NAME : CORA JOSU

DATE : 04/11/2023

In today’s rapidly evolving digital landscape, online transactions have seamlessly woven themselves into the fabric of our daily routines.Whether you’re purchasing goods online, booking tickets, or subscribing to services, the payment gateway transaction flow is a critical aspect of making these transactions happen. This article will delve deeper into the intricacies of payment gateway transactions and payment gateway mechanism – Cricpayz Blog on the processes and technologies that ensure smooth and secure financial transactions in the digital realm.

Understanding Payment Gateways

Before we dive into the transaction flow, it’s essential to grasp the concept of payment gateways. Payment gateways serve as the virtual bridge that connects customers and merchants during online transactions. They play a pivotal role in facilitating the secure and seamless transfer of funds. Payment gateways are designed to ensure that the payment process is swift, efficient, and, most importantly, secure.

The Payment Process

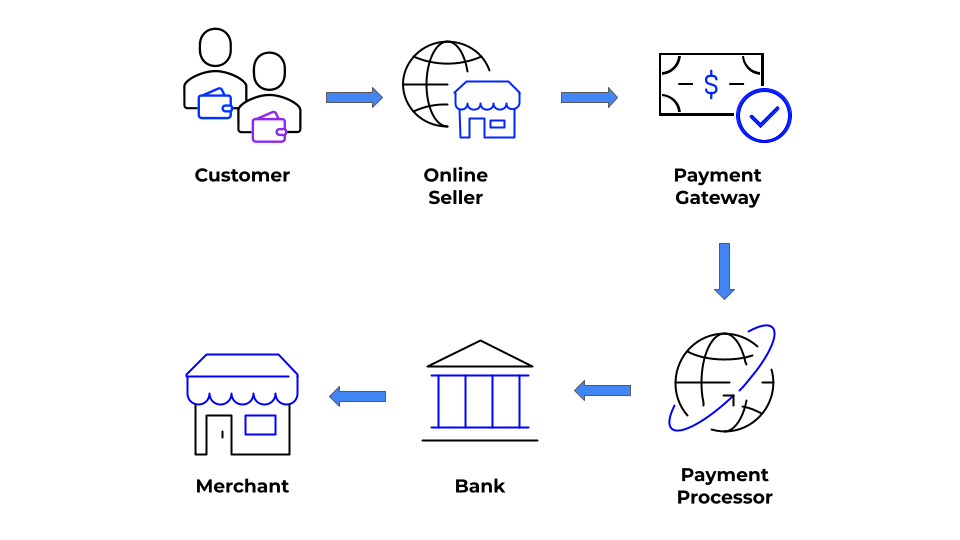

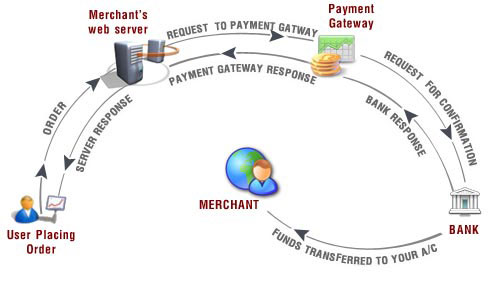

The payment gateway transaction process can be divided into several distinct stages, each playing a crucial role in ensuring the transaction’s success:

1. Request Initiation

The payment process begins when a customer initiates a payment on a merchant’s website or mobile application. This action sets the transaction in motion,[1] and the payment gateway steps in to handle the rest. The customer enters their payment details, such as credit card information or digital wallet credentials.

2. Authorization

Once the customer’s payment details are entered, the payment gateway takes over to verify and authorize the transaction. This involves a series of checks, including confirming the validity of the credit card, checking if there are sufficient funds in the customer’s account, and scrutinizing the transaction for any signs of fraud. Once the payment is authorized, the transaction proceeds to the next stage.

3. Payment Processing

In this phase, the actual payment is processed. The funds are transferred from the customer’s account to the merchant’s account. What makes this process particularly impressive is its real-time nature. In most cases, the entire transaction is completed almost instantly, ensuring that the customer receives the purchased goods or services promptly.

