AUTHOR : JAYOKI

DATE : 09/12/2023

In the digital era, online transactions have become an essential part of daily life, powering everything from e-commerce platforms to subscription services. The backbone of these online transactions is the Payment Gateway[1], a technology that securely processes payments for online businesses. This Payment Gateway Project aims to provide an efficient, secure, and reliable system for facilitating seamless online payment processing[2]. In this article, we will explore the essential components of a Payment Gateway Project[3], its benefits, and how it works to transform online business transactions.

What is a Payment Gateway?

A Payment Gateway[4] is an online service that acts as a bridge between a customer’s bank and an e-commerce website or business, enabling the secure transfer of funds. This service securely encrypts sensitive payment information, such as credit card details, ensuring that it is transmitted safely across networks. It plays a crucial role in authenticating the payment[5] and authorizing the transaction before processing it. Without payment gateways, online businesses would struggle to accept payments securely, making it a vital element in any Payment Gateway Project.

Importance of Payment Gateways

Facilitating Online Transactions

Payment gateways play a pivotal role in enabling seamless transactions over the internet. They act as intermediaries, ensuring that payments from customers reach merchants reliably and efficiently.

Ensuring Secure and Quick Payments

Security is paramount in the digital age, and payment gateways are designed with advanced encryption and authentication measures to safeguard sensitive financial information. Additionally, their efficiency ensures that transactions are processed swiftly, enhancing the overall user experience.

Essential Attributes of an Optimal Payment Gateway

Security Measures

An ideal payment gateway incorporates robust security protocols, including encryption and two-factor authentication, to protect both merchants and customers from potential threats.

Integration Capabilities

Seamless integration with various e-commerce platforms and websites is crucial. A good payment gateway should effortlessly adapt to the existing infrastructure, reducing the complexity of implementation.

User-Friendly Interface

The user interface of a payment gateway should be intuitive, making the payment process easy and accessible for customers. A smooth user experience encourages repeat business and customer loyalty.

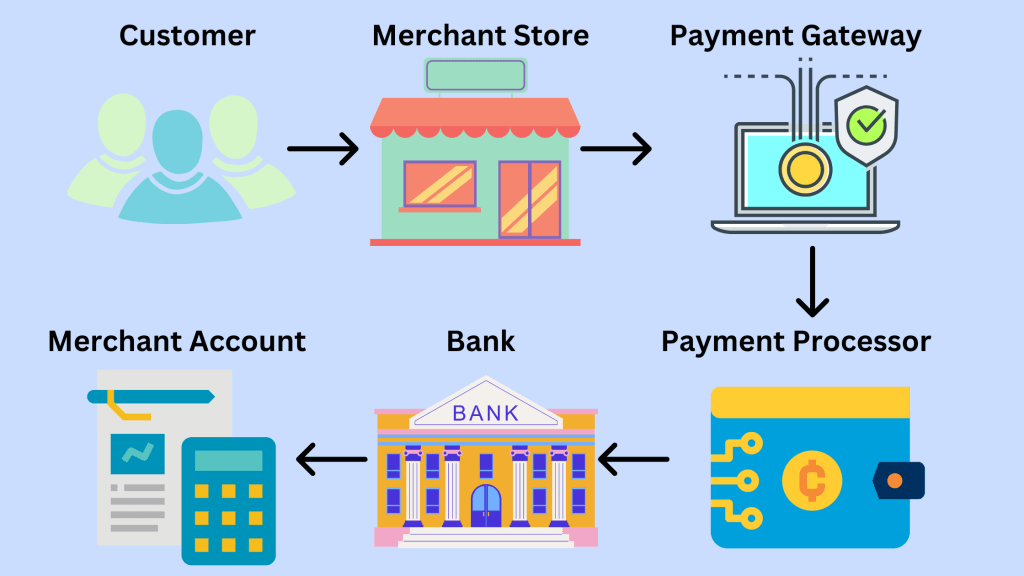

How Payment Gateways Work

Understanding the mechanics of payment gateways is essential for anyone embarking on a payment gateway project.

Transaction Flow

The payment process typically involves several steps, including authorization, authentication, and settlement. These steps ensure that the transaction is valid and that funds are transferred securely.

Authorization and Authentication

Authorization confirms whether the customer has sufficient funds for the transaction, while authentication verifies the identity of both the customer and the merchant.

