AUTHOR : MICKEY JORDAN

DATE : 19/12/2023

In today’s digital age, businesses and consumers are increasingly engaging in cross-border transactions. One of the most significant challenges in international business is facilitating secure, fast, and affordable payments[1] between countries. For businesses operating in the USA that need to make payments to Indian vendors, suppliers, or service providers, having a reliable Payment Gateway USA to India[2] is crucial.

This article will explore the importance of a Payment Gateway USA to India, the key features to look for, and the best options available to facilitate smooth international transactions[3]. We will also answer frequently asked questions to help guide you through the process.

What is a Payment Gateway USA to India?

A payment gateway[4] is a service that allows businesses to accept payments online by securely transferring transaction data between the payer and the payee. When it comes to a Payment Gateway[5] USA to India, it specifically refers to the online service that enables businesses in the USA to make payments to vendors, suppliers, or service providers in India. These payments can be made for various purposes including product purchases, service subscriptions, or contractor payments.

Key Features of a Payment Gateway USA to India

- Currency Conversion: Since the transaction involves two different countries with different currencies (USD and INR), a good payment gateway will provide real-time currency conversion to make payments seamless and cost-effective.

- Security: Transactions between the USA and India can involve large sums of money, so security is paramount. A reputable Payment Gateway USA to India will use encryption protocols like SSL and 3D Secure to protect sensitive payment data.

- Multi-Method Payment: A quality payment gateway should support various payment methods, such as credit cards, debit cards, and e-wallets, to provide flexibility and convenience for both businesses and recipients.

- Transaction Speed: With the increasing demand for instant payments, a fast transaction time is essential. A Payment Gateway USA to India that offers near-instant payment processing can improve cash flow and reduce delays.

- Customer Support: In cross-border transactions, problems can arise related to currency, exchange rates, or payment processing. Excellent customer support is essential to resolve issues quickly and efficiently.

Why Businesses Need a Payment Gateway USA to India

Global Expansion

For businesses in the USA looking to expand into the Indian market or collaborate with Indian partners, a smooth payment gateway is essential to make international business operations easier and more efficient.

Cost-Effective Transactions

Traditional methods of international payments such as wire transfers can involve high fees and long processing times. A Payment Gateway USA to India can often provide a more cost-effective and quicker solution for both businesses and individuals.

Reduced Payment Processing Delays

With traditional banking methods, the time it takes to transfer funds between countries can vary significantly. Payment gateways reduce processing times, ensuring that both the business and its Indian counterpart can access funds almost instantly.

Improved Customer Experience

Businesses looking to send payments to Indian vendors or clients need a seamless, secure, and hassle-free payment experience. A reliable Payment Gateway USA to India helps improve relationships with international clients by offering secure, on-time, and transparent payments.

