AUTHOR : ADINA XAVIER

DATE : 30/10/2023

In today’s digital landscape, a reliable payment gateway[1] is essential for businesses operating in Singapore. As e-commerce continues to flourish, understanding the nuances of a payment gateway in this region becomes crucial for both merchants and consumers. This guide will explore the importance of a payment gateway in Singapore[2], the various options available, and how to choose the best solution for your business. This guide will provide a comprehensive overview of payment[3] gateways in Singapore, highlighting their importance, features, and frequently asked questions.

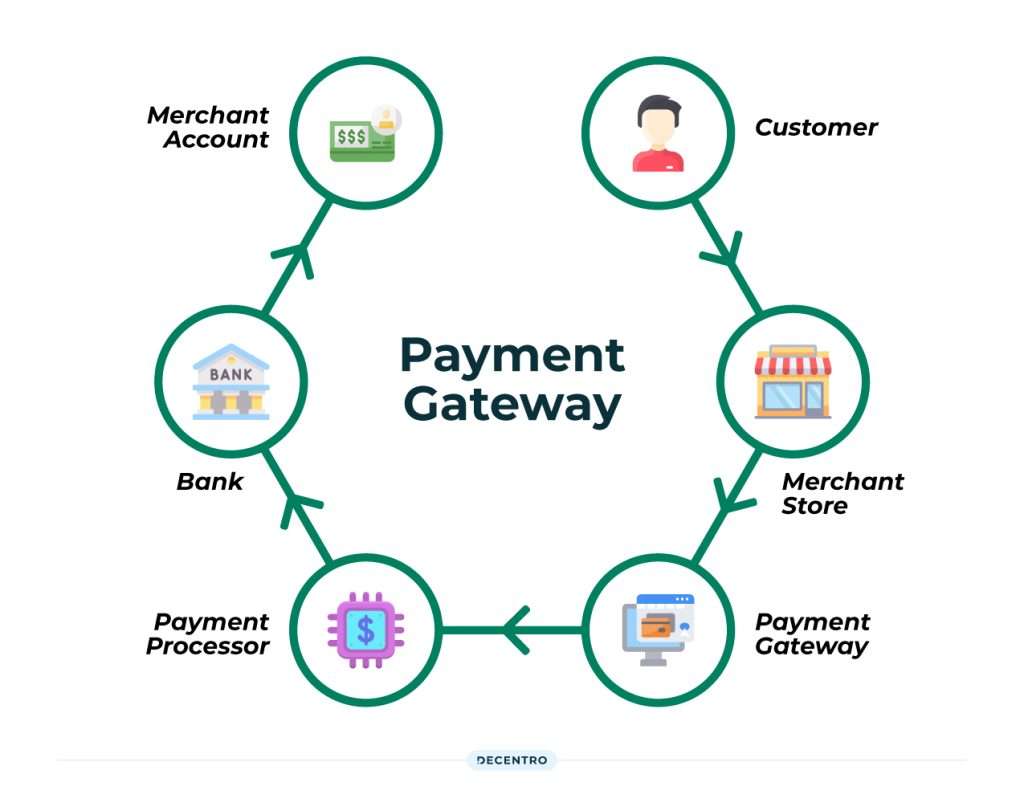

What is a Payment Gateway?

A payment gateway is a technology that allows businesses to accept payments online[4] securely. It acts as a bridge between a customer’s bank and the merchant’s account, facilitating the transfer of transaction data and ensuring that sensitive information remains protected. In Singapore, the rise of online shopping has made payment gateways[5] an integral part of e-commerce.

Why Payment Gateways Are Important in Singapore

1. Security and Trust

One of the primary reasons to implement a payment gateway in Singapore is to enhance the security of online transactions. With increasing incidents of cyber fraud, customers are more likely to trust merchants who provide secure payment options. Payment gateways employ advanced encryption techniques and comply with Payment Card Industry Data Security Standards (PCI DSS), which protect sensitive data during transactions.

2. Convenience for Customers

A reliable payment gateway offers multiple payment options, including credit cards, debit cards, and digital wallets. This variety enhances the customer experience, making it easier for them to complete their purchases. In Singapore, where consumers are tech-savvy, the convenience of various payment methods is a significant advantage.

3. Faster Transactions

Payment gateways streamline the payment process, allowing for faster transaction processing. This speed is crucial for reducing cart abandonment rates, as customers are less likely to abandon their purchases when they can complete payments quickly and easily.

