AUTHOR : EMILY PATHAK

DATE : 14 / 10 / 2023

In the era of digital technology, online transactions have seamlessly integrated into our daily routines.Whether you’re shopping online, paying bills, or transferring funds, the process involves a crucial intermediary known as a payment gateway. This article will delve into the intricacies of payment gateways, shedding light on their working process and importance in ensuring secure and seamless online payments.

1. Introduction

The world of e-commerce and online transactions has revolutionized the way we shop and conduct business. A critical component of this digital ecosystem is the payment gateway, which ensures that your payments are processed securely and efficiently. In this article, we will explore how payment gateways work, their types, security measures, and also their significance in today’s online world.

2. What is a Payment Gateway?

A payment gateway is essentially a technology that acts as a bridge between a merchant’s website and the financial institutions involved in a transaction. It facilitates the transfer of sensitive financial data between the customer, merchant, and also the bank or payment processor. Payment gateways play a pivotal role in authorizing and processing payments, making them a crucial part of online businesses.

3. The Role of Payment Gateways

Payment gateways serve as intermediaries that ensure that the customer’s payment details are securely transmitted to the bank for authorization. They are responsible for encrypting data, making real-time transaction decisions, and providing an essential layer of security for online payments.

4. Types of Payment Gateways

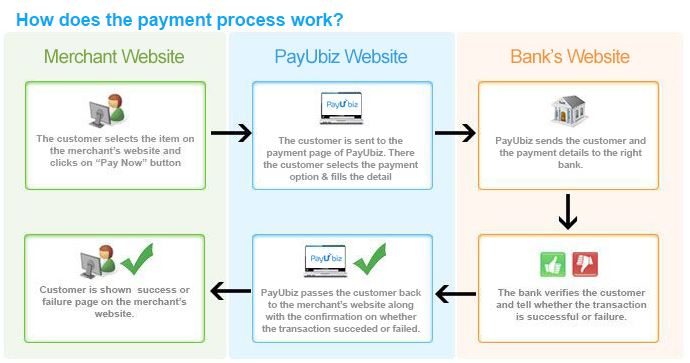

There are two main types of payment gateways: hosted and also integrated. Hosted gateways redirect customers to a separate payment page hosted by the gateway provider, while integrated gateways allow customers to complete transactions [1]without leaving the merchant’s site.

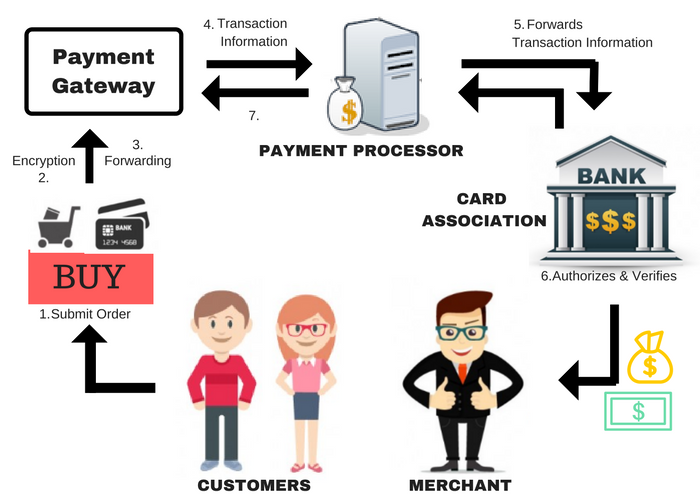

5. How Does a Payment Gateway Work?

The working process of a payment gateway involves multiple steps, from the moment a customer initiates a transaction to the final approval. These steps include request initiation, data encryption, authorization, and the confirmation of payment.

6. Step-by-Step Payment Process

- Customer initiates payment.

- Payment data is encrypted.

- Encrypted data is transmitted to the gateway.

- Gateway forwards data to the bank or payment processor.

- Authorization request is sent.

- Bank authorizes or declines the transaction.

- Confirmation is sent to the merchant and customer.

7. Encryption and Security

Security is paramount in the world of online payments. Payment gateways use encryption techniques to safeguard customer data during transmission. This ensures that sensitive information, such as credit card numbers, remains confidential and protected from potential threats.

8. Common Payment Gateway Providers

Numerous companies offer payment gateway services, including PayPal, Stripe, and also Square. Each provider may have its unique features and also pricing models, catering to various business needs.

9. Mobile Payment Gateways

With the proliferation of mobile devices, mobile payment gateways have gained prominence. These gateways are optimized for mobile transactions, making it easy for users to pay using their smartphones and tablets.

10. Challenges and Risks

While payment gateways provide convenience and security, they also come with challenges and risks. These include the potential for fraud, technical glitches, and also the need for constant updates to stay ahead of evolving threats.