Types of Payment Gateways

Payment gateways come in various types, each with its own unique features and benefits.[2] Understanding these types can help both businesses and consumers make informed choices when it comes to selecting the most suitable payment gateway:

Hosted Payment Gateways

Hosted payment gateways channel customers to a protected payment page graciously hosted by a trusted third-party service provider. This approach is user-friendly, and it ensures that sensitive payment data is securely managed by experts. Merchants often opt for hosted gateways to simplify the integration process and ensure high-level security.

Self-hosted Payment Gateways

Self-hosted payment gateways enable customers to enter their payment details directly on the merchant’s website. While this approach offers more control over the payment process, it also places more responsibility on the merchant to implement stringent security measures. Self-hosted gateways are often favored by larger businesses with the resources to manage the additional security requirements.

Security

Security is paramount in the digital world, and payment gateways are designed with this in mind. They use advanced encryption and other security measures to protect sensitive customer data.[3] Customers can trust that their payment information is handled securely.

Convenience

One of the primary advantages of payment gateways is the convenience they offer. Customers can make payments from the comfort of their homes or on the go, without the need for physical presence. This convenience has revolutionized the way people shop and pay for services, making it easier and more accessible than ever before.

Global Reach

Payment gateways have expanded the reach of businesses beyond borders. They enable international transactions, allowing merchants to tap into a global customer base. This has opened up new opportunities for businesses of all sizes, from small startups to large enterprises.

Challenges in Payment Gateway Transactions

While payment gateways offer numerous advantages, they are not without their challenges. Some common issues that both customers and merchants might encounter[4] during payment gateway transactions include:

Fraud

Online fraud remains a significant concern. Payment gateways must implement robust security measures to combat fraudulent activities, such as stolen credit card information or identity theft. Continuous monitoring and advanced security protocols are crucial to mitigating these risks.

Downtime

Technical glitches, server maintenance, or network issues can lead to payment gateway downtime. When these hiccups occur, it can disrupt business operations, inconvenience customers, and potentially result in lost sales. It’s essential for payment gateway providers to maintain high uptime and quickly address any technical issues.

Key Players in the Payment Gateway Industry

The payment gateway industry is highly competitive, with several key players dominating the market. Each of these providers offers a range of services and features to cater to different business needs and customer preferences. Here are some of the prominent names in the industry:

- PayPal: A widely recognized and trusted payment gateway provider, PayPal offers a user-friendly platform for both businesses and consumers. It supports online payments, transfers, and invoicing services.

- Stripe: Known for its developer-friendly tools and APIs, Stripe is a popular choice for businesses looking to customize their payment processes. It supports a variety of payment methods and offers advanced fraud prevention tools.

- Square: Square is well-known for its point-of-sale solutions, but it also provides online payment processing. It’s a great choice for businesses that operate both in physical and digital spaces.

- Authorize.Net: Authorize.Net is a long-established payment gateway that offers a wide range of features, including recurring billing, secure customer data storage, and support for various payment methods.

- Braintree: A subsidiary of PayPal, Braintree is another popular choice for e-commerce businesses. It offers a simple integration process and supports various payment methods, including mobile wallets.

Trends in Payment Gateway Transactions

The payment gateway industry is not static; it evolves with technological advancements and changing consumer preferences. Several trends are shaping the future of payment gateway transactions:

Mobile Payments

The advent of smartphones has precipitated a notable upswing in the realm of mobile payments. Consumers are increasingly using mobile wallets and payment apps to make purchases. Payment gateways that support mobile payments are in high demand, offering a seamless mobile shopping experience.

Biometric Authentication

Biometric authentication,[5] such as fingerprint recognition and facial recognition, is gaining popularity as a secure and convenient method for authorizing payments. Payment gateways are integrating biometric authentication to enhance security and ease of use.

Conclusion

In conclusion, the payment gateway transaction flow is a vital component of the online commerce landscape. It ensures that payments are processed securely, efficiently, and conveniently. Whether you’re a business owner looking to accept payments or a customer making an online purchase, understanding the various stages, types of payment gateways, and the benefits they offer is crucial.