AUTHOR : ADINA XAVIER

DATE : 30/10/2023

In the digital age, businesses are increasingly adopting online payment solutions[1] to cater to their customers’ needs. A Payment Gateway Site[2] serves as the critical infrastructure that enables secure and efficient online transactions. This guide will delve into what a payment gateway[3] site is, how it works, its benefits, key features to consider, and answer some frequently asked questions. This comprehensive guide will explore what a payment gateway site is, how it functions, its benefits, key features to consider, and address some frequently asked questions.

What is a Payment Gateway Site?

A Payment Gateway Site is a digital service that enables the secure transmission of transaction data between a payment[4] interface, such as a website or mobile application, and the payment processor responsible for handling the transaction. It encrypts sensitive data such as credit card numbers and ensures that transactions are processed securely. This site acts as the bridge between your business and the financial institution, allowing for seamless payment processing[5]. It securely captures customer payment information, encrypts it, and transmits it for authorization, ensuring that sensitive data is protected throughout the transaction process.

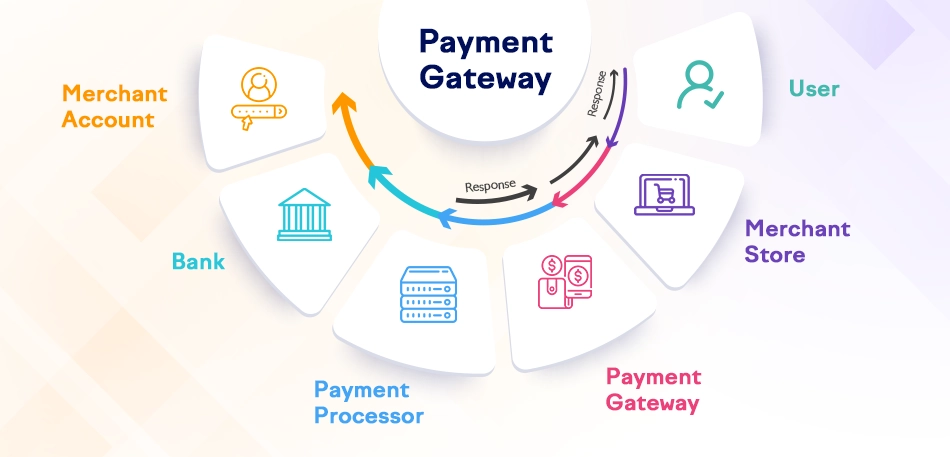

How Does a Payment Gateway Work?

Understanding the mechanics of a Payment Gateway Site is essential for businesses that wish to implement one. Here’s a step-by-step breakdown of how it works:

- Customer Initiates Payment: The process begins when a customer decides to purchase a product or service from an online store and enters their payment details.

- Encryption of Data: The payment gateway encrypts the customer’s payment information to protect it from potential fraudsters.

- Transaction Authorization: The encrypted data is sent to the payment processor, which then communicates with the customer’s bank (the issuing bank) to verify the transaction.

- Approval or Denial: The issuing bank checks the customer’s account to confirm that sufficient funds are available and either approves or declines the transaction.

- Transaction Confirmation: The payment gateway receives the response from the bank and relays it back to the merchant’s website, notifying the customer of the transaction status.

- Funds Transfer: If approved, the payment is processed, and the funds are transferred from the customer’s account to the merchant’s account.

Benefits of Using a Payment Gateway Site

1. Enhanced Security

A key advantage of utilizing a payment gateway is the significant improvement in security measures. These sites utilize encryption and compliance protocols, such as PCI DSS (Payment Card Industry Data Security Standard), to protect sensitive financial information from fraud and data breaches.

2. Increased Sales

A reliable Payment Gateway Site can lead to increased sales as it offers customers multiple payment options, including credit/debit cards, digital wallets, and bank transfers. Offering a wider variety of payment options increases the likelihood that customers will finalize their purchases.

3. Improved Customer Experience

A seamless and efficient checkout process improves the overall customer experience. A user-friendly payment gateway site ensures that customers can easily navigate through payment steps, reducing cart abandonment rates.

4. Global Reach

With a Payment Gateway Site, businesses can accept payments from customers worldwide. This capability opens up new markets and opportunities for growth.

5. Analytics and Reporting

Many payment gateways offer robust analytics and reporting features. Businesses can track transaction histories, sales trends, and customer behaviors, allowing for better decision-making and strategic planning.

Key Features to Look for in a Payment Gateway Site

1. Multiple Payment Options

Ensure that the gateway supports various payment methods, including credit/debit cards, e-wallets, and bank transfers. This versatility will cater to a broader audience.

2. Mobile Compatibility

With the rise of mobile shopping, your payment gateway must be mobile-friendly. A mobile-friendly design guarantees a smooth and effortless experience for users accessing the site via smartphones and tablets.

3. User-Friendly Interface

A clean, intuitive interface makes it easier for customers to complete transactions. Look for a gateway that minimizes the number of steps in the checkout process.

4. Security Features

Check for advanced security measures, such as fraud detection tools, SSL encryption, and compliance with industry standards.

5. Customer Support

Reliable customer support is crucial. Choose a payment gateway that offers 24/7 support to assist you and your customers in case of any issues.

Popular Payment Gateway Sites

1. PayPal

PayPal is one of the most recognized payment gateways, offering a simple way for customers to pay using their PayPal accounts or credit/debit cards.

2. Stripe

Stripe provides a developer-friendly API and supports various payment methods, making it an excellent choice for tech-savvy businesses.

3. Square

Square offers an all-in-one solution that includes payment processing, point-of-sale systems, and business management tools, making it ideal for small to medium-sized businesses.

4. Authorize. Net

This gateway provides comprehensive payment solutions, including recurring billing and advanced fraud detection.

Conclusion

A Payment Gateway Site is an indispensable tool for any business looking to thrive in the online marketplace. By facilitating secure and efficient transactions, these gateways enhance customer experience and broaden market reach. When choosing a payment gateway, prioritize security, compatibility, and customer support to ensure your business can handle online transactions effectively. Embrace the power of digital payments today and set your business on a path to success!

FAQs

A payment gateway is a service that authorizes credit card or direct payments for e-commerce businesses, brick-and-mortar stores, and online retailers.

2. Why do I need a payment gateway site?

A payment gateway site is essential for processing online payments securely. It enables businesses to accept various payment methods, improving customer satisfaction and boosting sales.

3. How do I choose the right payment gateway for my business?

When selecting a payment gateway, consider factors like transaction fees, payment methods supported, security features, and customer support. Ensure it aligns with your business needs and goals.

4. Are payment gateways safe?

Yes, most payment gateways use advanced encryption and security protocols to protect sensitive information. It’s essential to choose a reputable gateway that complies with PCI DSS standards.

5. What are transaction fees?

Transaction fees are charges incurred when processing payments through a payment gateway. These fees can vary based on the provider, payment method, and volume of transactions.