AUTHOR : HANIYA SMITH

DATE : 31/10/2023

In an increasingly digital world, having a reliable and secure online payment system is vital for any business. A payment gateway link[1] is a crucial element of this system, facilitating smooth transactions between consumers and merchants. This article will explore what a linking payment[2] seamlessly. is, how it functions, its advantages, and how to choose the right one for your business needs. This article explores what a payment gateway[3] link is, how it works, its benefits, and the key factors to consider when choosing one for your business.

What is a Payment Gateway Link?

A payment gateway link is a software application that enables online merchants to accept credit card payments and other forms of electronic payment[4]. It acts as an intermediary between the customer’s payment method and the merchant’s bank, securely transmitting transaction data.

When a customer decides to purchase a product or service online, they are prompted to enter their payment information[5], which the payment gateway link then encrypts. This ensures that sensitive data, such as credit card numbers, is protected during the transaction process.

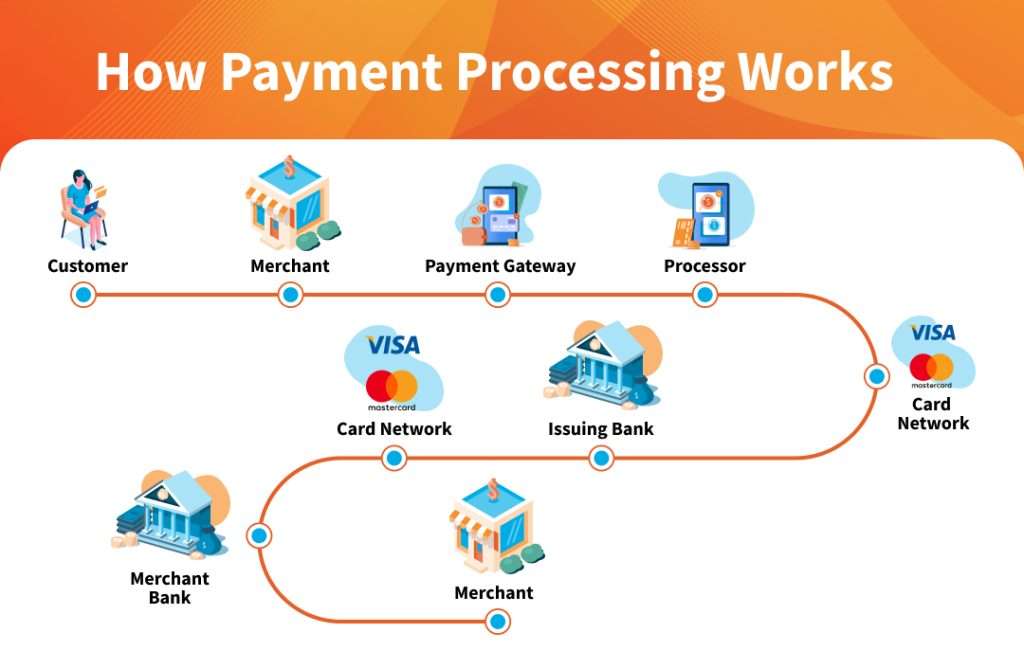

How Does a Payment Gateway Link Work?

The functioning of a linking payment seamlessly. involves several critical steps:

- Transactioninitiation: The customer selects items for purchase and proceeds to the checkout page, where they choose their payment method.

- Data Entry: The customer enters their payment details, which may include credit card information, billing address, and any other necessary data.

- Encryption: The payment gateway link encrypts this information to protect it from unauthorized access and fraud.

- Authorization Request: The encrypted data is sent to the payment processor, which communicates with the customer’s bank to verify that sufficient funds are available.

- Response Handling: The bank returns a response to the payment processor, indicating whether the transaction is approved or declined.

- Transaction Completion: If approved, the funds are transferred from the customer’s bank to the merchant’s account, and the customer receives a confirmation of the purchase.

