AUTOHR : HELLY KHAN

DATE : 03-11-2023

In today’s digital era, e-commerce in India is rapidly growing, and payment gateway[1] solutions play a pivotal role in facilitating secure and seamless online transactions. A Payment Gateway Solutions India allows businesses to accept payments via credit cards, debit cards, net banking, UPI, digital wallets, and other online payment methods[2]. This article will delve into the various types of payment gateway[3] solutions available in India, how they function, the benefits they offer, and key considerations for businesses when selecting a solution.

What Are Payment Gateway Solutions India?

Payment Gateway Solutions India[4] refers to the technology and services that enable online businesses to accept digital payments securely. These solutions act as intermediaries between the merchant and the financial institution, processing payments efficiently while protecting sensitive data.

In India, with the increasing number of online shoppers and a surge in digital payments[5], businesses need to adopt secure and efficient payment gateways. Payment gateways provide merchants with the tools to process payments, reduce fraud, and offer a better customer experience by supporting multiple payment methods.

How Do Payment Gateway Solutions India Work?

A Payment Gateway Solutions India works by securely transmitting payment information between the buyer, merchant, and bank. Here’s a simple breakdown of the process:

- Payment Initiation: The customer selects their items on the website and chooses a payment method (credit card, debit card, UPI, etc.) to make the payment.

- Data Encryption: Once the customer enters their payment details, the payment gateway encrypts the information and securely sends it to the merchant’s acquiring bank for authorization.

- Transaction Authorization: The acquiring bank forwards the payment details to the customer’s issuing bank, where the bank verifies if the customer has sufficient funds or credit for the transaction.

- Payment Approval or Decline: The issuing bank sends an authorization or decline message back to the acquiring bank, which is then passed to the payment gateway. The merchant’s website is notified of the approval or decline of the payment.

- Confirmation: If the transaction is approved, the funds are transferred to the merchant’s account, and the customer is notified about the successful transaction.

Types of Payment Gateway Solutions India

1. Hosted Payment Gateways

A hosted payment gateway redirects the customer to a secure external page, hosted by the payment gateway provider. After completing the payment on this page, the customer is redirected back to the merchant’s website.

Advantages of Hosted Payment Gateways:

- Simple to integrate into the website.

- There is no need for the merchant to handle sensitive payment information, as it is processed by the gateway.

- Ideal for small and medium businesses with basic payment needs.

Popular Hosted Payment Gateways in India:

- PayU India

- Razorpay

- Instamojo

2. Integrated Payment Gateways

An integrated payment gateway allows customers to complete the payment process directly on the merchant’s website. This solution is usually more customizable and provides a seamless checkout experience.

Advantages of Integrated Payment Gateways:

- Provides full control over the user experience.

- Customers are not directed to a third-party site, which helps reduce cart abandonment rates.

- Offers advanced customization options.

Popular Integrated Payment Gateways in India:

- CCAvenue

- BillDesk

- Paytm Payment Gateway

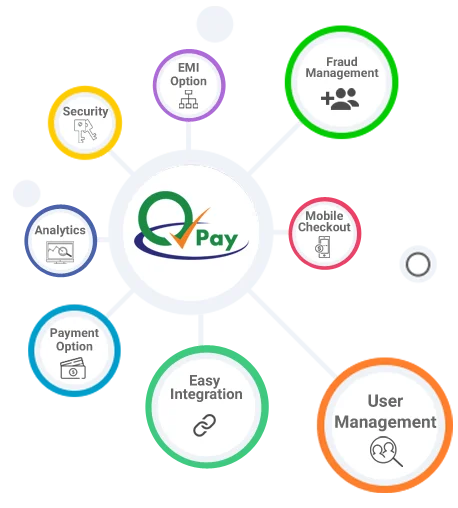

Benefits of Payment Gateway Solutions India

1. Enhanced Security

One of the most important aspects of a payment gateway is its ability to provide secure transactions. Most payment gateways in India comply with the Payment Card Industry Data Security Standard (PCI DSS) and use encryption and tokenization to protect sensitive data, such as card numbers and bank account details. Additionally, fraud prevention tools, such as 3D Secure authentication, help minimize the risk of unauthorized transactions.

