AUTHOR : MICKEY JORDAN

DATE : 09/12/2023

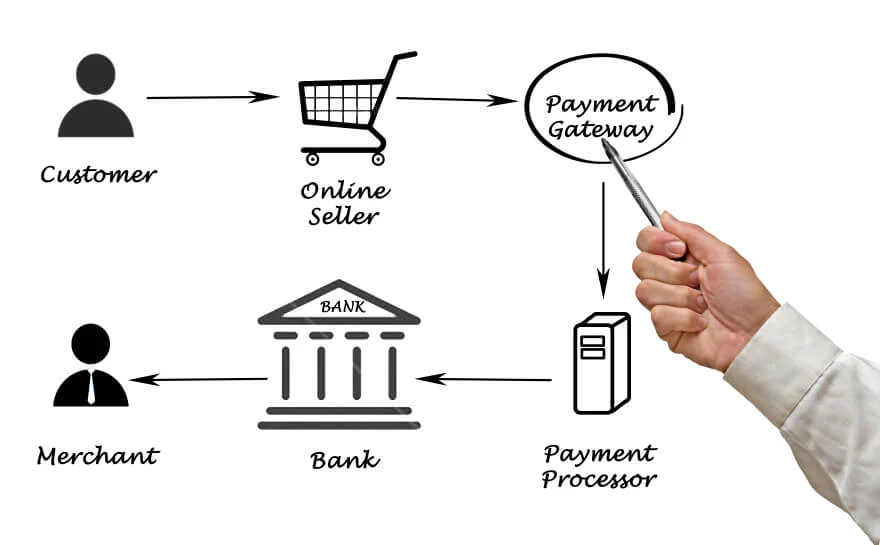

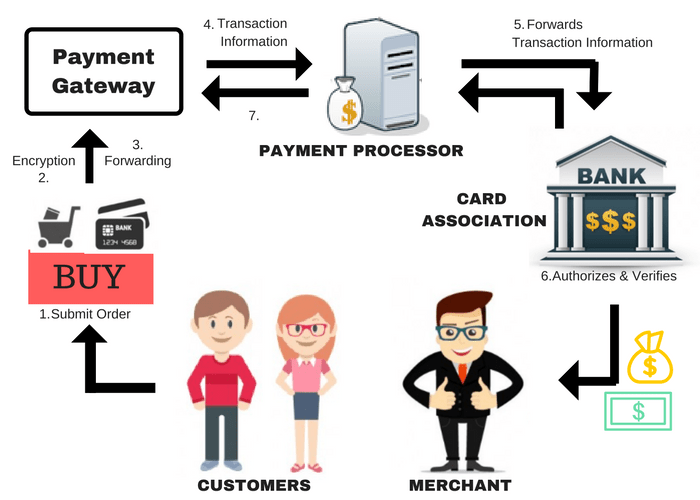

In today’s digital world, the payment gateway process flow[1] is essential for businesses that wish to accept online payments[2]. Understanding how a payment gateway works[3] can help ensure a smooth transaction experience for both merchants and customers. This guide delves deep into the payment gateway process flow, explaining each step in detail to provide a clearer understanding of how payments are processed online.

What is a Payment Gateway?

A payment gateway[4] is a technology that securely processes credit card and other payment transactions for e-commerce businesses. It acts as a bridge between a merchant’s website or app and the financial institutions that handle the funds, ensuring that payments are securely processed and authorized. The payment gateway[5] process flow involves several steps, from the initiation of a payment request to the final authorization and settlement.

Key Components of a Payment Gateway

Payment Request Initiation

Every transaction starts with a payment request initiated by the customer. This marks the beginning of the payment gateway process flow.

Encryption and Security Measures

To safeguard sensitive information, robust encryption and security measures are employed throughout the transaction process.

Authorization Process

Authorization is a critical step where the payment gateway communicates with the acquiring bank to verify the legitimacy of the transaction.

Common Challenges in Payment Gateway Process Flows

Despite the advancements, payment gateway processes face challenges such as technical issues, security concerns, and transaction delays.

Technical Issues

Glitches in the system can lead to transaction failures, affecting the user experience.

Security Concerns

The constant threat of cyberattacks emphasizes the need for robust security measures to protect user data.

Transaction Delays

Slow transaction processing can frustrate customers and impact the efficiency of business operations.

Strategies for Optimizing Payment Gateway Processes

To address challenges and enhance efficiency, businesses can implement strategies like regular system updates, robust security measures, and efficient customer support.

Regular System Updates

Frequent updates ensure the payment gateway remains secure and up-to-date with the latest technology.

Robust Security Measures

Implementing strong security protocols protects both businesses and customers from potential threats.

Efficient Customer Support

Prompt and effective customer support resolves issues quickly, maintaining a positive user experience.

Role of Technology in Enhancing Payment Gateways

Technological advancements have significantly influenced payment gateways, with applications of AI, machine learning, and blockchain technology revolutionizing the digital transaction landscape.

AI and Machine Learning Applications

Artificial intelligence enhances fraud detection, risk assessment, and personalized user experiences.

