AUTHOR :HAANA TINE

DATE :07/12/23

Introduction

In the rapidly evolving realm of online commerce , the necessity for a dependable payment gateway stands as a paramount factor for enterprises , regardless of their scale and scope. It ensures smooth transactions, builds trust among customers, and contributes to the overall success of online ventures. As we explore the Stripe India Payment Gateway, we’ll uncover its features, advantages, and the impact it’s making on the digital payment landscape.

Evolution of Digital Payments in India

Before delving into Stripe’s role, let’s take a quick journey through the evolution of digital payments in India. From the advent of online banking to the surge in e-commerce platforms, the need for secure and efficient payment gateways has never been greater.

Need for Stripe in India

While numerous payment gateways exist, what sets Stripe apart and makes it particularly relevant for India’s diverse market? We’ll explore the unique features that make Stripe a standout choice for businesses looking to streamline their payment processes.

Stripe’s Entry into the Indian Market

Understanding the timeline of Stripe’s entry into India provides insights into its adoption and the initial response from businesses and consumers alike. The challenges faced and the strategies employed by Stripe to establish a foothold will be discussed.

Key Features of Stripe India Payment Gateway

A payment gateway is only as good as its features. Stripe’s India-centric features, from seamless integration to support for various payment methods and currencies, make it a versatile choice for businesses with diverse needs.

Advantages for Indian Businesses

Indian businesses face unique challenges, and Stripe aims to address them effectively. We’ll explore how Stripe offers cost-effective solutions and transparent pricing, making it an attractive option for businesses of all scales.

Security Measures in Place

In the digital age, security is paramount. This section will detail the robust security measures implemented by Stripe, reassuring both businesses and customers about the safety of their transactions and sensitive information.

User-Friendly Interface

No matter how powerful a payment gateway is, user experience matters. We’ll discuss Stripe’s user-friendly design and its accessibility, ensuring that businesses, regardless of their technical expertise, can easily integrate and navigate the platform.

Case Studies

Real-world examples speak volumes. Through case studies, we’ll highlight success stories of businesses that have benefited from Stripe’s services, showcasing the tangible impact it has on streamlining payment processes.

Challenges and Solutions

No system is without its challenges. This section will candidly address common issues faced by businesses using payment gateways and how Stripe provides effective solutions, ensuring a smooth experience for all parties involved.

Future Prospects for Stripe in India

As the digital landscape continues to evolve, we’ll explore the potential growth of online transactions in India and how Stripe plans to adapt and expand its services to meet the changing needs of businesses and consumers.

Testimonials

What better way to understand the impact of Stripe than through the words of those who have used it? This section will feature quotes and testimonials from businesses and users, offering genuine insights into the positive experiences with Stripe.

Comparison with Competitors

In a competitive market, understanding how Stripe stands out is crucial. We’ll conduct a brief analysis, highlighting Stripe’s unique selling points and competitive advantages over other payment gateways.

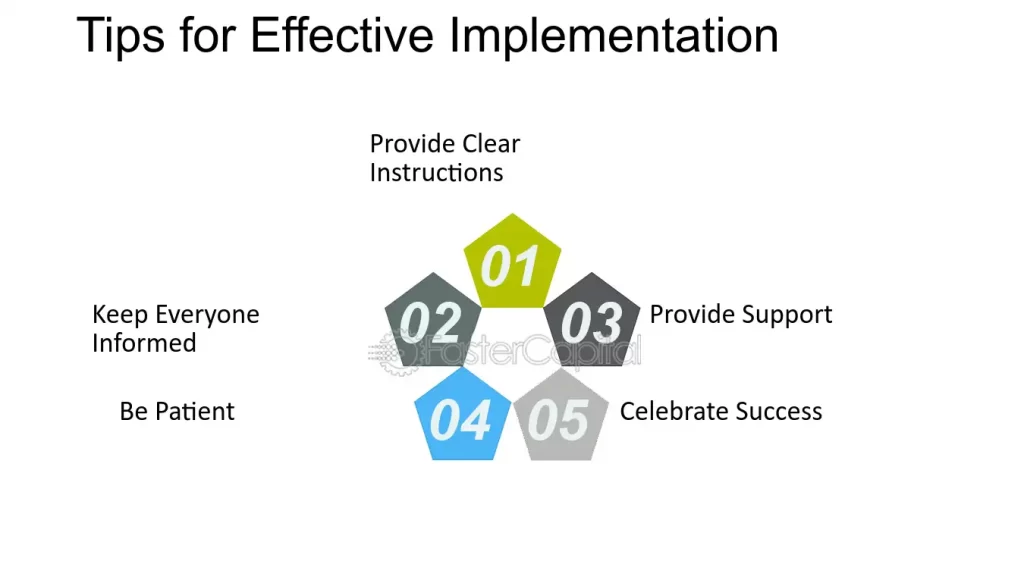

Tips for Effective Implementation

For businesses considering or already using Stripe, this section provides practical tips for effective implementation. From initial integration to ongoing management, these best practices ensure a seamless experience.

Comparison with Competitors

In a landscape crowded with payment gateways, it’s essential to understand how Stripe compares to its competitors. Stripe stands out with its user-friendly interface, versatile features, and transparent pricing. Unlike some competitors, Stripe ensures a hassle-free integration process, making it a preferred choice for businesses looking for efficiency and simplicity in their payment systems.

Tips for Effective Implementation

For businesses considering or already using Stripe, implementing it effectively[1] is crucial for maximizing its benefits. Here are some practical tips:

Choose the Right Integration Option

When integrating Stripe, choose the method that best suits your business model. Whether it’s a direct API integration for custom solutions or using Stripe plugins for popular e-commerce platforms[2], the right choice ensures a smoother implementation process.

Test Transactions Thoroughly

Before fully deploying Stripe, conduct thorough testing with test transactions[3]. This ensures that your integration is flawless and that customers will have a seamless experience when making real transactions.

Leverage Stripe’s Analytics

Stripe[4] provides robust analytics tools that offer valuable insights into your transactions and customer behavior. Utilize these tools to make informed decisions, identify trends, and optimize your payment processes.

Keep Payment Pages Simple and Intuitive

Design your payment pages with simplicity and user-friendliness in mind. A clean and intuitive interface reduces friction during the payment process[5], enhancing the overall customer experience.

Stay Informed About Updates

Stripe regularly updates its features and security measures. Stay informed about these updates to ensure that your system is up-to-date, secure, and taking advantage of the latest enhancements.

Conclusion

In conclusion, Stripe’s entry into the Indian payment landscape signifies a significant step towards revolutionizing digital transactions. The features, advantages, and success stories shared in this article emphasize its importance and the positive impact it can have on businesses in India.

FAQs

- Is Stripe suitable for small businesses in India?

- Yes, Stripe offers solutions scalable for businesses of all sizes.

- How does Stripe ensure the security of transactions?

- Stripe employs robust encryption and security protocols to safeguard transactions and user information.

- Can I use Stripe for international transactions?

- Absolutely, Stripe supports various currencies, making it ideal for international transactions.

- What makes Stripe stand out compared to other payment gateways?

- Stripe’s user-friendly interface, versatile features, and transparent pricing set it apart from competitors.

- How quickly can a business integrate Stripe into its system?

- Integration is designed to be seamless, and businesses can typically set up Stripe swiftly.

Get In Touch