Benefits of Using a Payment Gateway Link

1. Security

One of the primary benefits of linking payments seamlessly. is enhanced security. These systems use encryption protocols to protect sensitive information, reducing the risk of data breaches and fraud.

2. User Convenience

A well-integrated Linking payments seamlessly. provides customers with various payment options, such as credit cards, debit cards, and digital wallets. This flexibility enhances the user experience and can lead to increased sales.

3. Faster Transactions

Payment gateway links facilitate quick transaction processing, allowing businesses to receive payment confirmations in real-time. This rapidity is essential in the current dynamic landscape of online commerce.

4. Global Reach

With Linking payments seamlessly, businesses can accept payments from customers around the world. This capability expands market reach and opens new revenue streams.

5. Reduced Cart Abandonment

A streamlined checkout process with a payment gateway link can significantly reduce cart abandonment rates. When customers find it easy to complete their purchases, they are more likely to follow through.

Choosing the Right Payment Gateway Link

1. Transaction Fees

Various payment gateways impose varying fees for handling transaction processing. It’s crucial to understand these costs, as they can impact your overall profitability. Seek a provider that provides competitive pricing and clear fee structures.

2. Integration Capabilities

Ensure that the payment gateway link you choose can easily integrate with your existing e-commerce platform or website. Many providers offer plugins or APIs to facilitate this process, making it simpler for you to implement.

3. Supported Payment Methods

Check which payment methods are supported by the linking payments seamlessly. A wide variety of options (e.g., credit cards, PayPal, digital wallets) will cater to more customers, improving the overall payment experience.

4. Security Features

Prioritize security by selecting a payment gateway link that complies with the Payment Card Industry Data Security Standard (PCI DSS). Features such as fraud detection, tokenization, and 3D Secure can enhance the security of transactions.

5. Customer Support

Reliable customer support is vital when dealing with payment processing issues. Ensure that the payment gateway provider offers robust support options, including phone, email, and live chat.

Setting Up a Payment Gateway Link

1. Select a Payment Gateway Provider

Research various payment gateway providers and choose one that fits your business needs. Popular options include PayPal, Stripe, Razorpay, and Square.

2. Create an Account

After selecting a provider, proceed to create an account with them. You will need to provide information about your business, including banking details and verification documents.

3. Integrate the Gateway into Your Website

Follow the provider’s integration guide to set up the payment gateway link on your website. This could require the installation of a plugin or the insertion of code snippets.

4. Test the Payment Process

Before going live, conduct several test transactions to ensure everything functions correctly. This step is crucial to identify and rectify any issues before customers start making payments.

5. Go Live

Once you’ve confirmed that the payment gateway link is working correctly, you can officially launch it and start accepting payments from customers.

Conclusion

Linking payments seamlessly. is a vital component for businesses operating online. It not only ensures secure transactions but also enhances customer experience and drives sales. By understanding how payment gateway links work and their benefits, you can make informed decisions when selecting a provider. With the right linking payments seamlessly., your business can thrive in the competitive digital landscape, offering customers a seamless shopping experience while maintaining the highest security standards.

FAQs

Q1: What distinguishes a payment gateway from a payment processor?

A payment gateway is the technology that collects and encrypts payment data, while a payment processor is responsible for handling the transaction between the customer’s bank and the merchant’s bank.

Q2: Are payment gateway links safe for customers?

A: Yes, payment gateway links employ encryption and security protocols to protect sensitive information, making them safe for online transactions.

Q3: Can I use multiple payment gateway links on my site?

Yes, many businesses integrate multiple payment gateway links to offer customers various payment options, improving conversion rates.

Q4: How long does it take to set up a payment gateway link?

A: The setup duration can vary based on the provider and the complexity of your website, but it typically ranges from a few hours to a few days.

Q5: What are chargebacks, and how can they affect my business?

A: A chargeback occurs when a customer disputes a transaction and requests a refund through their bank. Frequent chargebacks can lead to penalties and increased fees from payment processors.