AUTHOR: DARCY SHARMA

DATE: 4/11/23

Payment gateways are the unsung heroes of the e-commerce world. They play a pivotal role in enabling secure online transactions. In today’s digital age, where the world is your marketplace, the choice of a payment gateway becomes even more critical. This article explores the world of payment gateways in Mexico, delving into their significance, popular choices, setup process, benefits, challenges, and what the future holds for this vital component of online businesses.

The Need for Payment Gateways in Mexico

E-commerce Boom

Mexico has experienced a significant surge in e-commerce activities. With more consumers turning to online shopping, businesses must cater to this growing market. Payment gateways facilitate seamless transactions, making it easier for consumers to shop online.

Consumer Preferences

Mexican consumers have diverse payment preferences. They use credit and debit cards, digital wallets, and even cash payments at convenience stores. Payment gateways are essential for businesses to accommodate these varied payment methods.

Security Concerns

One of the primary concerns in the e-commerce industry is security. Payment gateways employ stringent security protocols to protect both consumers and businesses from fraud and data breaches, instilling trust in online transactions.

Popular Payment Gateways in Mexico

PayPal

PayPal is a globally recognized payment gateway, and it has a strong presence in Mexico. With its international reputation, it’s a preferred choice for businesses targeting both local and international customers.

Stripe

Stripe offers a developer-friendly platform that simplifies payment processing. It’s known for its scalability and customization options, making it a popular choice for businesses of all sizes.

Conekta

Conekta specializes in the Latin American market, offering tailored solutions for Mexican businesses. It’s known for its seamless integration with local banks.

Openpay

Openpay is another Mexican payment gateway that focuses on the domestic market. It’s particularly well-suited for businesses looking to provide local payment options.

MercadoPago

MercadoPago, associated[14] with MercadoLibre, is widely used in Mexico and South America. It offers various payment methods and is a trusted choice for e-commerce businesses.

Key Features of Payment Gateways in Mexico

Payment gateways come with a range of features to meet the needs of businesses and consumers in Mexico.

Currency Support

Local gateways support the Mexican[1] Peso, making it easier for businesses to display prices and process transactions in the local currency.

Security Protocols

Security is paramount,[2] and payment gateways use advanced encryption and fraud detection to protect sensitive customer information.

Integration Options

Payment gateways offer different integration methods, from simple[3] plugins for small businesses to custom solutions for larger enterprises.

Setting Up a Payment Gateway

The process of setting up a payment gateway typically involves registration, integration[4] with e-commerce platforms, and customization to match a business’s branding.

Benefits of Local vs. International Payment Gateways

Transaction Fees

Local gateways may offer lower transaction fees for domestic transactions,[5] which can benefit businesses with a primarily Mexican customer base.

Customer Trust

Local payment gateways often enjoy higher trust levels among Mexican consumers due to their familiarity.

Market Reach

International gateways can extend your reach globally, allowing you to tap into international markets as well.

Challenges and Solutions

Regulatory Hurdles

Navigating Mexican regulations can be a challenge, but payment gateways can assist businesses in compliance.

Fraud Prevention

Fraud is a constant threat in the e-commerce world. Payment gateways employ anti-fraud measures to protect businesses and customers.

Customer Support

Reliable customer support is vital for businesses using payment gateways. Choose a gateway that offers excellent support to resolve issues promptly.

Success Stories

Case Study 1: E-commerce Store A

E-commerce Store A experienced a significant increase in sales after integrating a local payment gateway. Their customers appreciated the ease of transactions and the familiarity of using a Mexican payment solution.

Case Study 2: Start-up B

Start-up B, targeting the international market, benefited from an international payment gateway. It expanded its customer base to include buyers from various countries.

Future Trends in Payment Gateways

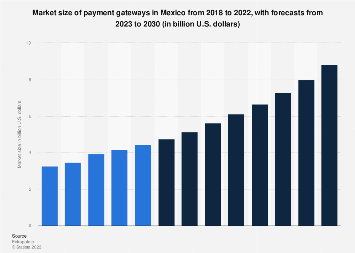

The payment gateway industry is dynamic and continues to evolve. Some trends to watch out for include the integration of cryptocurrencies, mobile wallets, and the use of AI and machine learning to enhance security and user experience.

Conclusion

In a world where online transactions are prevalent, selecting the right payment gateway is crucial for businesses. Whether you’re catering to local or international markets, the choice of payment gateway can significantly impact your success in the e-commerce arena.

FAQs

- Are payment gateways in Mexico secure?

- Yes, payment gateways in Mexico prioritize security and employ advanced encryption and fraud detection measures.

- What are the advantages of using a local payment gateway?

- Local gateways often offer lower transaction fees for domestic transactions and enjoy higher trust levels among Mexican consumers.

- How can I seamlessly incorporate a payment gateway into my e-commerce website?

- Integration usually involves registering with the payment gateway provider, integrating their services with your e-commerce platform, and customizing the user experience.

- What is the future of payment gateways in Mexico?

- The future holds trends such as cryptocurrency integration, mobile wallet support, and the use of AI and machine learning for enhanced security.

- Do international payment gateways work well for Mexican businesses?

- International payment gateways can be a good choice if your business aims to expand internationally and target customers from various countries.