AUTHOR : EMILY PATHAK

DATE : 23 – 09 – 2023

In today’s fast-paced digital era, the way businesses operate has evolved significantly. With the increasing reliance on online platforms for both shopping and services, having a secure and efficient payment gateway is paramount. Mumbai, often considered the financial capital of India, is at the forefront of this digital transformation. In this article, we will delve into the world of payment gateways in Mumbai, exploring their significance, benefits, and also the top providers in the city.

Understanding the Basics

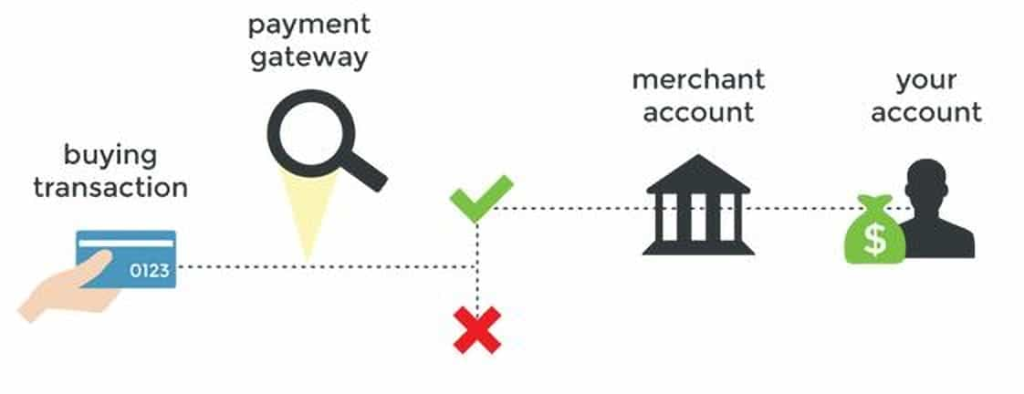

What is a Payment Gateway?

A payment gateway is essentially a technology that facilitates online transactions by acting as a bridge between the merchant’s website and the bank. It ensures that the customer’s payment information is encrypted and securely transmitted for processing.

Why are Payment Gateways Essential?

In an age where e-commerce and online payments[1] are the norm, payment gateways are vital for businesses. They enable smooth and also secure transactions, which, in turn, enhance customer trust and satisfaction.

The Significance of Payment Gateways in Mumbai

Mumbai, with its bustling commercial activities and also a thriving startup ecosystem, is a hub for businesses of all sizes. Here’s why payment gateways [2]are particularly significant in this dynamic city.

E-commerce Boom

Mumbai has witnessed a remarkable growth in e-commerce businesses.[3] Payment gateways play a pivotal role in ensuring that online shoppers can make hassle-free payments, leading to increased sales and also revenue.

Financial Hub

As the financial capital of India, Mumbai handles a substantial volume of financial transactions daily. Payment gateways [4]streamline these transactions, making them more efficient and also secure.

Diverse Customer Base

Mumbai’s diverse population means that businesses cater to customers from various backgrounds and preferences. Payment gateways offer a range of payment options, accommodating the needs of a varied clientele.

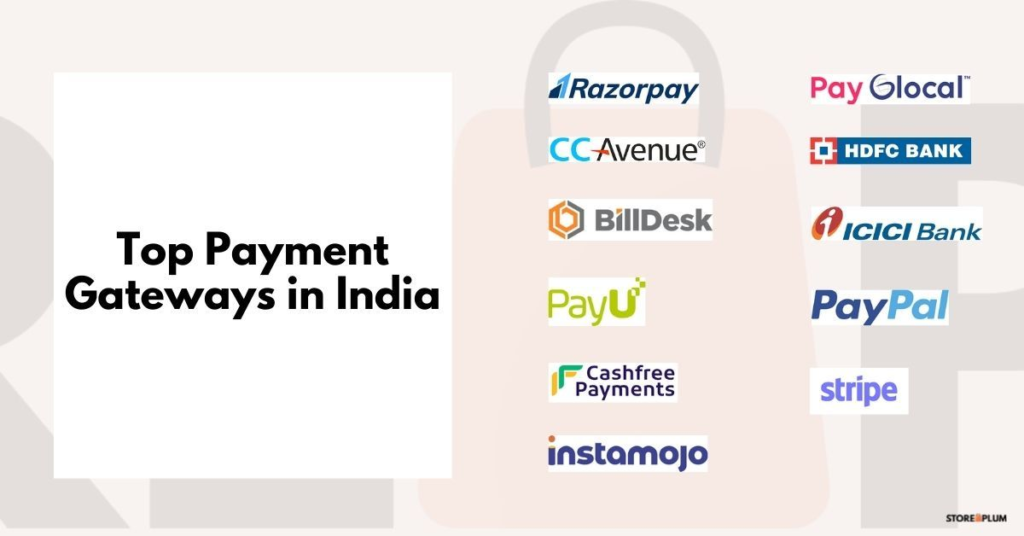

Top Payment Gateway Providers in Mumbai

Now that we understand the importance of payment gateways in Mumbai, let’s explore some of the top service providers in the city.