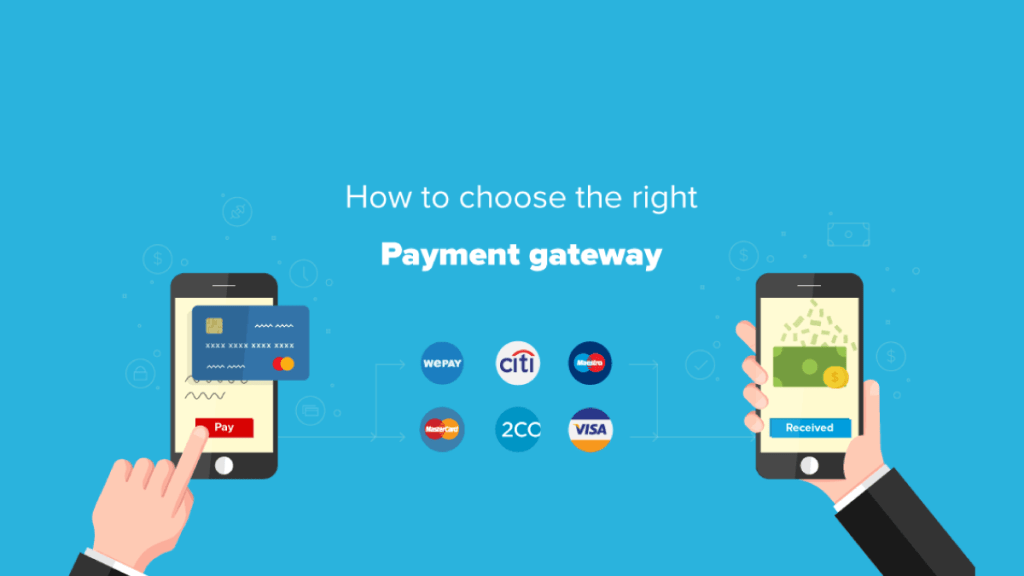

Popular Payment Gateway Providers

Several payment gateway providers dominate the market, each offering unique features and capabilities.

PayPal

Known for its global reach and ease of use, PayPal remains a top choice for businesses of all sizes.

Stripe

Stripe stands out with its developer-friendly approach and a wide range of customizable features.

Square

Square excels in simplicity and is particularly popular among small businesses, offering a user-friendly experience.

Choosing the Right Payment Gateway for Your Project

Selecting the most suitable payment gateway involves careful consideration of various factors.

Assessing Business Needs

Recognizing the unique needs of your enterprise is imperative for strategic decision-making Consider factors such as the volume of transactions, types of products or services, and target audience.

Considering Transaction Fees

Different payment gateways have varying fee structures. Evaluate transaction fees and choose a provider that aligns with your budget and revenue model.

Steps to Implement a Payment Gateway Project

Embarking on a payment gateway project requires a systematic approach.

Research and Planning

Thorough research and planning are essential to identify the most suitable payment gateway for your business. Consider compatibility, features, and security measures.

Integration with Website or App

Integrating the chosen payment gateway seamlessly with your website or application is critical. This step requires coordination between developers and the payment gateway provider.

Testing and Troubleshooting

Prior to launch, thorough testing ensures that the payment gateway functions flawlessly. Address any technical issues promptly to avoid disruptions in customer transactions.

Challenges in Payment Gateway Projects

Despite their advantages, payment gateway projects can encounter challenges.

Security Concerns

As technology evolves, so do potential threats. Payment gateway projects must continually update security measures to protect against fraud and cyber attacks.

Technical Glitches

System malfunctions or glitches can disrupt the payment process, leading to inconvenience for both merchants and customers. Regular maintenance and updates are crucial to prevent technical issues.

Future Trends in Payment Gateways

The landscape of payment gateways is dynamic, with emerging trends shaping the future.

Blockchain Technology

The integration of blockchain technology enhances transparency and security in transactions, revolutionizing the payment gateway industry.

Contactless Payments

With the rise of mobile devices, contactless payments are gaining popularity. Payment gateways are adapting to facilitate these convenient and secure transactions.

Successful Payment Gateway Implementation

Examining a real-world example Implementatio ncan provide insights into the positive impact of a well-executed payment gateway project.

Business Growth and Customer Satisfaction

A case study showcasing business growth and improved customer satisfaction highlights the tangible benefits of a successful payment gateway implementation.

Conclusion

A Payment Gateway Project is essential for any online business looking to offer secure, efficient, and seamless payment solutions to its customers. By integrating a reliable payment gateway, businesses can enhance the customer experience, improve security, and expand their reach across borders. Whether you’re developing a new e-commerce platform or looking to upgrade your existing payment system, a Payment Gateway Project is key to staying competitive in the digital economy.

FAQs

1. How do payment gateways ensure security?

Payment gateways employ encryption, two-factor authentication, and other security measures to protect sensitive financial information.

2. What factors should businesses consider when choosing a payment gateway?

Businesses should assess their transaction volume, types of products or services, and budget when selecting a payment gateway.

3. How can businesses address technical glitches in payment gateway projects?

Regular maintenance, updates, and prompt troubleshooting are essential to address and prevent technical issues.

4. What are the future trends in payment gateways?

Blockchain technology and the rise of contactless payments are shaping the future of payment gateways.

5. How can businesses ensure a smooth integration of a payment gateway with their website or app?

Thorough research, planning, and collaboration between developers and the payment gateway provider are key to a seamless integration process.

Get In Touch