AUTHOR : ADINA XAVIER

DATE : 30/10/2023

In today’s digital age, having a reliable payment gateway[1] is essential for any business that wants to operate online. A payment gateway serves[2] as the bridge between the customer and the merchant, facilitating secure online transactions. Whether you run a small online store or a large e-commerce platform, understanding the nuances of payment[3] gateway setup is crucial. This guide will walk you through everything you need to know about setting up a payment gateway, from choosing the right provider to ensuring secure transactions.

Understanding Payment Gateways

What is a Payment Gateway?

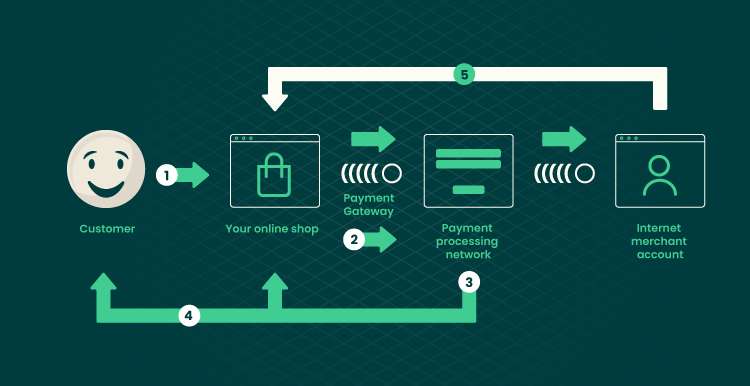

A Payment Gateway Setup[4] is a technology that allows businesses to accept payments over the internet. It encrypts sensitive information, such as credit card numbers and personal details, to ensure secure transactions between customers and merchants. The payment gateway[5] processes transactions and communicates with the payment processor to confirm whether a payment has been approved or declined.

Why is Payment Gateway Setup Important?

The setup of a payment gateway is vital for several reasons:

- Security: Payment gateways protect sensitive customer information, reducing the risk of fraud.

- Convenience: They provide a seamless payment experience for customers, which can improve sales.

- Variety of Payment Options: A well-chosen payment gateway allows you to accept various payment methods, increasing your customer base.

- Integration with E-commerce Platforms: Payment gateways can integrate easily with popular e-commerce platforms, making it easier to manage transactions.

Choosing the Right Payment Gateway

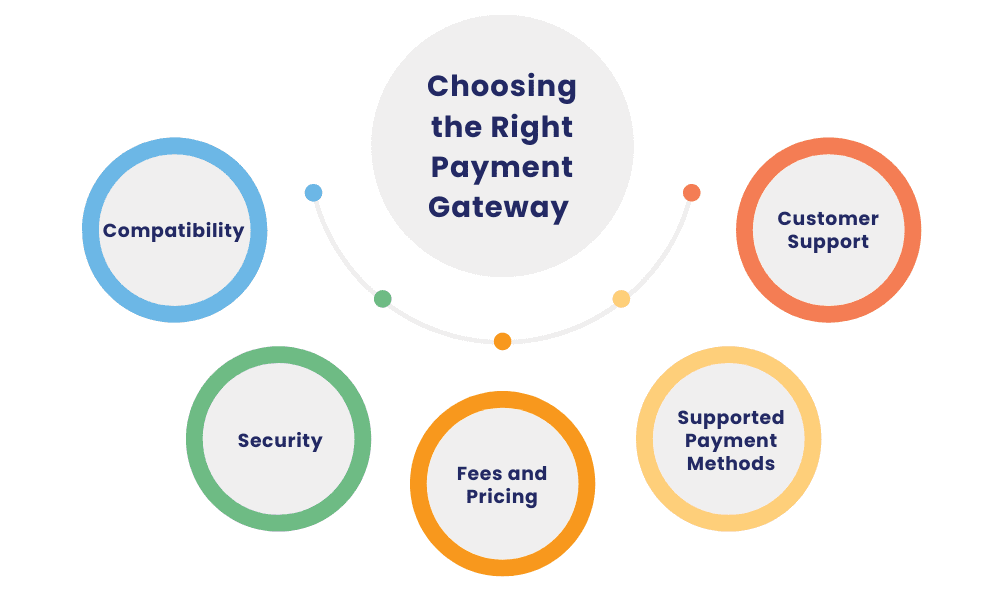

Factors to Consider

- Transaction Fees: Different gateways have varying fee structures. Understand how much you will pay per transaction, and whether there are monthly fees or setup costs.

