AUTHOR : MICKEY JORDAN

DATE : 16/12/2023

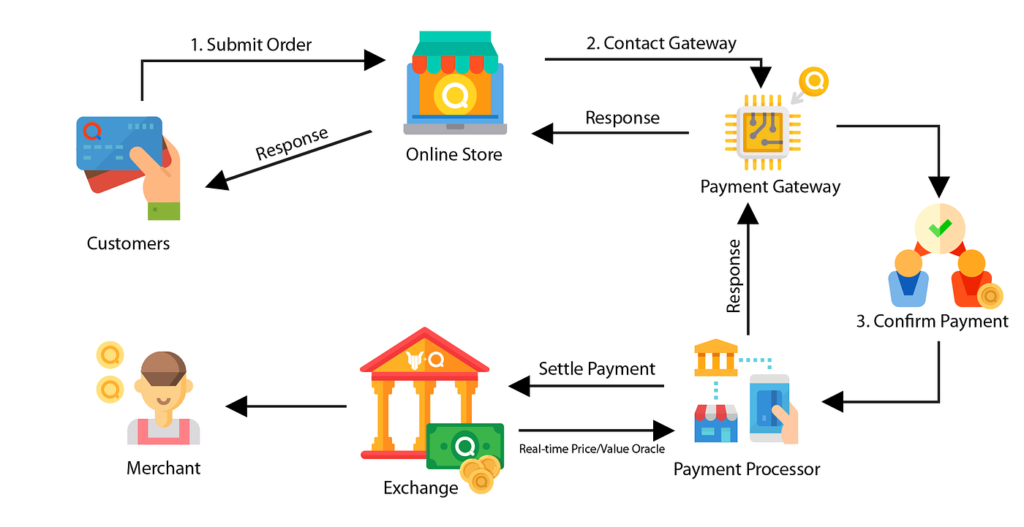

In the ever-evolving world of e-commerce and digital transactions, a Payment Gateway Without Verification[1] is an option that has been gaining attention. Traditional payment gateways often require multiple levels of verification, such as two-factor authentication or manual checks, to process payments[2]. However, some gateways[3] bypass these verification steps, allowing users to make payments faster and more conveniently. While this can be a benefit for users seeking speed, it also comes with certain risks and considerations. In this article, we will explore what a Payment Gateway[4] Without Verification is, how it works, its advantages and drawbacks, and when it might be a good choice for your business or platform.

What is a Payment Gateway Without Verification?

A Payment Gateway Without Verification refers to a payment processing system that does not require additional layers of security or validation, such as multi-factor authentication or manual review, for each transaction. This type of gateway is designed to simplify and speed up the payment process[5] by reducing the steps necessary for a transaction to be approved.

Typically, payment gateways require some form of verification to ensure the legitimacy of the transaction and the security of the user’s financial information. These security measures are essential for preventing fraud, protecting sensitive data, and ensuring compliance with industry standards. However, a Payment Gateway Without Verification eliminates or reduces these checks, which can lead to faster transactions, especially for low-value payments.

The Conventional Conundrum

Lengthy Verifications: A Barrier to Seamless Transactions

Traditional payment gateways often subject users to a cumbersome verification process, hampering the user experience and hindering the speed of transactions.

User Friction: Striking the Balance

Examining the delicate balance between implementing stringent security measures and ensuring a frictionless user experience in the conventional verification process.

Embracing Innovation: No-Verification Solutions

Streamlining Transactions: The Essence of No-Verification Gateways

An exploration of innovative payment gateways designed to eliminate the need for extensive user verification, focusing on expediting the transaction process.

The Advantages Unveiled

Delving into the perks of opting for payment gateways that bypass traditional including faster transactions, enhanced user convenience, and increased conversion rates.

Fortifying Security in the Absence of Verification

Encryption Excellence

Unpacking the technological marvels behind payment gateways, particularly the implementation of advanced encryption techniques to safeguard sensitive information.

Proactive Fraud Prevention Measures

Examining the strategies employed by these gateways to prevent activities without relying on conventional verification steps.

Industries Redefined: The Impact of No-Verification Gateways

E-Commerce Evolution

How the sector is experiencing a transformative shift with the integration of no-verification payment gateways, leading to a more efficient and transaction environment.

Fintech’s Foothold

Analyzing the pivotal role played by fintech companies in driving the widespread adoption of innovative payment solutions, reshaping the financial landscape.

Challenges and Considerations

Striking the Right Balance

Addressing the challenges associated with userand security in the realm of payment gateways without traditional verification.

Navigating Regulatory Compliance

Highlighting the importance of to regulatory standards while providing payment options and trust within the industry.

Understanding the Traditional Verification Process

The Conventional Verification Hassles

Traditional payment often entail a lengthy and process, causing to both merchants and customers.

Balancing Security and User Experience

Examining the delicate balance between robust security measures and a user experience during the verification process.

The Rise of Payment Gateways Without Verification

Breaking the Mold: No-Verification Solutions

An exploration of innovative payment gateways that eliminate the need for extensive user while a high level of security.

Advantages of No-Verification Gateways

Unveiling the perks of opting for payment gateways that bypass traditional including faster transactions and user convenience.

Navigating the Security Landscape

The Role of Advanced Encryption

Delving into the technological that make paymentsecure, including state-of-the-art encryption techniques.

Fraud Prevention Strategies

Examining the payment gateways to prevent fraud in the absence of traditional steps.

Industries Embracing No-Verification Payment Gateways

E-Commerce Revolution

How the e-commerce sector is from the transaction process facilitated by no-verification payment gateways.

Fintech Integration

The role of fintech companies in driving the adoption of innovative payment solutions, the financial landscape.

User Experience: The Heart of No-Verification Gateways

Seamless Transactions

Exploring how a transaction process enhances the overall user experience and fosters customer loyalty.

Customer Feedback and Satisfaction

Drawing insights from user feedback to highlight the positive impact of no-verification payment on customer satisfaction.

The Future of Digital Transactions

Evolution of Payment Technologies

A glimpse into the landscape of payment technologies and how fit into the future narrative.

Market Trends and Adoption Rates

Analyzing current market trends and the increasing adoption rates of payment gateways without traditional verification.

Conclusion

In conclusion, the of payment without verification marks a paradigm shift in the digital payment ecosystem. Striking the right balance between security and user convenience, these solutions are the way we transact online.

FAQs

1. Are no-verification payment gateways safe?

Yes, these gateways leverage advanced encryption methods to ensure secure transactions.

2. How do no-verification gateways expedite the transaction process?

By eliminating lengthy verification steps, transactions become faster and more efficient.

3. Can businesses in highly regulated industries benefit from no-verification gateways?

Adherence to regulatory compliance is crucial; businesses must ensure they comply with financial regulations.

4. What customer data is at risk with no-verification gateways?

These gateways prioritize data security; sensitive information is protected through robust encryption.

5. How can businesses integrate no-verification gateways into their existing systems?

Most providers offer seamless integration options, and businesses can consult with experts for a smooth transition.

Get In Touch