AUTHOR : EMILY PATHAK

DATE : 17 / 10 / 2023

In today’s digital age, online payments have become an integral part of the global economy. For businesses and consumers alike, it is essential to have secure and efficient payment gateways to facilitate transactions. In the United Kingdom, several payment gateways have emerged to cater to the diverse needs of businesses and individuals. This article will provide you with an in-depth understanding of payment gateways in the UK, discussing their types, benefits, and how to choose the right one for your needs.

Introduction to Payment Gateways

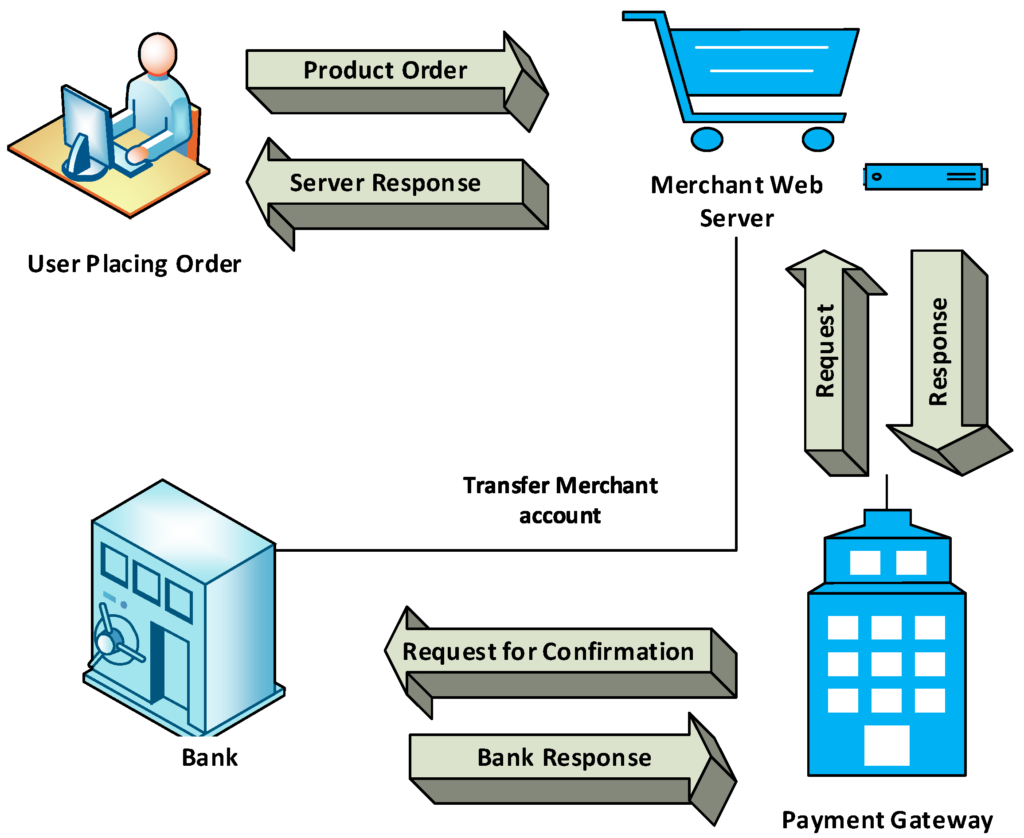

Payment gateways are online systems that enable the seamless and secure transfer of funds between a buyer and a seller. In the UK, these gateways play a crucial role in e-commerce, allowing businesses to accept payments through various means, including credit and debit cards, digital wallets, and bank transfers.

Types of Payment Gateways

Hosted Payment Gateways

Hosted payment gateways redirect customers to a secure payment page, where the actual transaction takes place. This method offers simplicity and security but may redirect users away from your website during the payment process.

Self-Hosted Payment Gateways

Self-hosted gateways allow you to host the payment process on your own site,[1] offering more control over the payment experience. However, these self-hosted gateways demand a higher level of technical proficiency for both setup and ongoing maintenance.