4. Global Reach

For businesses looking to expand their reach, a payment gateway in Singapore can facilitate international transactions. Many gateways support multiple currencies and payment methods, enabling merchants to cater to a broader audience beyond local customers.

Key Features of Payment Gateways in Singapore

1. Multiple Payment Methods

A robust payment gateway should support various payment options, including credit cards, debit cards, and digital wallets like PayNow and GrabPay. This flexibility allows businesses to cater to diverse customer preferences.

2. Mobile Optimization

With the rise of mobile shopping, it’s essential for payment gateways to be mobile-friendly. A good payment gateway in Singapore will offer an optimized mobile experience, allowing customers to make purchases easily from their smartphones.

3. Fraud Detection and Prevention

Advanced fraud detection tools are critical for any payment gateway. These features help identify suspicious transactions and protect merchants from potential losses due to fraud.

4. User-Friendly Interface

An intuitive and easy-to-navigate interface is vital for a seamless customer experience. Payment gateways should provide a straightforward checkout process to minimize friction during transactions.

5. Integration Capabilities

The ability to integrate with existing e-commerce platforms, such as Shopify, WooCommerce, or Magento, is essential for smooth operations. A payment gateway in Singapore should offer easy integration options to ensure compatibility with various systems.

Popular Payment Gateways in Singapore

1. PayPal

PayPal is one of the most recognized payment gateways globally and is widely used in Singapore. It offers a user-friendly interface, multiple payment options, and robust security features.

2. Stripe

Stripe is known for its flexibility and developer-friendly APIs. It supports various payment methods and currencies, making it an excellent choice for businesses looking to scale.

3. Razer Merchant Services

Razer Merchant Services is tailored for gaming and e-commerce businesses. It provides a seamless payment experience and supports various payment options, including cryptocurrencies.

4. 2C2P

2C2P is a popular choice among Southeast Asian businesses. It offers a comprehensive payment solution that includes fraud detection and multiple payment options, catering specifically to the regional market.

5. Asia Pay

Asia Pay is a leading payment service provider in Asia, offering a wide range of payment solutions. Their platform is designed for businesses of all sizes and supports various currencies.

Steps to Set Up a Payment Gateway in Singapore

Step 1: Choose the Right Payment Gateway

Evaluate different payment gateways based on your business needs. Consider factors such as transaction fees, supported payment methods, integration capabilities, and customer support.

Step 2: Create a Merchant Account

Most payment gateways require you to set up a merchant account. This account is necessary for processing payments and transferring funds. You may need to provide business documentation and identification during this process.

Step 3: Integrate the Payment Gateway with Your E-commerce Platform

Once you have selected a payment gateway and created a merchant account, the next step is integration. Most gateways provide plugins or APIs for popular e-commerce platforms, making it easier to connect your online store.

Step 4: Test the Payment Gateway

Before going live, conduct thorough testing to ensure that the payment gateway functions correctly. Test various payment methods and scenarios to identify and resolve any potential issues.

Step 5: Go Live

After successful testing, you can launch your payment gateway on your e-commerce site. Monitor transactions closely to address any issues that may arise during the initial phase.

Conclusion

A payment gateway in Singapore is a critical component for any business looking to succeed in the e-commerce landscape. By understanding the key features, options, and setup process, you can select the right solution that enhances security, improves customer experience, and facilitates smooth transactions. As digital payments continue to evolve, staying informed about the latest trends and technologies will help your business thrive in the competitive online market.

FAQs

1. What fees are associated with using a payment gateway in Singapore?

Fees vary by provider but typically include transaction fees (a percentage of each sale), monthly fees, and setup fees. It’s essential to review the fee structure before committing to a payment gateway.

2. How long does it take to set up a payment gateway?

The setup process can take anywhere from a few hours to a few days, depending on the complexity of your e-commerce platform and the payment gateway you choose. Testing is also crucial to ensure everything works smoothly.

3. Can I use multiple payment gateways for my business?

Yes, integrating multiple payment gateways can provide your customers with various payment options, improving user experience and reducing cart abandonment.

4. Is it safe to use a payment gateway in Singapore?

Most payment gateways in Singapore are equipped with advanced security features, such as encryption and fraud detection, making them safe for processing online transactions. However, it’s essential to choose a reputable provider.

5. What payment methods should I offer?

It’s advisable to offer a range of payment options, including credit cards, debit cards, and popular digital wallets, to cater to different customer preferences and increase sales.