AUTHOR: MARIA SK

DATE:- 04/11/2023

Payment Gateway Name In today’s digital world, a reliable PG is essential for any online business. Payment gateways act as intermediaries between your business and your customers, facilitating secure and smooth transactions. With numerous options available, choosing the right PG for your business is crucial. In this article, we’ll explore the key factors to consider when selecting a payment gateway, ensuring that it aligns perfectly with your business needs.Payment Gateway Name

Introduction

Payment gateways are pivotal to the triumph of your e-commerce enterprise. They ensure secure and efficient online transactions, creating trust among your customers. However, with a multitude of PG options available, making the right choice can be challenging. In this article, we’ll delve into the world of payment gateways, guiding you through the selection process to boost your business’s online presence.

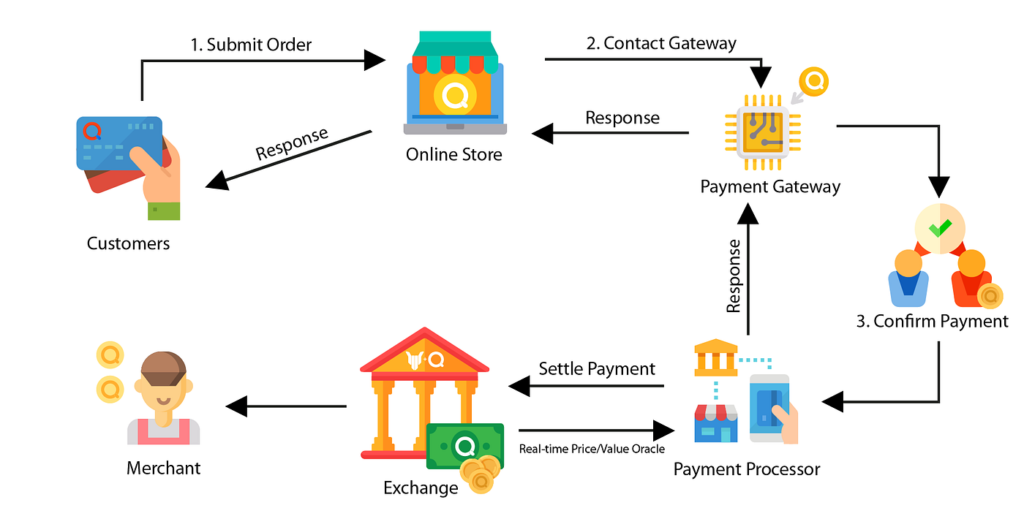

Understanding Payment Gateways

A PG is a technological marvel that empowers businesses to receive online payments seamlessly. It acts as a bridge between the customer’s bank and your business, securely processing transactions and also ensuring the funds reach your account. Payment Gateway Name

Importance of Choosing the Right Payment Gateway

Opting for the correct PG is vital to ensuring the success of your company. It impacts the user experience, security, and also transaction efficiency. A well-chosen PG can lead to higher conversion rates and also customer trust.

Key Factors to Consider

4.1 Security

The security[1] of your PG is paramount. Ensure it meets industry standards and also offers features like encryption and fraud protection to safeguard your business and customer data.

4.2 Payment Methods

Different customers prefer various payment methods. Your chosen gateway should support a wide range of payment options, including credit cards, digital wallets, and also alternative payment methods.

4.3 User Experience

A seamless and user-friendly payment[2] process is essential. Customers should not face unnecessary hurdles during checkout. The PG should be intuitive and responsive.

4.4 Fees and Pricing

Every PG comes with its own pricing structure[3]. Evaluate the fees involved, including setup, transaction, and monthly fees, to find the one that aligns with your budget.

4.5 Integration Options

Consider how easily the PG can integrate[4] with your e-commerce platform or website. The smoother the integration, the better the overall experience for both you and your customers.

Popular PG Providers

5.1 PayPal

PayPal is a widely recognized[5] and trusted PG known for its simplicity and versatility.

5.2 Stripe

Stripe offers a customizable and developer-friendly gateway with a strong emphasis on security.

5.3 Square

Square provides an integrated solution with user-friendly features and competitive pricing.

5.4 Authorize.Net

Authorize.Net is a long-established gateway with a reputation for reliability and security.

Steps to Integrate a Payment Gateway

To integrate a PG into your online business, follow these steps:

- Choose your PG provider.

- Create an account.

- Customize the gateway settings.

- Incorporate it into your website or e-commerce system.

- Test the payment process.

- Go live and start accepting payments.

Case Study: A Business’s Journey with a Payment Gateway

Let’s explore a real-world example of how the right PG selection can significantly impact a business’s growth and customer satisfaction.

Common PG Pitfalls to Avoid

Be aware of common mistakes businesses make when choosing a PG to ensure a smooth payment experience for your customers.

Benefits of a Seamless Payment Gateway

Discover the advantages of having a seamless payment gateway, including higher conversion rates and improved customer trust.

Continuation

The right PG can be the linchpin for your online business’s success, ensuring a secure and efficient transaction process that leaves your customers satisfied. Here are some additional insights to help you make the best choice:

Consider Industry Compatibility

Different industries may have unique requirements when it comes to payment gateways. For instance, an e-commerce store might prioritize compatibility with popular shopping cart software, while a subscription-based service could need a gateway that supports recurring payments seamlessly. Evaluate your industry’s specific needs and look for gateways that cater to them.

Evaluate Customer Support

Technical hiccups can happen, and when they do, responsive customer support can be lifesaver. Prioritize PG providers with excellent customer support. Being able to reach out for assistance, whether by phone, email, or chat, can make a significant difference when troubleshooting issues.

Explore Integration with Third-Party Tools

Consider your business’s existing tech stack. Will the chosen PG integrate smoothly with your current tools and software? An easy integration with accounting, inventory management, and other systems can streamline your business operations.

Conclusion

In the world of e-commerce, choosing the right PG is a critical decision that can influence the success of your business. By considering factors like security, payment methods, user experience, fees, and integration, you can select the perfect PG for your unique needs.

(FAQs)

Q1. Can I use multiple payment gateways for my online store? Yes, it’s possible to use multiple payment gateways, but it can be complex to manage. Most businesses stick to one primary gateway for simplicity.

Q2. What should I look for in terms of transaction fees? Transaction fees can vary significantly. Look for a PG with competitive rates that align with your sales volume.

Q3. How do payment gateways handle international transactions? Most payment gateways support international transactions. Ensure your chosen gateway supports the countries you plan to do business with.

Q4. Is it necessary to have a developer for PG integration? While some gateways are more developer-friendly, many offer easy-to-use plugins for popular e-commerce platforms that don’t require extensive coding knowledge.

Q5. Can I change my PG if I’m not satisfied with the current one? Yes, it’s possible to switch payment gateways, but it may require some effort to ensure a smooth transition for your customers.