AUTHOR : EMILY PATHAK

DATE : 14 / 10 / 2023

In this era of digitization, online transactions have become an indispensable facet of our daily existence. Whether it’s purchasing products, paying for services, or making donations, we rely on payment gateways to process our payments efficiently and securely. But how exactly do payment gateways wor? In this article, we’ll delve into the intricate workings of payment gateways, breaking down the process into easily digestible sections.

Understanding Payment Gateways

Introduction to Payment Gateways

Payment gateways are online systems that facilitate the seamless transfer of money from the buyer to the seller. They act as a bridge between various parties involved in a transaction, including the customer, merchant, and banks.

The Significance of Payment Gateways

Payment gateways play a crucial role in e-commerce, ensuring secure, quick, and also hassle-free transactions. They encrypt sensitive information and also provide a safe passage for your payment details.

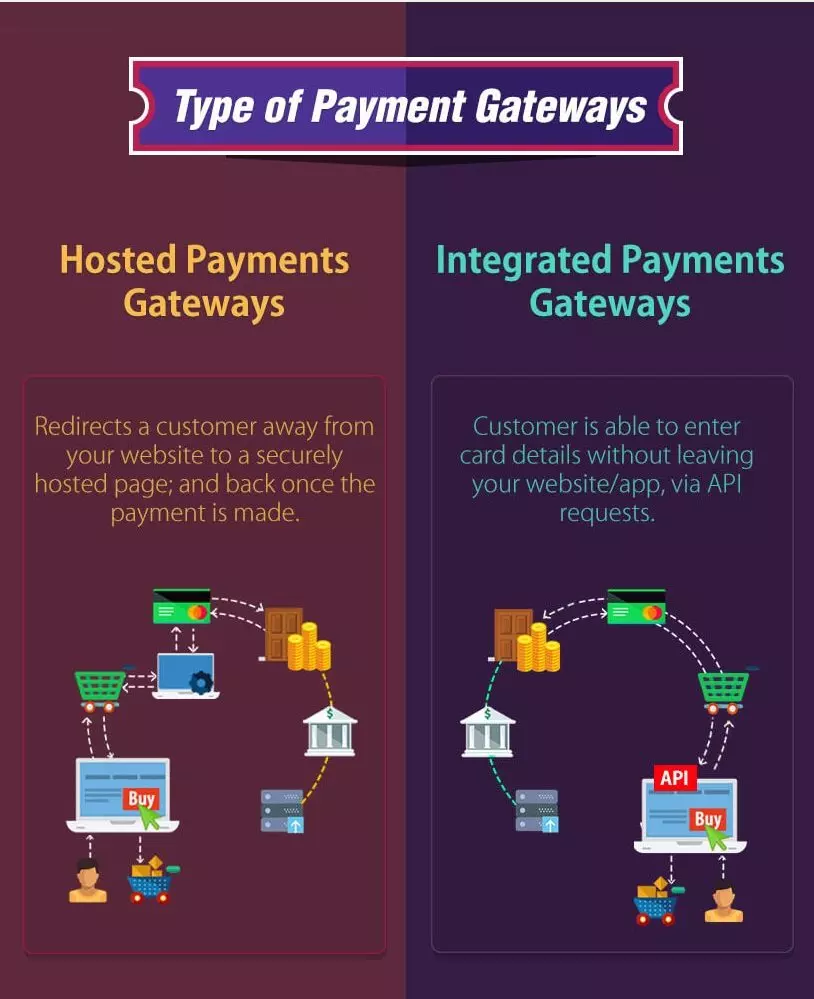

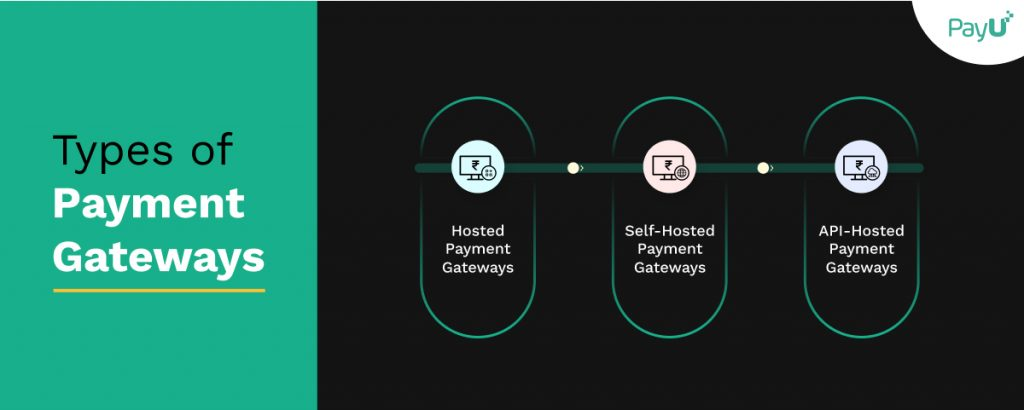

Types of Payment Gateways

Hosted Payment Gateways

These gateways redirect customers to a third-party website to complete their transactions. Popular examples include PayPal and also Stripe.

