AUTHOR : JAYOKI

DATE : 15/12/2023

In today’s digital economy, businesses rely heavily on payment gateways[1] to process online transactions efficiently. However, transaction fees can accumulate over time, especially for small and medium-sized enterprises (SMEs). As a result, finding a Payment Gateway with Lowest Charges[2] has become a priority for many businesses. In this article, we will explore what defines a payment gateway with low charges, how to choose the right one for your business, and the benefits of opting for such a solution.

What is a Payment Gateway?

A payment gateway is a service that authorizes and processes payments[3] for online businesses. It acts as a bridge between a customer’s bank and the merchant’s bank, ensuring the secure transfer of payment information. Payment gateways[4] are critical for e-commerce, as they handle various payment methods[5], including credit cards, debit cards, and digital wallets.

Typically, payment gateways charge a fee for each transaction, which may include a fixed fee, a percentage of the transaction, or both. These charges can vary greatly between providers, which is why finding a Payment Gateway with Lowest Charges is essential for businesses seeking to reduce their operational costs.

Factors to Consider When Choosing a Payment Gateway

When navigating the payment gateway market, businesses need to consider various factors, including transaction fees, setup costs, monthly fees, and potential hidden charges. A comprehensive evaluation ensures a transparent understanding of the financial implications.

Top Payment Gateways with Low Charges

To aid businesses in their quest for cost-effective payment solutions, we’ll compare and contrast popular payment gateways known for their low charges. By examining their features, businesses can make an informed choice that aligns with their budgetary constraints.

Benefits of Opting for a Payment Gateway with Low Charges

Beyond mere cost savings, choosing a payment gateway with low charges can have profound benefits for businesses, leading to increased profit margins and improved financial sustainability.

Challenges of Using Low-Cost Payment Gateways

However, it’s crucial to acknowledge the potential challenges associated with low-cost payment gateways, such as limitations in features and potential security concerns. Striking a balance between cost-effectiveness and functionality is essential.

Tips for Negotiating Lower Charges

For businesses seeking even more cost savings, we’ll delve into practical strategies and negotiation tactics to secure lower charges from providers.

Emerging Trends in Payment Gateway Industry

The payment gateway industry is dynamic, with constant innovations in cost-effective solutions. We’ll explore emerging trends and make predictions about the future of payment gateways.

User-Friendly Payment Gateways with Low Charges

A seamless user experience is paramount in the online payment process. We’ll recommend user-friendly payment gateways that not only offer low but also prioritize ease of use.

Security Measures in Low-Cost Payment Gateways

Security is a non-negotiable aspect of online transactions. We’ll discuss how businesses can ensure secure transactions while still benefiting from the cost-effectiveness of low-cost payment gateways.

Impact of Payment Gateway Charges on Small Businesses

Small businesses face unique challenges, and the impact of payment gateway charges can be significant. We’ll explore the specific challenges startups encounter and provide solutions to help them thrive.

Global Comparison of Payment Gateway Charges

Considering the global nature of many businesses, we’ll examine the variances in gateway charges worldwide and offer insights into international considerations for businesses operating on a global scale.

Customer Reviews and Ratings

The importance of customer feedback cannot be overstated. We’ll discuss how businesses can use customer reviews and ratings to guide their decision-making process when selecting a payment gateway.

The Role of Data Security in Payment Gateways

Security is paramount in online transactions. This section will delve into the importance of data security in payment gateways, exploring encryption standards, PCI DSS compliance, and how businesses can ensure the protection of sensitive customer information.

Integrating Payment Gateways with E-commerce Platforms

For businesses operating in the e-commerce space, seamless integration with platforms like Shopify, WooCommerce, and Magento is essential. This section will provide insights into how businesses can integrate payment gateways with these platforms for a streamlined and efficient process.

Understanding Cross-Border Transactions and Associated Costs

Global businesses face unique challenges when it comes to cross-border transactions. This section will shed light on the complexities of international payments, including currency conversion fees, and offer strategies to minimize costs for businesses engaged in global commerce.

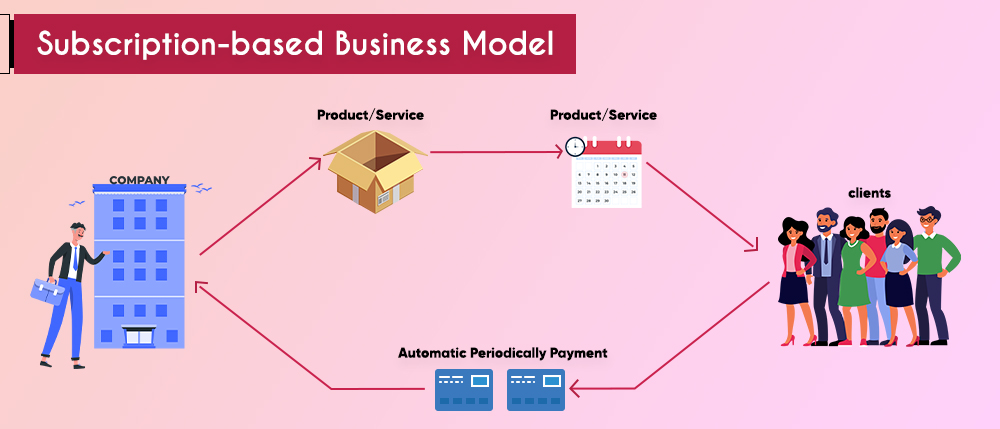

Exploring Subscription-Based Payment Models

For businesses offering subscription-based services, understanding how payment gateways handle recurring transactions is crucial. This section will explore the nuances of subscription-based payment models and highlight gateways that excel in this area.

Conclusion

Choosing the Payment Gateway with Lowest Charges is a strategic decision that can significantly reduce your business’s operating costs. By evaluating transaction fees, setup charges, and other related costs, businesses can find a provider that aligns with their financial goals. While low charges are important, don’t overlook factors such as security, customer support, and scalability when making your decision. With careful planning, businesses can optimize their payment processing and enhance profitability.

FAQs

- Q: Are low-cost payment gateways secure?

- A: Yes, many low-cost payment gateways prioritize security measures to ensure safe transactions.

- Q: How can small businesses negotiate lower charges with payment gateway providers?

- A: Small businesses can explore bundle deals, negotiate transaction fees, and emphasize their growth potential to secure lower charges.

- Q: What are the potential limitations of using a low-cost payment gateway?

- A: Limitations may include fewer advanced features and potential restrictions on transaction volumes.

- Q: Are there payment gateways suitable for global transactions with low charges?

- A: Yes, some payment gateways offer competitive rates for international transactions.

- Q: How can businesses balance cost-effectiveness with a seamless user experience?

- A: Choosing a user-friendly payment gateway with competitive charges ensures a balance between cost savings and a positive user experience.

Get In Touch