11. Future Trends in Payment Gateways

The payment gateway industry[2] is continually evolving. Future trends may include enhanced security[3] measures, increased support for cryptocurrency transactions, and also greater integration with emerging technologies like AI and IoT.

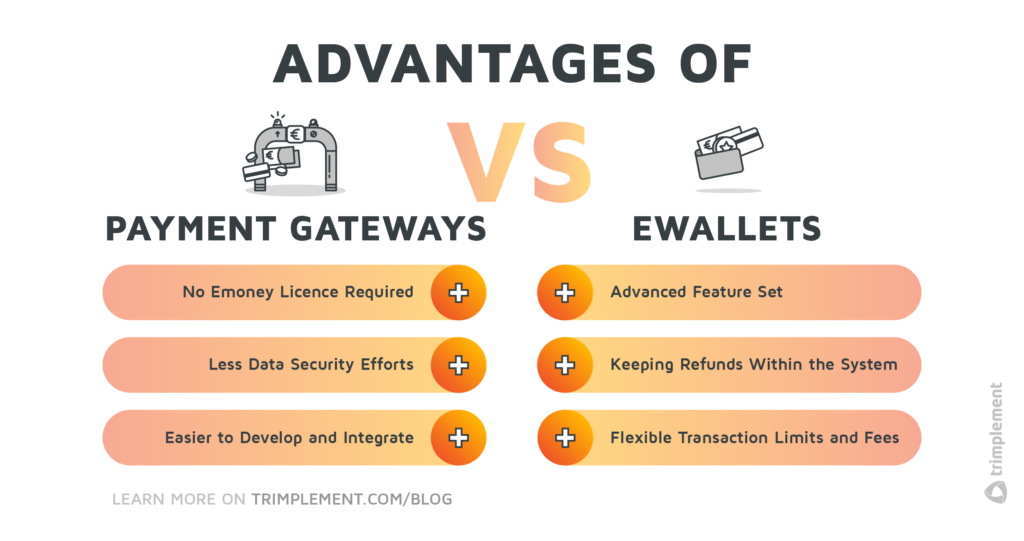

12. Advantages of Payment Gateways

Payment gateway[4]s offer several advantages, such as global reach, real-time transaction processing, and enhanced security. They contribute to improved customer trust [5]and also higher conversion rates for online businesses.

13. Disadvantages of Payment Gateways

Despite their many benefits, payment gateways can have drawbacks, including transaction fees, the potential for technical issues, and dependency on internet connectivity.

14. Frequently Asked Questions (Continued)

6. What are the advantages of using a payment gateway?

Using a payment gateway offers several advantages, including global reach, real-time transaction processing, and also enhanced security. This can improve customer trust and lead to higher conversion rates for online businesses.

7. Are there any disadvantages to using payment gateways?

While payment gateways provide numerous benefits, they also come with some disadvantages. These may include transaction fees, the potential for technical issues, and also a degree of dependency on internet connectivity.

8. How can businesses choose the right payment gateway provider?

Choosing the right payment gateway provider depends on the specific needs of your business. Factors to consider include transaction fees, security features, ease of integration, and also the level of customer support offered by the provider.

9. Can payment gateways be integrated with e-commerce platforms?

Yes, most payment gateways are designed to be easily integrated with various e-commerce platforms. This streamlines the payment process for online businesses.

10. What measures can customers take to ensure the security of their online payments?

Customers can enhance the security of their online payments by using strong and also unique passwords, monitoring their bank statements for any suspicious activity, and being cautious about sharing personal and financial information online.

15. Conclusion

In conclusion, payment gateways are the unsung heroes of the online shopping and transaction world. Their ability to secure and streamline payment processes has revolutionized e-commerce and online business. As we move forward, these gateways will continue to adapt to new challenges and opportunities, ensuring that online transactions remain safe, convenient, and efficient.

16. Frequently Asked Questions

1. What is a payment gateway? A payment gateway is a technology that acts as a bridge between a merchant’s website and the financial institutions involved in a transaction.

2. How do payment gateways work? Payment gateways encrypt and transmit payment data, obtain authorization from the bank, and confirm payment to the merchant and customer.

3. Are payment gateways secure? Yes, payment gateways use encryption techniques to safeguard sensitive customer data during transmission, ensuring security.

4. What are the types of payment gateways? There are two main types: hosted gateways that redirect customers to a separate payment page, and integrated gateways that allow transactions without leaving the merchant’s site.

5. What are the future trends in payment gateways? Future trends may include enhanced security measures, increased support for cryptocurrency transactions, and greater integration with emerging technologies like AI and IoT.

Get In Touch