Self-Hosted Payment Gateways

Self-hosted gateways allow customers to complete their transactions on the merchant’s website, providing a more seamless experience.

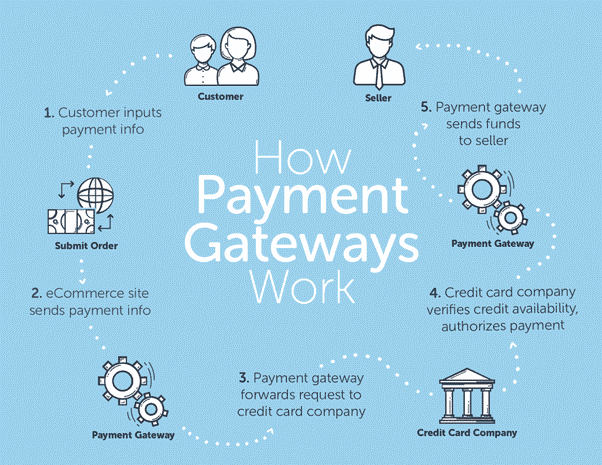

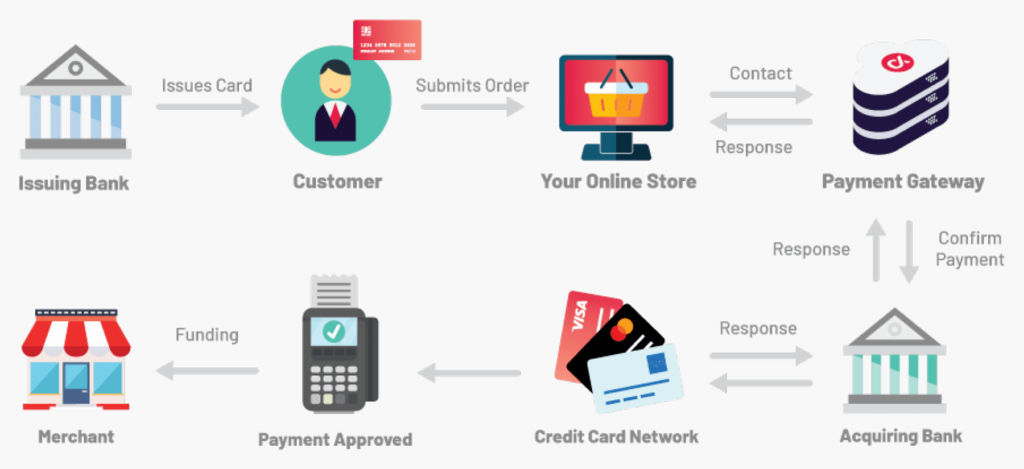

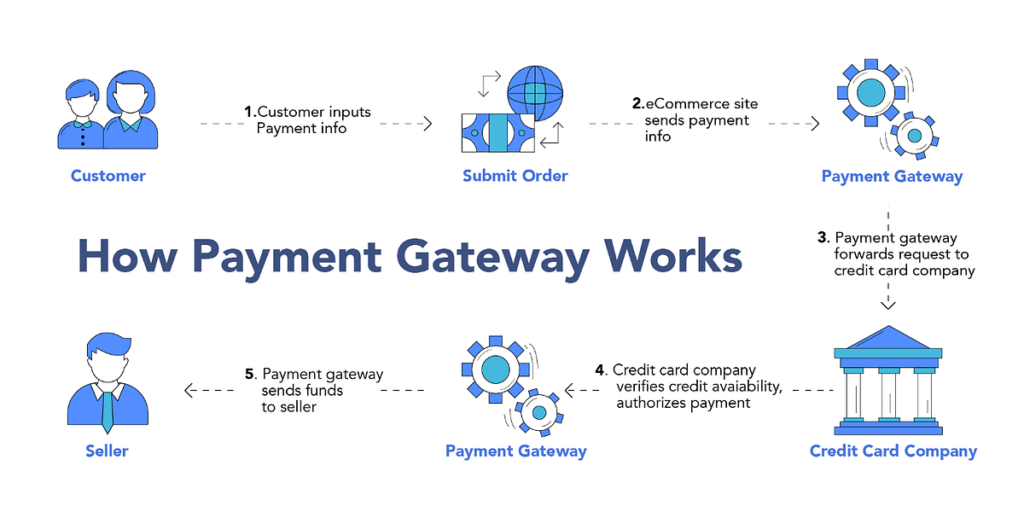

Payment Gateway Process

Customer Initiation

The process begins when a customer initiates a payment. They enter their payment information, such as credit card details or digital wallets, on the merchant’s checkout page.

