AUTHOR : SELENA GIL

DATE : 6/11/2023

Introduction to Payment Gateways

Payment gateways serve as the virtual cashiers of the online world. They are the technology that facilitates and authorizes online payments, ensuring that the money moves securely from the buyer’s bank to the seller’s bank. But what about merchant accounts?

What Is a Merchant Account?

Traditionally, a merchant account was a fundamental requirement for businesses looking to accept card payments. It was essentially a bank account that allowed you to receive funds from your customers’ credit or debit card transactions. However, with the advent of payment gateways, this is no longer an absolute necessity.

The Traditional Payment Process

In the past, when a customer made a purchase online, their payment information would be sent to the merchant’s website. The merchant would then send this information to their bank, and after several intermediary steps, the transaction would eventually be approved or declined. The funds would be transferred to the merchant’s account after approval.

The Role of Payment Gateways

Now, payment gateways have revolutionized this process. They act as intermediaries between the customer, the merchant, and the bank. The payment gateway securely encrypts and processes the payment information, eliminating the need for a direct connection to the merchant’s bank account.

Payment Gateway Benefits

Payment gateways offer a host of benefits, including enhanced security, faster transaction processing, and wider compatibility with various payment methods. They also provide businesses with valuable insights into their transaction data, helping them make informed decisions.

Payment Gateway vs. Merchant Account

The key distinction between payment gateways and merchant accounts lies in the ownership and management of the payment process. While a merchant account is directly linked to your business and requires your maintenance, payment gateways are third-party services.

Types of Payment Gateways

Payment gateways come in various forms, such as hosted gateways, integrated gateways, and self-hosted gateways. The choice of gateway depends on your business model and requirements.

How to Choose the Right Payment Gateway

Selecting the right payment gateway is crucial for a seamless online payment experience. Factors to consider include transaction fees, security features, user-friendliness, and compatibility with your e-commerce platform.

Setting Up a Payment Gateway

The process of setting up a payment gateway involves creating an account, configuring the gateway settings, and integrating it into your website or app. It’s a relatively straightforward process, and many payment gateway providers offer user-friendly setup guides.

Security Measures

Ensuring the security of online transactions is paramount. Payment gateways employ cutting-edge encryption and tokenization methods to safeguard the confidentiality of valuable customer informationThese security measures are vital in gaining and maintaining the trust of your customers.

User-Friendly Payment Gateways

A user-friendly payment gateway simplifies the checkout process, reducing cart abandonment rates. It should offer a seamless and intuitive interface, ensuring that customers can complete their purchases with ease.

Fees and Costs

Every payment gateway comes with its own fee structure. It’s essential to understand the pricing model, including transaction fees, monthly charges, and any additional costs. Acquiring this understanding[1] will enable you to adeptly strategize your financial resources

Exploring Payment Gateway Features

Payment gateways are more than just a secure bridge for processing transactions. They offer various features that can benefit both businesses and customers.

1. Multiple Payment Methods

Payment gateways typically support a wide range of payment methods, including credit cards, debit cards[2], digital wallets, and bank transfers. This flexibility ensures that customers can choose the payment option that suits them best.

2. International Transactions

For businesses with a global reach, payment gateways often facilitate international transactions by converting currencies and handling cross-border payments. This feature can significantly[3] expand your customer base.

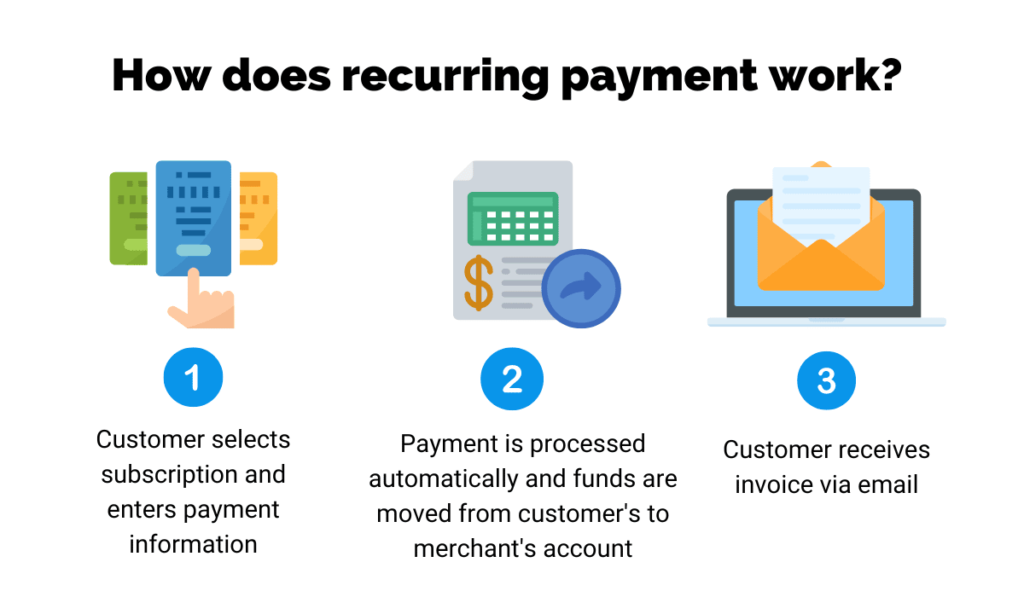

3. Recurring Payments

If your business relies on subscription-based models, payment gateways[4] offer the capability for automated recurring payments. This simplifies billing processes and enhances customer convenience.

4. Reporting and Analytics

Payment gateways provide valuable transaction data and analytics. This information[5] helps businesses track sales trends, customer behavior, and the effectiveness of different payment methods.

Conclusion

In the world of online transactions, payment gateways have made it easier than ever to accept payments without the need for a traditional merchant account. They offer enhanced security, faster processing, and a seamless user experience. However, selecting the right payment gateway and understanding its features and costs are essential for any online business.

In the era of e-commerce and digital payments, choosing the right payment gateway is a critical decision for your business’s success. Make the right choice, and your customers will enjoy a smooth and secure payment experience. Make the wrong choice, and you may face challenges that hinder your growth.

If you’re ready to take the plunge into the world of payment gateways, get started today. Get

FAQs

1. What is the primary advantage of using a payment gateway over a traditional merchant account? Payment gateways offer enhanced security, faster transaction processing, and compatibility with various payment methods, making them a preferred choice for online businesses.

2. Are payment gateways suitable for all types of businesses? Payment gateways can be suitable for a wide range of businesses, but the choice of the right gateway depends on your specific needs and business model.

3. How do I ensure the security of my customers’ payment data when using a payment gateway? Payment gateways use encryption and tokenization to protect sensitive customer data. Additionally, choosing a reputable and secure gateway provider is crucial.

4. Can I use multiple payment gateways for my online business? Yes, some businesses choose to use multiple payment gateways to offer their customers a variety of payment options. However, this can increase complexity.

5. Are there any hidden fees associated with using payment gateways? While most payment gateways are transparent about their fees, it’s essential to carefully review the fee structure to understand all potential costs.