2. Multiple Payment Options

Payment Gateway Solutions India supports a wide variety of payment methods, including credit/debit cards, UPI, digital wallets (like Paytm and PhonePe), net banking, and more. This flexibility ensures that customers can pay using their preferred method, thus enhancing the likelihood of successful transactions.

3. Faster Transactions

Payment gateways facilitate instant processing of payments, helping businesses to quickly confirm orders and proceed with order fulfillment. This fast processing reduces the time customers spend waiting for payment confirmation, resulting in a better customer experience.

4. Global Reach

With international payment capabilities, businesses can accept payments from customers all over the world. Many Indian payment gateways support multi-currency transactions, which makes it easier for businesses to expand globally and cater to an international audience.

5. Seamless Integration

Payment gateway providers in India offer easy integration with various website platforms such as Shopify, Magento, WooCommerce, and others. This allows businesses to quickly implement a payment solution without requiring extensive technical knowledge.

6. Cost-Effective

While there is a cost associated with using a payment gateway (usually a transaction fee), many Indian payment gateways offer affordable pricing plans, especially for small and medium-sized businesses. The cost of using a payment gateway is often outweighed by the convenience and security it provides, making it a worthwhile investment.

Key Considerations When Choosing Payment Gateway Solutions India

1. Transaction Fees

Most payment gateway providers levy a transaction fee, which differs depending on the payment method selected. It is essential to consider the transaction fees and ensure that they are competitive and affordable for your business.

2. Integration with Your Website

Ease of integration is a significant factor. The payment gateway should integrate seamlessly with your existing website or e-commerce platform. It should also offer customization options for a smooth checkout experience.

3. Security Features

Look for a payment gateway that provides robust security features, such as encryption, tokenization, and fraud detection tools. Compliance with PCI DSS standards is a must, as it ensures that customer data is handled securely.

4. Customer Support

Customer support is essential in case of any technical issues or problems with the payment gateway. Make sure the provider provides round-the-clock support via various channels, including phone, email, or live chat.

5. User Experience

The payment process should be quick, easy, and seamless for your customers. A complicated or slow payment process can lead to cart abandonment, so it is crucial to choose a gateway that offers a smooth user experience.

6. Mobile Compatibility

Given the rise in mobile payments, ensure that the payment gateway is mobile-friendly and supports mobile transactions. This is especially important if you are targeting customers who shop on their mobile devices.

Conclusion

Payment Gateway Solutions India are essential for businesses looking to accept secure online payments. With multiple payment options, enhanced security features, and ease of integration, payment gateways provide businesses with the tools they need to thrive in the digital marketplace. By understanding the different types of payment gateways, their benefits, and the key considerations when choosing a provider, businesses can make informed decisions that contribute to long-term success and customer satisfaction.

FAQs

1. What is a payment gateway?

It acts as a bridge between the customer, merchant, and financial institutions, processing payment data securely.

2. Why do I need a payment gateway for my business?

A payment gateway is essential for online businesses to accept digital payments securely. It protects sensitive payment information and ensures a smooth transaction process, which can enhance customer trust and satisfaction.

3. What Payment Methods Are Supported by Payment Gateways?

Payment gateways in India support multiple payment methods, including credit/debit cards, UPI, digital wallets (Paytm, PhonePe), net banking, and more.

4. How are transaction fees determined?

Transaction fees are typically determined by the payment gateway provider and can vary based on the payment method used, the volume of transactions, and the pricing plan chosen.

5. Is it safe to use a payment gateway for online transactions?

Yes, payment gateways use encryption, tokenization, and fraud prevention tools to ensure that transactions are secure and customer data is protected.