NAME : ROSELLA LEE

DATE : 4/11/2023

In today’s increasingly digital world, payment gateway transactions have become an integral part of our daily lives. Whether you’re shopping online, subscribing to streaming services, or making donations to your favorite charities, payment gateways play a vital role in securely facilitating these financial transactions. This article will delve into the world of payment gateway transactions, exploring what they are, how they work, and their significance in the online business landscape.

What Is a Payment Gateway?

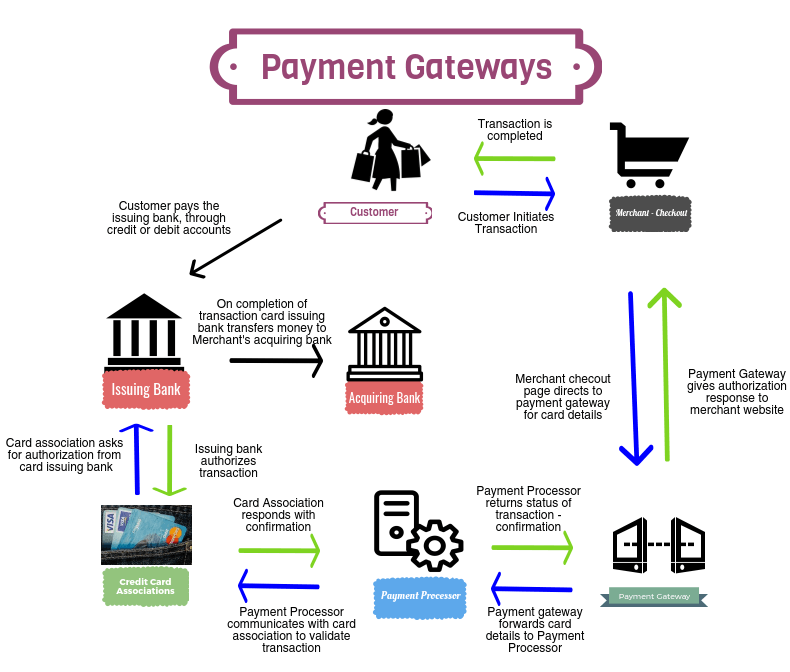

A payment gateway is a technology that acts as a bridge between an online merchant and the financial institution that processes payments. Its primary function is to enable the secure [1]transfer of customer[2] payment data from the merchant’s website to the payment processor, ensuring that transactions are executed smoothly.

How Payment Gateways Work

Payment gateways operate by encrypting sensitive customer information and transmitting it to the payment processor. This encryption ensures that customer data[3], such as credit card information, remains secure during the transaction. Once the payment is authorized or declined, the gateway provides feedback to both the customer and the merchant.

Types of Payment Gateways

1. Hosted Payment Gateways

Hosted payment gateways redirect customers to a separate payment page, often hosted by the payment service provider. This approach is user-friendly and minimizes the merchant’s responsibilities in terms of security[4] and compliance. Popular examples of hosted payment gateways include PayPal[5] and Worldpay.

2. Integrated Payment Gateways

Integrated payment gateways, on the other hand, allow customers to complete transactions without leaving the merchant’s website. This seamless process enhances the user experience and gives businesses more control over the payment process. Examples of integrated gateways include Stripe and Square.

Key Players in Payment Processing

The payment processing industry is dominated by several key players, each offering its unique advantages and services. It’s essential for businesses to understand the differences between these providers to make informed choices:

- PayPal stands out as a globally renowned and universally recognized payment gateway. It provides a user-friendly and secure platform for online payments, making it an excellent choice for small businesses and individuals.

- Stripe: Stripe is known for its developer-friendly approach and seamless integration options. It’s a favorite among businesses looking to customize their payment processes.

- Square: Square offers a range of services, from payment processing to point-of-sale hardware. It’s especially popular among businesses with physical stores.

- Authorize.Net: Authorize.Net is a reliable and secure payment gateway that caters to businesses of all sizes. It provides a wide range of features and customization options.

Benefits of Using Payment Gateways

Using payment gateways offers several advantages for businesses and consumers alike:

- Increased Sales: Payment gateways simplify the payment process, reducing cart abandonment rates and increasing conversion rates for businesses.

- Enhanced Security: Payment gateways employ robust encryption and security measures to protect sensitive customer data, providing peace of mind for both customers and merchants.

- Simplified Financial Management: Payment gateways offer reporting and analytics tools that help businesses track transactions, manage revenue, and plan for the future.

- Convenience for Customers: Payment gateways make it easy for customers to make online payments, whether they are purchasing products or subscribing to services.

Security Measures in Payment Gateway Transactions

Security is paramount in online transactions. Payment gateways employ encryption protocols, such as SSL (Secure Sockets Layer), to protect sensitive data. Additionally, they implement stringent security measures to prevent fraud and data breaches. With these safeguards in place, customers can trust that their personal and financial information is safe when making online payments.

Challenges in Payment Gateway Transactions

While payment gateways simplify online payments, they do come with certain challenges:

- Transaction fees are a common occurrence with payment gateways, entailing a charge for each individual transaction. Businesses need to factor these fees into their pricing models.

- Chargebacks: Chargebacks occur when customers dispute a transaction, leading to a reversal of funds. Addressing chargebacks proves both time-intensive and financially taxing.

- Technical Issues: Technical glitches or downtime of payment gateways can disrupt business operations and affect customer trust.

The Future of Payment Gateway Transactions

As technology continues to advance, payment gateways will evolve to meet the changing demands of consumers and businesses. Here are some trends shaping the future of online transactions:

- Mobile Payments: Mobile payment options will become more prevalent, allowing customers to pay using their smartphones.

- Biometric Authentication: Enhanced security through biometric authentication methods, such as fingerprint recognition and facial scans.

- Improved Fraud Detection: Advanced machine learning and artificial intelligence algorithms will help detect and prevent fraudulent transactions.

Conclusion

Payment gateway transactions are the lifeblood of e-commerce and online businesses. They ensure that financial transactions are safe, secure, and efficient. Understanding the different aspects of payment gateways is crucial for both consumers and businesses, as it plays a fundamental role in the growth and success of online commerce.

Frequently Asked Questions

- What exactly constitutes a payment gateway, and what mechanisms underpin its operation? A payment gateway is a technology that facilitates secure online transactions by transmitting customer payment data from the merchant’s website to the payment processor. It encrypts sensitive information to ensure security.

- Are there different types of payment gateways? Yes, there are two main types of payment gateways: hosted payment gateways, which redirect customers to a separate payment page, and integrated payment gateways, which allow transactions to occur without leaving the merchant’s website.

- What are the key benefits of using payment gateways for businesses? Payment gateways offer benefits such as increased sales, enhanced security, simplified financial management, and convenience for customers, ultimately improving the overall user experience.

- How do payment gateways ensure the security of online transactions? Payment gateways employ encryption protocols and stringent security measures to protect sensitive customer data, preventing fraud and data breaches.