Razorpay

Razorpay is a popular choice among startups and established businesses alike. It offers a user-friendly interface, quick setup, and upports various payment methods.

PayU

PayU is known for its robust security features and also extensive payment options. It provides solutions for e-commerce, travel, and more.

Instamojo

Instamojo is an excellent choice for small businesses and freelancers. It offers simple integration and transparent pricing.

CCAvenue

CCAvenue is one of the oldest and most trusted payment gateway providers in Mumbai. It caters to a wide range of industries and also has a strong track record of reliability.

Ensuring Security in Payment Gateways

Security is a top concern when it comes to payment gateways. Businesses and also customers alike need assurance that their financial data is protected. Payment gateways in Mumbai employ the latest encryption and security protocols to ensure safe transactions.

The Future of Payment Gateways

As technology continues to advance, payment gateways in Mumbai are also evolving to meet the changing needs of businesses and consumers. Here are some trends shaping the future of payment gateways in the city:

1. Mobile Wallet Integration

With the increasing use of smartphones, mobile wallets like Paytm, Google Pay, and also PhonePe have gained immense popularity in Mumbai. Payment gateways are now integrating with these wallets to offer a seamless and also convenient payment experience.

2. Contactless Payments

The COVID-19 pandemic accelerated the adoption of contactless payments in Mumbai. Payment gateways are now equipped to handle NFC (Near Field Communication) payments, allowing customers to make payments by simply tapping their cards or phones.

3. Enhanced Security Measures

As cyber threats become more sophisticated, payment gateways are continually enhancing their security measures. Multi-factor authentication, biometrics, and AI-driven fraud detection are becoming standard features to protect customer data.

4. Global Expansion

Many Mumbai-based businesses are looking to expand globally. Payment gateways are facilitating international transactions by supporting multiple currencies and also offering competitive exchange rates.

Subscription Billing

Subscription-based services are on the rise in Mumbai, from streaming platforms to software-as-a-service (SaaS) companies. Payment gateways are adapting to handle recurring payments efficiently.

Choosing the Right Payment Gateway

Selecting the appropriate payment gateway for your Mumbai-based business is a critical decision. Here are some factors to consider:

Business Type

Your industry and also business model will influence your choice of payment gateway. For e-commerce, you’ll need a gateway that supports online transactions, while a brick-and-mortar store may require different features.

Security

Ensure that the payment gateway you choose offers robust security measures to protect both your business and also your customers’ data.

Integration

Consider the ease of integration with your website or mobile app. A smooth integration process can save you time and resources.

Transaction Fees

Review the pricing structure of the payment gateway. Understand the transaction fees, setup costs, and any additional charges.

Customer Support

Responsive customer support is crucial. In case of any issues or queries, you’ll want prompt assistance.

Top Payment Gateway Providers in Mumbai

Now that we understand the importance of payment gateways in Mumbai, let’s explore some of the top service providers in the city.

Razorpay

Razorpay is a popular choice among startups and established businesses alike. It offers a user-friendly interface, quick setup, and also supports various payment methods.

PayU

PayU is known for its robust security features and also extensive payment options. It provides solutions for e-commerce, travel, and more.

Instamojo

Instamojo is an excellent choice for small businesses and also freelancers. It offers simple integration and transparent pricing.

CCAvenue

CCAvenue is one of the oldest and most trusted payment gateway providers in Mumbai. It caters to a wide range of industries and has a strong track record of reliability.

Ensuring Security in Payment Gateways

Security is a top concern when it comes to payment gateways. Businesses and also customers alike need assurance that their financial data is protected. Payment gateways in Mumbai employ the latest encryption and security protocols to ensure safe transactions.

Conclusion

In a digitally-driven city like Mumbai, payment gateways are the backbone of online commerce. They not only make transactions seamless but also contribute to the overall growth of businesses. By choosing the right payment gateway provider, businesses in Mumbai can enhance customer trust and boost their bottom line.

FAQs

- Are payment gateways in Mumbai safe to use? Absolutely. Payment gateways in Mumbai prioritize security and use advanced encryption to protect your data.

- Can I use multiple payment gateways for my business in Mumbai? Yes, you can integrate multiple payment gateways to provide more options to your customers.

- What fees are associated with using payment gateways in Mumbai? Fees vary by provider and the type of transaction. It’s essential to review the pricing structure of your chosen payment gateway.

- Do payment gateways support international transactions in Mumbai? Yes, many payment gateways in Mumbai offer international transaction support, allowing businesses to cater to a global audience.

- How long does it take to set up a payment gateway for my Mumbai-based business? The setup time varies depending on the provider, but many offer quick and straightforward integration processes.

Get In Touch