Name : Buddy kim

Date : 4/11/23

Introduction

In this digital age, the world of commerce has undergone a profound transformation. From the corner store to e-commerce giants, businesses of all sizes are embracing the convenience of online payments. To facilitate these transactions, payment gateways have become the backbone of secure and efficient financial interactions. In this article, we will explore the intricate world of payment gateways and how they enable businesses to accept online payments effortlessly.

Understanding Payment Gateways

What is a Payment Gateway?

At its core, a payment gateway is like the virtual cash register of an online store. It is a software application that acts as an intermediary between the customer, the merchant, and the financial institution. Its primary function is to securely transmit payment data, ensuring that online transactions are swift and secure.

How Payment Gateways Work

Delving deeper into the mechanics, payment gateways work in a few key steps. First, they capture the customer’s payment information. Next, they encrypt and transmit this data to the payment processor. Finally, the payment processor communicates with the customer’s bank to authorize the transaction.

The Importance of Payment Gateways

Trust and Security

Payment gateways[1] are the guardians of trust and security in the digital payment landscape. They employ encryption and fraud detection tools to protect sensitive information, instilling confidence in customers and merchants alike.

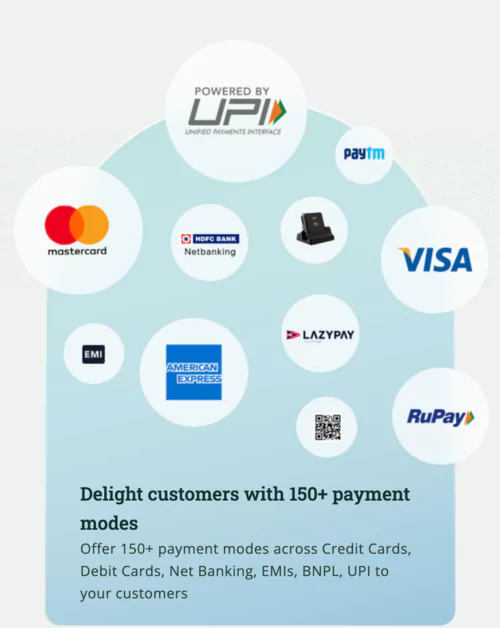

Convenience and Accessibility

One of the primary advantages of payment gateways is their ease of use. Customers can make payments from the comfort of their homes, and businesses can receive payments from around the globe, breaking geographical barriers.

Types of Payment Gateways

Hosted Payment Gateways

Hosted payment gateways direct customers away from the merchant’s website to a secure payment page, enhancing security.

Integrated Payment Gateways

Integrated[2] payment gateways, on the other hand, allow customers to complete transactions without leaving the merchant’s website. This approach offers a seamless user experience and is commonly used by larger e-commerce platforms.

Choosing the Right Payment Gateway

Factors to Consider

When selecting a payment gateway, several factors must be weighed. These include transaction[3] fees, security features, compatibility with your website, and the gateway’s reputation. Careful consideration is crucial to ensure the best fit for your business.

Steps to Integrate a Payment Gateway

1. Sign Up

To get started, you need to sign up with a payment gateway provider. Be sure to choose one that aligns with your business[4] needs.

2. Account Verification

The gateway provider may require you to complete a verification process[5], which includes providing essential business information.

3. Integration

The process may vary depending on the platform you use.

4. Testing

Before going live, conduct thorough testing to ensure that payments are processed smoothly without any hiccups.

5. Go Live

Once testing is successful, you can activate the payment gateway and start accepting online payments.

Advantages of Accepting Online Payments

Increased Sales

Accepting online payments broadens your customer base and potentially increases your sales, as it caters to tech-savvy consumers.

Reduced Costs

Handling physical payments and checks can be costly. Online payments are more efficient, saving time and resources.

Improved Cash Flow

Online payments are typically processed faster than traditional methods, ensuring a healthier cash flow for your business.

Conclusion

In conclusion, payment gateways are the unsung heroes of online transactions, providing a secure and efficient means for businesses to accept payments. By choosing the right payment gateway and following the integration steps, you can enhance your business’s capabilities and offer a seamless transaction experience for your customers.

Frequently Asked Questions

1. Are payment gateways secure?

Yes, payment gateways employ robust security measures like encryption and fraud detection to ensure the safety of online transactions.

2. What are the fees associated with payment gateways?

Transaction fees can vary, so it’s essential to compare different gateway providers to find the one that best suits your budget.

3. Can I use multiple payment gateways for my online store?

Yes, some e-commerce platforms allow you to integrate multiple payment gateways to provide options for your customers.

4. How long does it take to integrate a payment gateway?

The integration process can vary but generally takes a few days to set up and test before going live.

5. Do I need a merchant account to use a payment gateway?

It depends on the payment gateway provider. Some require a merchant account, while others do not. Be sure to check the requirements of your chosen gateway.