face?

Payment gateway providers face challenges such as security risks, regulatory compliance issues, and intense competition within the industry.