API-Hosted Payment Gateways

API-hosted gateways offer a balance between the two by providing a customizable payment experience while maintaining security. They integrate directly into your website, giving you control over the payment process.

Exploring Payment Gateways in the UK

The United Kingdom has witnessed a substantial increase in e-commerce activities over the past decade, and the role of payment gateways in facilitating these transactions cannot be overstated. As the digital marketplace continues to evolve, businesses need to stay informed about the latest developments in payment technology [2]and consumer preferences.

The Evolution of Online Payments

The evolution of online payments has been marked by significant changes in consumer behavior. Shoppers are increasingly embracing the convenience of online shopping, which has led to a surge in digital transactions. This trend has driven the demand for secure and efficient payment gateways.

Popular Payment Gateways in the UK

PayPal

PayPal is a widely recognized payment gateway that allows users to pay with their PayPal accounts or credit cards. It’s known for its user-friendliness and broad acceptance.

Worldpay

Worldpay offers a range of payment solutions for businesses of all sizes. With its comprehensive services, it’s a popular choice among UK merchants.

Stripe

Stripe is known for its developer-friendly approach and also is a top choice for businesses looking for customization and integration options.

Sage Pay

Sage Pay is a reliable choice for businesses seeking a secure and also straightforward payment gateway. It offers a range of features and also pricing plans.

Choosing the Right Payment Gateway

Making the correct choice of payment gateway holds immense significance for the success of your business. Consider the following factors:

Security

Ensure the gateway meets industry security standards to protect both your business and customers from fraud.

Transaction Fees

Compare transaction fees, including setup, monthly, and also per-transaction fees, to find a cost-effective solution.

Integration Options

Choose a gateway that integrates seamlessly with your e-commerce platform or website.

User-Friendly Interface

Opt for a gateway that provides a smooth and intuitive payment experience for your customers.

Setting Up a Payment Gateway

To establish a payment gateway, adhere to this sequence of actions:

Registering for an Account

Start by creating an account with your chosen payment gateway provider and also complete the necessary documentation.

Integration with Your Website

Integrate the gateway with your website [3]using the provided plugins, APIs, or guidance from your provider.

Testing the Payment Gateway

Before going live, conduct thorough testing to ensure a seamless payment process for your customers.

Benefits of Using Payment Gateways

Using payment gateways offers various advantages, including:

Enhanced Security

Payment gateways implement robust security protocols to safeguard confidential financial data. information.

Convenient Payment Options

Customers can choose from a variety of payment methods, making it easy for them to complete transactions.

Global Reach

Payment gateways allow you to cater to a global audience, expanding your business’s reach.

Efficient Payment Processing

Payments are swiftly processed, [4]mitigating the likelihood of shopping cart abandonment.

Challenges and Considerations

However, using payment gateways comes with challenges and also considerations:

Chargebacks and Disputes

Be prepared to handle chargebacks and also disputes, which can affect your revenue.

Compliance and Regulations

Stay updated with UK and international regulations to ensure your business operates within the law.

Technical Support

Choose a provider that offers reliable technical support to address any issues promptly.

Conclusion

Payment gateways in the UK are the backbone of the e-commerce industry, offering secure and also convenient payment solutions. Selecting the right one for your business is crucial to providing a seamless shopping experience for your customers.

FAQs

- How do I choose the best payment gateway for my online business?

- Consider your specific needs, security features, and integration options when selecting a payment gateway.

- What sets hosted and also self-hosted payment gateways apart?

- Hosted gateways redirect customers to a secure payment page, while self-hosted gateways allow you to host the payment process on your own website.

- Are there any fees associated with using payment gateways in the UK?

- Yes, payment gateways typically charge setup, monthly, and also per-transaction fees.

- How can I ensure the security of my customers’ financial information when using payment gateways?

- Choose a payment gateway that complies with industry security standards and also uses encryption to protect data.

- What are the common challenges businesses face when using payment gateways?

- Challenges include handling chargebacks and disputes, staying compliant with regulations, and also receiving reliable technical support.