- Payment Methods: Ensure the gateway supports multiple payment methods, including credit and debit cards, digital wallets, and alternative payment methods.

- Ease of Integration: Look for gateways that easily integrate with your existing e-commerce platform, whether it’s Shopify, WooCommerce, Magento, or another service.

- Security Features: Investigate the security measures offered by the gateway, such as encryption, fraud detection, and compliance with Payment Card Industry Data Security Standards (PCI DSS).

- Customer Support: Choose a provider that offers reliable customer support. You may encounter issues that require prompt assistance.

Popular Payment Gateways

- PayPal: One of the most widely recognized payment gateways, offering a user-friendly experience and multiple payment options.

- Stripe: Known for its robust API and customizable solutions, Stripe is ideal for tech-savvy businesses looking for flexibility.

- Square: Perfect for small businesses, Square offers easy setup and a flat-rate pricing model.

- Authorize.Net: A well-established player in the market, Authorize.Net provides a comprehensive suite of payment solutions.

Steps for Payment Gateway Setup

Step 1: Create a Merchant Account

Before setting up your payment gateway, you will need a merchant account. This account enables you to process payments made through credit and debit cards. Some Payment Gateway Setup a merchant account as part of their services, while others may require you to set up one separately with a bank or financial institution.

Step 2: Gather Required Documentation

To establish a merchant account, you will typically need to provide certain documentation, including:

- Business registration information

- Tax identification number

- Bank account details

- Personal identification (e.g., driver’s license or passport)

Step 3: Choose a Payment Gateway Provider

After assessing your needs and comparing different providers, choose the payment gateway that best suits your business model. Once you have made your choice, sign up for their services and create your account.

Step 4: Integrate the Payment Gateway with Your Website

Integrating the payment gateway with your e-commerce platform involves several steps:

- Access the Provider’s API Documentation: Familiarize yourself with the gateway’s API and integration process. Most providers offer detailed documentation to guide you.

- Install Required Plugins or Extensions: If you’re using an e-commerce platform like WooCommerce, Shopify, or Magento, you may need to install specific plugins to facilitate the integration.

- Configure Payment Settings: Set up your payment preferences, such as accepted currencies, transaction types, and customer notifications.

- Test the Integration: Conduct test transactions to ensure that everything works correctly. This is a critical step to identify any potential issues before going live.

Step 5: Implement Security Measures

Ensuring the security of your payment transactions is paramount. Here are some security measures to implement during your payment gateway setup:

- SSL Certificate: An SSL certificate encrypts data transferred between your website and your customers, safeguarding sensitive information.

- PCI Compliance: Ensure that your payment gateway is PCI compliant to protect cardholder data and minimize the risk of fraud.

- Fraud Detection Tools: Utilize fraud detection features offered by your payment gateway to monitor and prevent fraudulent transactions.

Step 6: Go Live and Monitor Transactions

Once you’ve completed the integration and testing phases, you can go live with your payment gateway setup. Monitor transactions regularly to ensure everything operates smoothly. Look out for any discrepancies or issues and address them promptly.

Conclusion

The process of payment gateway setup is essential for the success of any online business. By understanding the key steps involved—from choosing the right provider to ensuring security—you can create a seamless payment experience for your customers. As you navigate the world of online transactions, always prioritize security and customer satisfaction. With a reliable payment gateway in place, you can focus on growing your business and providing exceptional service.

FAQs

1. What are the common costs associated with payment gateway setup?

The costs can vary significantly based on the payment gateway provider. Common fees include transaction fees (usually a percentage of each sale), monthly fees, and sometimes setup fees. It’s crucial to review the fee structure before committing.

2. How long does the payment gateway setup process take?

The setup process can take anywhere from a few hours to a few days, depending on the complexity of your website and the payment gateway you choose. Allow ample time for testing to ensure a smooth launch.

3. Can I integrate several payment gateways for my business?

Yes, many businesses opt to integrate multiple payment gateways to offer customers various payment options. This can improve the overall user experience and lower the rates of cart abandonment.

4. What should I do if a payment fails?

If a payment fails, your payment gateway will usually notify you and the customer. Have a clear error-handling process in place to guide customers on what to do next, such as trying again or using a different payment method.

5. How do I ensure PCI compliance?

To maintain PCI compliance, follow best practices, including encrypting customer data, using secure networks, and conducting regular security audits. Most payment gateways provide resources to help you achieve compliance.