AUTHOR : ADINA XAVIER

DATE : 18/10/2023

Introduction

In today’s digital age, online transactions have become a cornerstone of commerce. From buying products to paying for services, payment gateways have revolutionized the way we conduct business. However, what happens when a transaction goes awry, or you’re not satisfied with a product or service? That’s where the payment gateway refund process comes into play, ensuring your financial safety and convenience.

What is a Payment Gateway?

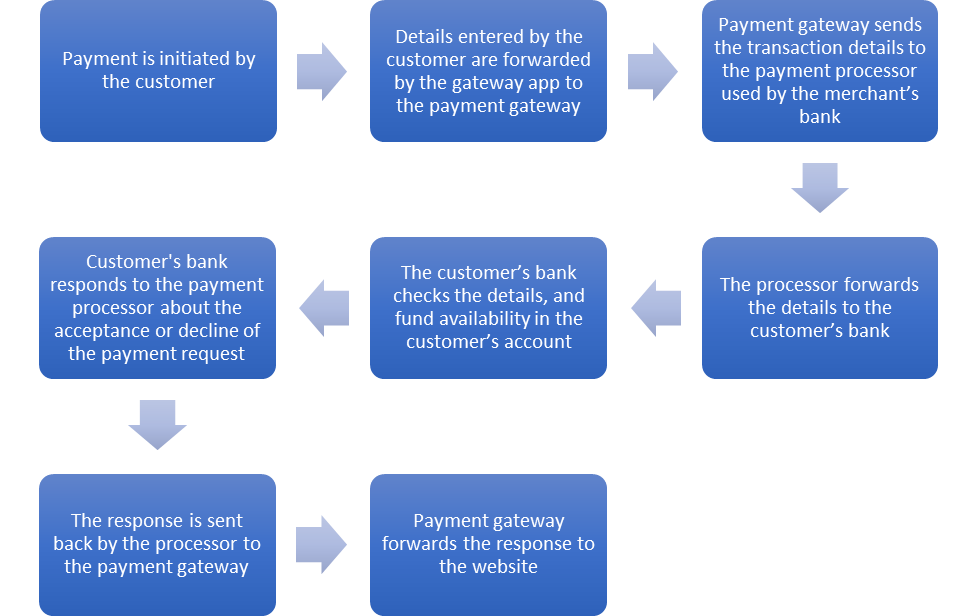

Before we delve into the refund process, let’s clarify the basics. A payment gateway serves as the digital conduit that enables seamless electronic financial transactions to occur. It acts as an intermediary between the customer also the merchant, securely transmitting payment information to authorize and complete the transaction.

The Need for Refunds

In an ideal world, every online transaction[1] would be flawless. But in reality, hiccups can occur. Whether it’s a faulty product, a service that didn’t meet expectations, or a simple mistake in the transaction, there are various reasons you might need a refund.

