AUTHOR : FUZZIE SK

DATE : 04-11-23

In the digital age, the ease and security of online transactions are of utmost importance for businesses and consumers alike. Payment gateway vendors play a pivotal role in ensuring that online payments are processed seamlessly and securely. This article explores the world of PGV, what they do, how to choose the right one, and their significance in the e-commerce landscape.

What is a PGV?

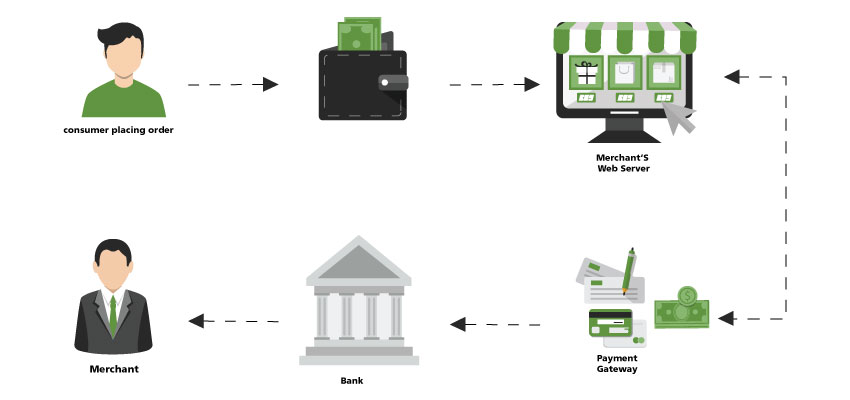

A payment gateway vendor is a service provider that facilitates online transactions by acting as an intermediary between a merchant’s website or app and the financial institutions that process payments. Essentially, they enable the transfer of sensitive financial information, such as credit card details, from the customer to the merchant and from the merchant to the payment processor.

How PGV Works

Payment gateway vendors work by encrypting the customer’s payment information and transmitting it securely to the payment processor. They ensure that the transaction details are accurate and complete before sending the data to the relevant financial institution. Once the payment is authorized, the payment gateway vendor confirms the transaction’s success to the merchant and the customer.

Types of PGV

There are various types of payment gateway[1] vendors available in the market, each with its own set of features and advantages. These include:

Hosted Payment Gateways

Hosted payment gateways redirect customers to a secure payment page hosted by the vendor. The advantage of this approach is that it offloads the responsibility[2] of securing payment information from the merchant.

Self-hosted Payment Gateways

Self-hosted payment gateways allow the merchant[3] to host the payment page on their website. While this offers more control, it also requires a higher level of security to protect sensitive customer data.

API-Based Payment Gateways

API-based payment gateways provide[4] a high degree of customization, allowing the merchant to integrate payment processing into their website or app seamlessly.

Importance of Choosing the Right PGV

Selecting the right payment gateway vendor is crucial for any business[5]. The choice can significantly impact the user experience, security, and the success of online transactions.

Factors to Consider When Selecting a PGV

When choosing a payment gateway vendor, several factors need to be taken into consideration, including:

Security

The vendor’s security measures must be robust to protect customer data from cyber threats.

Integration Options

The ease of integrating the payment gateway into the merchant’s platform is essential.

Transaction Fees

Understanding the transaction fees and pricing structure is vital for budgeting.

Payment Methods Supported

The vendor should support a wide range of payment methods to cater to diverse customer preferences.

User-Friendliness

A user-friendly interface is essential for a smooth customer experience.

Customer Support

Reliable customer support ensures quick resolution of issues and concerns.

Popular PGV

Several payment gateway vendors have earned a reputation for their reliability and effectiveness. Some of the notable ones include:

- PayPal: A widely recognized and trusted payment gateway used by millions of businesses and consumers globally.

- Stripe: Known for its developer-friendly approach and seamless integration options.

- Square: Popular for its user-friendly interface and in-person payment solutions.

- Authorize.Net: A well-established payment gateway with robust security features.

- Braintree is owned by PayPal; it offers a range of payment options and global support.

The Role of PGV in E-commerce

In the e-commerce industry, payment gateway vendors play a pivotal role in ensuring that customers can make secure payments. They are the backbone of online retail, allowing businesses to accept payments and customers to shop with confidence.

Challenges and Solutions

Payment gateway vendors face challenges related to security and evolving payment methods. However, they continually adapt by implementing advanced security protocols and supporting new payment technologies to stay ahead of the curve.

Trends in Payment Gateway Services

The payment gateway industry is dynamic, with continuous innovation. Emerging trends include mobile payments, biometric authentication, and enhanced fraud detection.

The Future of PGV

As e-commerce continues to grow, payment gateway vendors will remain central to online transactions. The future will likely see more advanced security features, streamlined integration, and a broader range of supported payment methods.

Conclusion

Payment gateway vendors are the unsung heroes of the online shopping world, ensuring that transactions are smooth, secure, and efficient. Choosing the right payment gateway vendor is a critical decision for businesses looking to thrive in the digital age.

Unique FAQs

1. What is the primary function of a payment gateway vendor?

A payment gateway vendor’s primary function is to facilitate secure online transactions between customers and businesses.

2. How do I know which PGV is right for my business?

Consider factors such as security, integration options, transaction fees, payment methods supported, user-friendliness, and customer support when making your choice.

3. Are there any upcoming trends in payment gateway services to watch out for?

Yes, trends like mobile payments, biometric authentication, and advanced fraud detection are on the horizon.

4. What are the key security measures that PGV should have in place?

Robust encryption, secure data storage, and compliance with industry standards are essential security measures.

5. Why are hosted payment gateways popular among some businesses?

Hosted payment gateways are popular because they offload the responsibility of securing payment information from the merchant, making it a convenient and secure option.