Blockchain Technology

In the realm of digital transactions, blockchain technology guarantees transactions that are both transparent and secure, effectively mitigating the potential risk of fraudulent activities.

Contactless Payments

The rise of contactless payments reflects the changing preferences of consumers for quick and convenient transactions.

Future Trends in Payment Gateway Process Flows

The landscape of payment gateways continues to evolve, with advancements in technology and the emergence of new payment methods shaping the future.

Advancements in Technology

Continual technological advancements will bring about more efficient and secure payment processes.

Emerging Payment Methods

New payment methods, such as cryptocurrency and digital wallets, will gain prominence in the market.

Impact on E-Commerce

The evolving payment gateway landscape will influence the growth and direction of e-commerce globally.

Tips for Choosing the Right Payment Gateway

Selecting the appropriate payment gateway involves considerations such as compatibility with business needs, security features, and cost considerations.

Compatibility with Business Needs

The chosen payment gateway should align with the specific requirements and scale of the business.

Security Features

Prioritize gateways with robust security features to protect sensitive customer information.

Cost Considerations

Evaluate the costs associated with each payment gateway to ensure it aligns with the business budget.

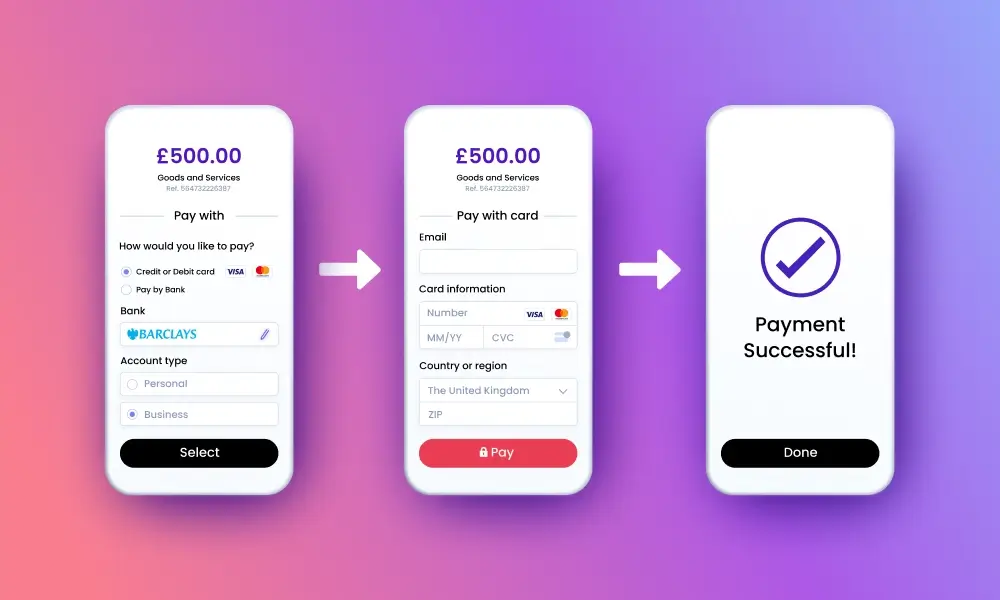

User-Friendly Payment Gateway Interfaces

An intuitive design, accessibility features, and mobile responsiveness contribute to a user-friendly payment gateway interface.

Importance of Intuitive Design

A well-designed interface simplifies the transaction process, enhancing user satisfaction.

Accessibility Features

Ensuring accessibility for users with disabilities promotes inclusivity and broadens the customer base.

Mobile Responsiveness

With the increasing use of mobile devices, a responsive design is essential for a seamless user experience.

Regulatory Compliance in Payment Gateways

Navigating the legal landscape is crucial for payment gateways, with GDPR, PCI DSS compliance, and other regulations demanding attention

GDPR and Data Protection

Strict adherence to GDPR ensures the protection of user data and compliance with privacy regulations.

PCI DSS Compliance

Payment Card Industry Data Security Standard compliance is essential for securing cardholder information.

Legal Considerations

Understanding and complying with relevant legal requirements safeguards businesses from legal complications.

Conclusion

Understanding the payment gateway process flow is crucial for both merchants and customers. From the initial payment initiation to the final settlement, every step plays a vital role in ensuring smooth and secure transactions. By utilizing secure payment gateways, businesses can enhance customer trust and boost conversion rates, ultimately contributing to their success in the digital marketplace.

FAQs

- Q: How does a payment gateway ensure the security of online transactions? A: Payment gateways employ encryption, secure communication protocols, and fraud detection mechanisms to ensure the security of online transactions.

- Q: Can payment gateways process international transactions? A: Yes, many payment gateways offer international payment processing services, facilitating transactions across borders.

- Q: What role does customer support play in the efficiency of a payment gateway? A: Efficient customer support resolves issues quickly, contributing to a positive user experience and minimizing disruptions in the payment process.

- Q: How often should businesses update their payment gateway systems? A: Regular system updates are recommended to ensure security, compliance with regulations, and the adoption of the latest technological advancements.

- Q: Are there alternatives to traditional payment gateways emerging in the market? A: Yes, emerging technologies such as blockchain and cryptocurrency present alternative options for secure and efficient digital transactions.

Get In Touch