AUTHOR : HANIYA SMITH

DATE : 31/10/2023

Introduction

In today’s digital age, the convenience of online transactions[1] has become paramount. Whether you’re an e-commerce business owner, a consultant, or a customer, having access to a reliable Payment Gateway List India[2] is essential. In India, a country with a booming digital economy, there are several payment gateways to choose from. In this article, we will explore the top payment gateways[3] in India, discussing their features, benefits, and how they can cater to your specific needs.

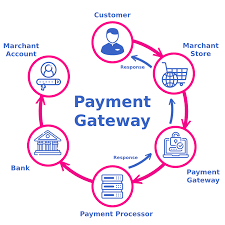

Understanding Payment Gateways

As the Indian market continues to embrace online payments[4], the demand for secure and efficient payment gateways has grown for new ventures. A payment gateway is a technology that authorizes credit cards or other forms of electronic transactions. It plays a pivotal role in ensuring the smooth flow of funds for businesses and customers. Let’s dive into the top payment[5] gateways in India that are making online transactions unbroken.

Popular Payment Gateways in India

Paytm

Paytm, one of India’s leading payment gateways, offers a wide range of services. It allows you to make payments for various utilities, book flights and hotels, and even shop online. With its user-friendly interface and robust security measures, PayPal is a favorite among Indian consumers.

Razorpay

Razorpay is known for its easy integration and exceptional support. It provides a range of payment options, including credit and debit cards, net banking, UPIs, and digital wallets. Businesses appreciate its analytics and reporting tools, which help them make informed decisions.

CC Avenue

CC Avenue is one of the oldest payment gateways in India, and it’s trusted by thousands of businesses. It supports multiple payment options, including international cards, and provides real-time transaction monitoring. The gateway’s customization options make it versatile for businesses of all sizes.

Instamojo

Instamojo is a popular choice for consultants and small businesses. It offers easy setup and a variety of payment options, including payment links and QR codes. With no setup fees, it’s an attractive choice for beginning businesses and individual innovators.

PayU Money

It provides a secure and hassle-free payment experience, making it a selected choice for e-commerce businesses.

Specialized Payment Gateways

PayPal

Payment Gateway List India While not an Indian gateway per se, PayPal is widely used for international transactions. It’s a reliable choice for businesses that cater to a global audience.

BillDesk

BillDesk focuses on utility bill payments and is a go-to choice for those looking to pay their bills manually.

Factors to Consider

When selecting a payment gateway for your business, there are several factors to keep in mind:

- Transaction Fees: Each gateway may have different fee structures. Compare them to find the most cost-effective option.

- Security Measures: Ensure that the payment gateway adheres to strict security standards to protect sensitive customer data.

- User Experience: An unbroken and user-friendly interface is crucial for customers. Look for a gateway that offers a smooth payment process.

- Integration: Consider how easily the gateway can be integrated into your website or app.

- Customer Support: Reliable customer support is essential, as any technical issues need to be resolved promptly.

Importance of a Payment Gateway

Payment Gateway List In a rapidly automated world, a payment gateway is the bridge between customers and businesses. It ensures that payments are processed securely and efficiently, enabling the growth of e-commerce and other online services. Here are some key reasons why payment gateways are crucial in the Indian market:

- Enhanced Convenience: Payment gateways offer customers the convenience of making transactions from the comfort of their homes, reducing the need for physical cash transactions.

- Global Accessibility: Many payment gateways, like PayPal, allow businesses to cater to a global audience, opening up new opportunities for expansion.

- Security: Payment gateways employ advanced security measures to protect sensitive financial information, giving customers and businesses peace of mind.

- Transaction Monitoring: These gateways provide real-time transaction monitoring, allowing businesses to keep track of their financial activities and detect any irregularities.

Choosing the Right Payment Gateway

Payment Gateway List India Selecting the right payment gateway for your business is a critical decision. The choice you make can significantly impact your operations, customer satisfaction, and overall success. Here are some steps to help you decide which payment gateway is best for your needs:

Identify Your Business Needs

- Determine the types of payments you’ll be accepting (credit cards, digital wallets, UPI, etc.).

- Consider your customer base and their selected payment methods.

- Evaluate the volume of transactions you expect to handle.

Research Payment Gateways

- Explore the features and services offered by different payment gateways.

- Compare transaction fees and other associated costs.

- Read reviews and seek recommendations from other businesses.

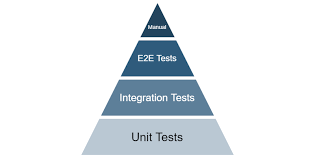

Test Integration

- Ensure that the payment gateway can be unbrokenly integrated into your website or app.

- Verify that it provides an easy and smooth checkout process for your customers.

Conclusion

In the digital era, having a reliable payment gateway is crucial for businesses and individuals alike. The top payment gateways in India offer an abundance of features to cater to diverse needs. From Paytm’s versatility to Razorpay’s ease of use, there’s an appropriate option for everyone. When choosing a payment gateway, it’s important to consider factors like transaction fees, security, and user experience to ensure an efficient payment process for your customers.

FAQs

- Is it necessary to have a payment gateway for an online business in India? While not mandatory, having a payment gateway significantly enhances the convenience of online transactions and can boost your sales.

- Which payment gateway is best for startups in India? Instamojo is a popular choice for startups due to its ease of use and no setup fees.

- Are these payment gateways secure for online transactions? Yes, the mentioned payment gateways adhere to strict security standards to protect customer data.

- Can I use PayPal for domestic transactions in India? Yes, PayPal is accepted for both international and domestic transactions.

- What if I face technical issues with a payment gateway? Most payment gateways offer customer support to assist with any technical problems, ensuring a smooth payment experience.