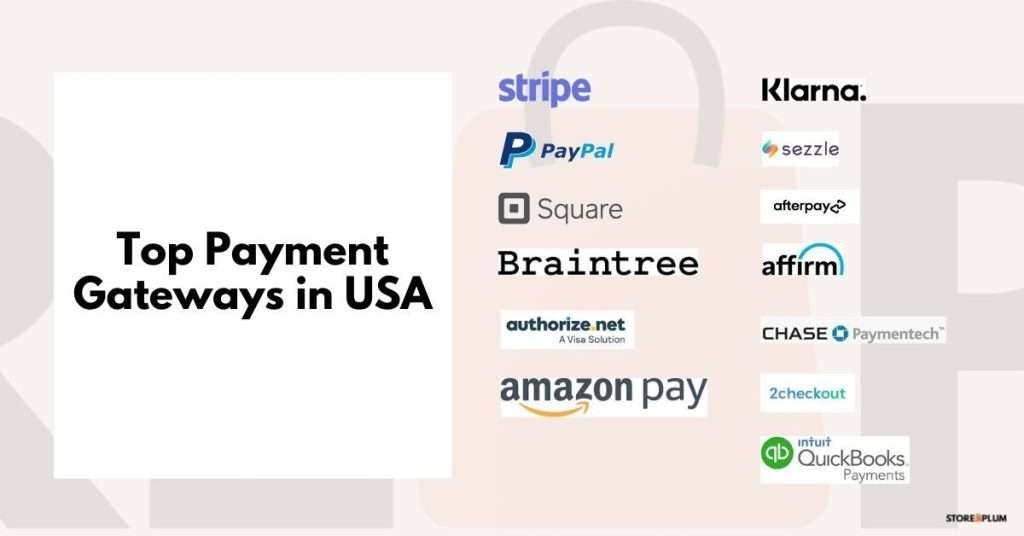

Best Payment Gateways USA to India

PayPal

One of the most recognized and widely used payment gateways globally, PayPal enables businesses to send money from the USA to India quickly. PayPal supports multiple currencies, has robust fraud protection, and provides ease of use. The platform is trusted by both small businesses and large corporations.

Wise (formerly TransferWise)

Wise is known for its low fees and competitive exchange rates when sending money internationally. It provides a transparent pricing structure and converts USD to INR at the real exchange rate, which is often better than traditional banks. Wise is ideal for both small businesses and individuals making payments to India.

Payoneer

Payoneer offers international payment services with the ability to send payments from the USA to India. It’s especially useful for freelancers, online businesses, and service providers, as it supports payments to local Indian bank accounts and offers the ability to hold funds in multiple currencies.

Razorpay

While Razorpay is a popular payment gateway for Indian businesses, it also supports international payments. It enables businesses in the USA to transfer funds directly to Indian vendors through secure and cost-effective methods. Razorpay also provides detailed analytics and reporting tools to help businesses track transactions.

Stripe

Stripe is an easy-to-integrate payment gateway for businesses that need to send or receive payments globally. It supports multiple currencies and provides a user-friendly interface for both businesses and customers. While primarily known for accepting payments, Stripe can also be used to make payments to Indian accounts.

Factors to Consider When Choosing a Payment Gateway USA to India

Transaction Fees

Different gateways have different fee structures. Be sure to review the cost of each transaction, including hidden fees such as exchange rate margins and additional charges for currency conversion.

Speed of Transfer

Some payment gateways offer instant or same-day transfers, while others might take a few business days. If your business depends on quick transactions, choose a service with faster transfer capabilities.

Security and Compliance

Ensure that the payment gateway complies with industry standards such as PCI-DSS (Payment Card Industry Data Security Standard) and provides robust encryption technologies.

Customer Support

Since cross-border payments can sometimes be complicated, it’s essential to have access to responsive customer support when issues arise. Choose a gateway with reliable customer service.

Currency Conversion Rates

A Payment Gateway USA to India should offer competitive exchange rates, as this can affect the overall cost of the transaction. Compare the exchange rates provided by different gateways before making a decision.

Conclusion

Choosing the right Payment Gateway USA to India is a crucial decision for businesses engaged in international transactions. The gateway should provide secure, fast, and cost-effective solutions that make cross-border payments easy. By considering the available options and factors such as transaction fees, speed, and security, businesses can make an informed choice to streamline their payment processes and enhance their international operations.

(FAQ)

1. How do I send money from the USA to India?

You can use online payment gateways such as PayPal, Wise, or Payoneer to send money from the USA to India. Most platforms will require you to create an account, link a payment method, and specify the recipient’s details in India.

2. Is PayPal a good option for a Payment Gateway USA to India?

Yes, PayPal is one of the most popular payment gateways for international transactions, including USA to India payments. It is secure, fast, and supports multiple payment methods.

3. What are the fees for sending money from the USA to India?

Fees vary depending on the payment gateway used. Generally, PayPal charges a percentage of the transaction amount, while platforms like Wise offer low-cost transfers with a transparent fee structure.

4. How long does a USA to India transfer take through an online payment gateway?

Transaction times vary by platform. Some gateways, like PayPal and Wise, offer near-instant transfers, while others may take a few days.

5. Can I send payments directly to an Indian bank account?

Yes, most payment gateways, including Payoneer and Razorpay, allow you to send payments directly to an Indian bank account. You’ll need the recipient’s account details to complete the transaction.

Get In Touch