AUTHOR : ADINA XAVIER

DATE : 18/10/2023

In today’s fast-paced digital landscape, businesses need to adapt to the ever-changing consumer preferences and technological advancements. One crucial aspect of this adaptation is setting up a robust payment gateway system. This article will guide you through the process of payment gateway registration, ensuring that your business can smoothly handle online transactions.

Introduction

Payment gateway registration is a fundamental step for any business looking to accept online payments securely. In an era where e-commerce is thriving, the ability to process payments efficiently is vital. This article will explore the intricacies of payment gateway registration and guide you through the process.

Understanding Payment Gateways

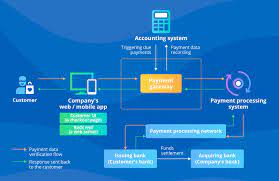

Payment gateways are essentially the digital counterparts of traditional point-of-sale systems. They facilitate secure online transactions[1] by encrypting sensitive information also connecting various parties, such as the customer, merchant, and financial institutions.

Why Payment Gateway Registration is Essential

The registration process is crucial for a variety of reasons. It ensures that your business adheres to legal requirements, provides a seamless transaction experience for your customers, also safeguards sensitive financial data.

Choosing the Right Payment Gateway

Selecting the right payment gateway for your business is paramount. Consider factors like transaction fees, payment methods supported, also the gateway’s compatibility with your e-commerce platform.

Prerequisites for Registration

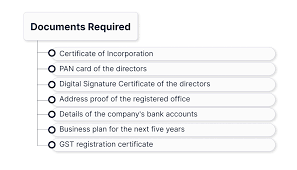

Before you begin the registration process, you should have your business details, bank account information, also the required documents ready.

Steps for Payment Gateway Registration

6.1. Research and Selection

Start by researching and selecting a payment gateway that aligns with your business needs also customer preferences.

6.2. Documentation

Gather all the necessary documents[2], such as your business registration certificate, bank account details, and tax identification number.

6.3. Application Submission

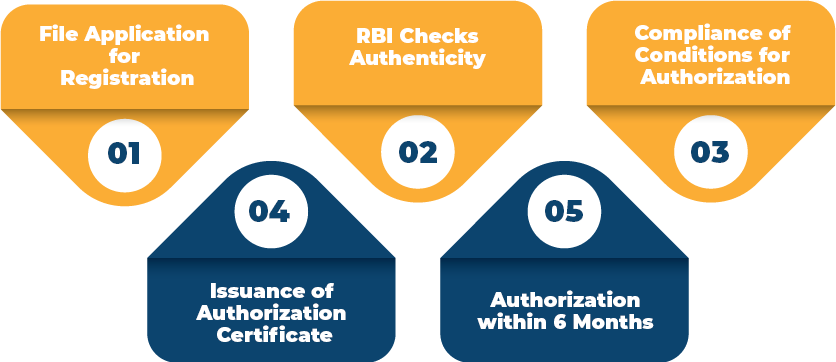

Submit your application to the selected payment gateway service, making certain that all details are precise and thorough.

6.4. Verification Process

The provider will review your application also may conduct due diligence to verify the authenticity of your business.

Integration with Your Website

Once your application is approved, you’ll need to integrate the payment gateway with your website or e-commerce[3] platform.

Testing Your Payment Gateway

Thoroughly test the gateway to ensure that it functions as expected, including making successful test transactions.

Security Measures

Establish strong security protocols to safeguard customer information also thwart any potential fraudulent actions.

Maintenance and Updates

Regularly update and maintain your payment gateway to ensure it remains secure and efficient.

Charges and Fees

Understand the charges also fees associated with your chosen payment gateway, as these can impact your business’s profitability.

Common Challenges

Learn about common challenges that businesses face with payment gateways and how to address them.

Benefits of a Secure Payment Gateway

Discover the numerous benefits of a secure payment gateway, such as increased customer trust, global reach, and seamless transactions.

7. Integration with Your Website

After successfully registering with your chosen payment gateway, the next step is integrating it with your website or e-commerce platform. This step is vital to ensure a seamless also efficient payment process for your customers. Most payment gateway providers offer easy-to-follow integration guides also support to assist you in this process.

The integration process involves inserting the necessary code or API (Application Programming Interface) into your website’s checkout page. This allows your website to communicate with the payment gateway when customers make a purchase. It’s essential to test the integration thoroughly to ensure that it works without any glitches.

8. Testing Your Payment Gateway

Testing your payment gateway is a critical phase in the registration process[4]. This step helps verify that the gateway functions as expected before you start accepting real payments. Most payment gateway providers offer a sandbox environment where you can conduct test transactions without any actual money changing hands.

During testing, pay close attention to various scenarios, such as successful transactions, declined payments, and refunds. This will help you understand how the gateway handles different situations also whether any adjustments are needed.

10. Maintenance and Updates

Once your payment gateway is up and running, regular maintenance and updates are essential to ensure its continued functionality and security. Stay informed about updates from your gateway provider and apply them promptly. Monitor the performance of your payment gateway and be ready to address any issues that may arise. Regularly review your security measures to keep pace with evolving threats.

11. Charges and Fees

Every payment gateway provider charges fees for their services. It’s crucial to understand the fee structure of your chosen payment gateway[5] to assess its impact on your business’s profitability. Compare different providers to find the one that aligns with your budget and business model.

Conclusion

Payment gateway registration is a critical step in establishing a successful online presence for your business. By following these guidelines, you can ensure that your customers have a secure and hassle-free payment experience.

Frequently Asked Questions

1. What is a payment gateway, and why do I need to register for one?

A payment gateway serves as a technological solution facilitating the secure processing of online transactions. Registering for one is essential to accept payments online.

2. How do I choose the right payment gateway for my business?

Consider factors like transaction fees, payment methods, and compatibility with your e-commerce platform when selecting a payment gateway.

3. What documents are required for payment gateway registration?

You’ll typically need your business registration certificate, bank account details, and tax identification number.

4. How can I ensure the security of my payment gateway?

Implement strong security measures, including encryption and regular updates, to protect customer data.

5. Are there any ongoing fees associated with payment gateways?

Yes, payment gateways often charge transaction fees and other associated costs. Be sure to understand these before choosing a provider.