Data Encryption

To ensure the security of the transaction, the payment information is encrypted. This step protects sensitive data from potential threats.

Transaction Authorization

The encrypted data is sent to the payment gateway[1], which communicates with the customer’s bank for authorization. The bank validates the transaction, checking the availability of funds and also the legitimacy of the transaction.

Transaction Approval

If the bank approves the transaction, the payment gateway sends an approval message to the merchant. This indicates that the payment was successful.

Settlement

The payment gateway ensures the settlement of funds between the customer’s bank and also the merchant’s account. This marks the ultimate stage in the progression.

Benefits of Payment Gateways

Security

Payment gateways prioritize security by encrypting data and also preventing fraudulent activities.

Convenience

They offer a convenient way for customers to make payments from the comfort of their homes.

Global Reach

Payment gateways enable businesses to reach customers worldwide, accepting various currencies.

Payment Options

Customers can choose from a range of payment options, including credit cards, debit cards, digital wallets, and more.

Challenges and Solutions

Chargebacks

Dealing with chargebacks can be a challenge for merchants[1]. Implementing a robust dispute resolution system is essential.

Technical Glitches

Technical issues can hinder the payment process. Regular maintenance and also troubleshooting are key to ensuring smooth transactions.

Mobile Payment Gateways

As mobile commerce grows, the demand for mobile payment gateways has surged. Mobile-friendly gateways provide a seamless experience for customers using smartphones and tablets.

E-commerce and Payment Gateways

E-commerce businesses heavily rely on payment gateways to process payments from customers worldwide. A robust payment gateway is crucial for the success of online stores.

Challenges in Payment Processing

Despite the efficiency of payment gateways, challenges like transaction failures and fraud still exist. Merchants must continuously monitor and improve their payment processes to minimize these issues.

The Future of Payment Gateways

With technological advancements,[2] payment gateways are evolving. The future holds innovations in biometric authentication and seamless cross-border transactions.

How Payment Gateways Work

The functioning of a payment gateway can be broken down into three key steps:

Authorization

When a customer initiates a purchase, the payment gateway verifies the validity of the payment method (credit card, digital wallet, etc.) and the availability of funds. It ensures that the customer has sufficient funds for the transaction.

Authentication

Once authorized, the payment gateway securely transmits the payment information to the acquiring bank, which further validates the transaction. This involves checking for any fraudulent activity, ensuring that the cardholder’s information is accurate and up-to-date.

Settlement

After the authentication process, the acquiring bank transfers the payment [3]to the seller’s bank account. This step concludes the transaction, and the customer’s account is debited while the seller’s account is credited.

Types of Payment Gateways

Payment gateway[4]s are available in diverse formats, each tailored to address distinct business requirements.

Hosted Payment Gateways

These gateways redirect customers to a third-party payment page, where the actual transaction[5] occurs. Popular examples include PayPal and also Square.

Self-hosted Payment Gateways

In this setup, the seller hosts the payment page on their website, providing more control and also customization options.

Conclusion

In conclusion, payment gateways are the unsung heroes of online transactions. They work tirelessly behind the scenes to ensure that your payments are processed securely and also efficiently. With the ever-increasing demand for online transactions, understanding how payment gateways work is vital for both consumers and merchants.

So, the next time you shop online or make a payment, you can appreciate the technology and security measures that make it all possible.

FAQs

1. Are payment gateways safe to use?

- Yes, payment gateways employ robust security measures to protect your payment information.

2. How long does a typical payment transaction take?

- Most payment transactions are processed within seconds, providing a seamless experience.

3. Can I use a payment gateway for international transactions?

- Absolutely, payment gateways are designed to handle transactions in various currencies, making them suitable for global business.

4. What should I do if I encounter a payment gateway issue?

- Contact the merchant’s customer support, and they will assist you in resolving any problems you may encounter.

5. Are there any additional fees associated with using payment gateways?

- Some payment gateways charge transaction fees, so it’s essential to check with the service provider for details on their pricing.

Get In Touch