Understanding Payment Gateway Refunds

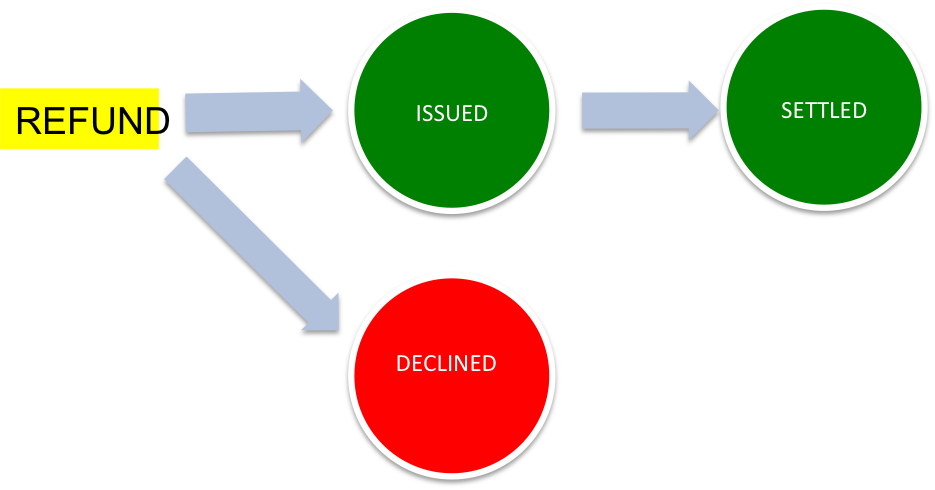

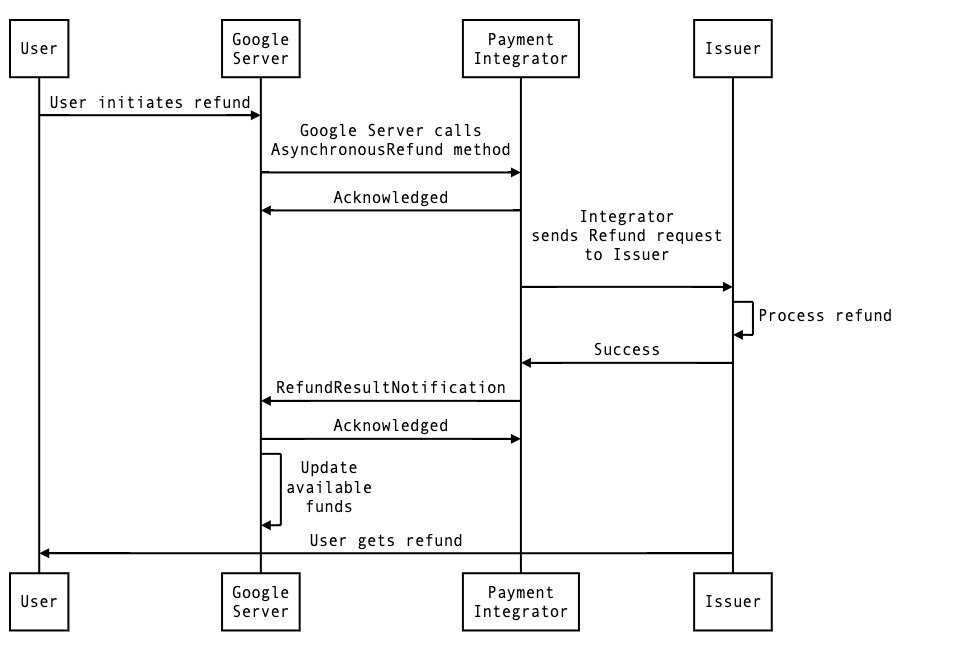

1. Initiation of Refund

The first step in the refund process is to initiate the refund request. This can be done through the merchant’s website, customer support, or directly through the payment gateway.

2. Verification

Once your request is received, the payment gateway verifies the transaction details, ensuring that it’s eligible for a refund. This step is crucial to prevent fraudulent claims.

Types of Refunds

3. Full Refunds

A full refund means that the entire amount of the original transaction is returned to the customer. This is typically the case when the product or service didn’t meet expectations or was defective.

4. Partial Refunds

Partial refunds are given when only a portion of the transaction amount is returned. This can happen when you’ve received part of the service or product but not all of it.

The Refund Process

5. Processing Time

The time it takes to process a refund can vary depending on the payment gateway[2] also the method of payment. Some may take a few business days, while others can take up to a week.

6. Notification

You will receive a notification via email or SMS once the refund has been processed. It should include the refunded amount also the method by which it was returned.

Common Challenges

7. Chargebacks

Sometimes, a customer disputes a transaction with their bank, resulting in a chargeback. This can be challenging for merchants, as they need to provide evidence to defend the transaction.

8. Refund Policies

Each merchant may have its own refund policies, which can vary widely. It’s essential to familiarize yourself with these policies before making a purchase.

9. Document Everything

When initiating a refund request, it’s vital to document everything related to the transaction. This includes receipts, confirmation emails, also any communication with the merchant. This documentation[3] can be immensely helpful in case of disputes or issues.

10. Contact Customer Support

If you’re unsure about the refund process or facing challenges, don’t hesitate to reach out to the customer support of the payment gateway or the merchant. They are there to assist you and provide guidance through the process.

Factors Affecting Refunds

11. Payment Method

The method you used for payment can influence the refund process. Credit card refunds, for instance, can be quicker compared to other methods.

12. Merchant’s Responsiveness

The speed and efficiency of your refund often depend on how responsive the merchant is to your request. A cooperative and customer-focused merchant[4] is more likely to expedite the process.

International Transactions

13. Currency Exchange

In the case of international transactions, currency exchange rates can fluctuate between the initial transaction and the refund. This might result in slight differences in the refunded amount.

14. Cross-Border Regulations

Different countries have various regulations and taxation rules concerning refunds. Understanding these can be crucial, especially in international transactions.

Conclusion

In the world of online transactions, the payment gateway refund process acts as a safety net for consumers. It ensures that you can shop also transact with confidence, knowing that you have the option for a refund if things don’t go as planned. By understanding this process, you can navigate the world of e-commerce[5] with ease and peace of mind.

FAQs

1. How long does it typically take to receive a refund through a payment gateway?

The processing time for refunds can vary, but it often takes a few business days to a week.

2. What should I do if I don’t receive a refund notification after the specified processing time?

If you don’t receive a notification, it’s advisable to contact the merchant or payment gateway’s customer support for assistance.

3. Can I request a refund for digital products or services?

Yes, you can request a refund for digital products or services if they do not meet your expectations or are faulty.

4. What is a chargeback, and how does it affect the refund process?

A chargeback materializes when a customer raises a concern with their financial institution regarding a specific transaction. It can complicate the refund process, as merchants need to provide evidence to defend the transaction.

5. Are refund policies the same for all merchants?

No, refund policies can vary widely between different merchants. It’s important to review a merchant’s specific refund policy before making a purchase.