AUTHOR : EMILY PATHAK

DATE : 27 – 09 – 2023

In the current rapid-paced digital terrain, electronic commerce has firmly integrated itself into our daily existence. Whether you’re a small business owner or a customer making online purchases, the concept of payment gateways is something you encounter regularly. Payment gateways assume an essential role in enabling secure and effortless online transactions. In this article, we will delve into the world of payment gateways, exploring their significance, working mechanism, key players, and the impact they have on global commerce.

Understanding Payment Gateways

What is a Payment Gateway?

A payment gateway is a technology based service that acts as an intermediary between an online merchant and also a customer, ensuring that financial transactions are secure and hassle-free. It plays a pivotal role in authorizing payments for e-commerce websites, ensuring that funds are transferred securely from the customer’s account to the merchant’s account.

How Does a Payment Gateway Work?

The process begins when a customer initiates a transaction on an e-commerce website. The payment gateway encrypts the customer’s payment information and sends it to the issuing bank for approval. Once approved, the funds are transferred to the merchant’s account, completing the transaction. Payment gateways also perform fraud detection checks to prevent unauthorized transactions.

The Global Landscape of Payment Gateways

A Worldwide Network

Payment gateways have expanded [1]their reach globally, enabling businesses to accept payments from customers around the world. This has paved the way for the globalization of e-commerce, breaking down geographical barriers.

Key Players in the Industry

Several payment gateway providers dominate the global market. Companies [2]like PayPal, Stripe, Square, and Braintree have established themselves as trusted partners for online businesses, offering a wide range of services to cater to diverse needs.

Advantages of Payment Gateways

Security and Trust

One of the primary advantages of payment gateways [3]is the level of security they provide. Customers can make purchases with confidence, knowing that their financial information is encrypted and protected from potential threats.

Convenience and Accessibility

Payment gateways offer convenience to both businesses and customers. They enable swift transactions, reducing the time and effort required to process payments. Moreover,[4] customers can choose from various payment options, including credit cards, debit cards, and digital wallets.

Challenges and Emerging Trends

Data Security Concerns

As payment gateways continue to evolve, so do the challenges. Data security remains a top concern, with cybercriminals constantly seeking ways to breach systems. Payment gateway providers must stay vigilant and invest in robust security measures.

Mobile Payment Solutions

With the rise of mobile devices, mobile payment solutions have gained prominence. Payment gateways are adapting to this trend, offering seamless mobile payment options to cater to the growing mobile-centric consumer base.

Payment Gateway Global Simplifying Transactions Worldwide

In the contemporary, swiftly evolving digital environment, electronic commerce has firmly entrenched itself as an indispensable component of our daily routines. Whether you’re a small business owner or a customer making online purchases, the concept of payment gateways is something you encounter regularly. Payment gateways play a crucial role in facilitating secure and seamless online transactions. In this article, we will delve into the world of payment gateways, exploring their significance, working mechanism, key players, and the impact they have on global commerce.

Understanding Payment Gateways

What is a Payment Gateway?

A payment gateway is a technology-based service that acts as an intermediary between an online merchant and a customer, ensuring that financial transactions are secure and hassle-free. It plays a pivotal role in authorizing payments for e-commerce websites, ensuring that funds are transferred securely from the customer’s account to the merchant’s account.

How Does a Payment Gateway Work?

The process begins when a customer initiates a transaction on an e-commerce website. The payment gateway encrypts the customer’s payment information and sends it to the issuing bank for approval. Once approved, the funds are transferred to the merchant’s account, completing the transaction. Payment gateways also perform fraud detection checks to prevent unauthorized transactions.

The Global Landscape of Payment Gateways

A Worldwide Network

Payment gateways have expanded their reach globally, enabling businesses to accept payments from customers around the world. This has paved the way for the globalization of e-commerce, breaking down geographical barriers.

Key Players in the Industry

Several payment gateway providers dominate the global market. Companies like PayPal, Stripe, Square, and Braintree have established themselves as trusted partners for online businesses, offering a wide range of services to cater to diverse needs.

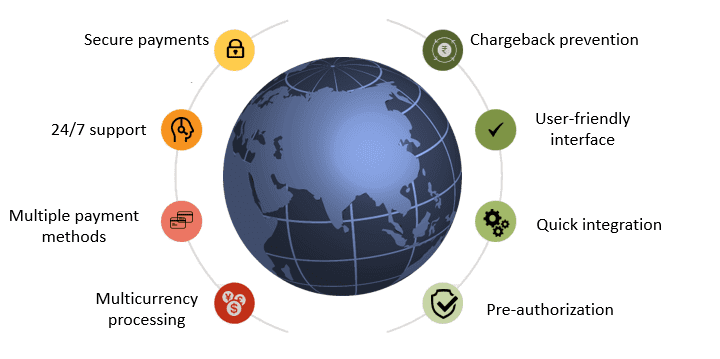

Advantages of Payment Gateways

Security and Trust

One of the primary advantages of payment gateways is the level of security they provide. Customers can make purchases with confidence, knowing that their financial information is encrypted and protected from potential threats.

Convenience and Accessibility

Payment gateways offer convenience to both businesses and customers. They enable swift transactions, reducing the time and effort required to process payments. Moreover, customers can choose from various payment options, including credit cards, debit cards, and digital wallets.

Challenges and Emerging Trends

Data Security Concerns

As payment gateways continue to evolve, so do the challenges. Data security remains a top concern, with cybercriminals constantly seeking ways to breach systems. Payment gateway providers must stay vigilant and invest in robust security measures.

Mobile Payment Solutions

With the rise of mobile devices, mobile payment solutions have gained prominence. Payment gateways are adapting to this trend, offering seamless mobile payment options to cater to the growing mobile-centric consumer base.

Emerging Trends in Payment Gateways

Cryptocurrency Integration

In recent years, cryptocurrency has gained popularity as a digital alternative to traditional currencies. Payment gateways are increasingly integrating cryptocurrencies like Bitcoin and Ethereum as payment options. This trend opens up new opportunities for businesses to tap into the growing crypto market, appealing to tech-savvy customers who prefer digital currencies.

Artificial Intelligence and Machine Learning

Payment gateways are leveraging the power of artificial intelligence (AI) and machine learning (ML) to enhance fraud detection and also customer experience. AI algorithms can analyze transaction patterns in real-time, identifying anomalies and potential fraud with greater accuracy. Additionally, ML algorithms can personalize the payment experience, offering tailored payment options to individual customers based on their preferences and behavior.

Support for Multiple Payment Methods

Different regions and also demographics prefer different payment methods. Payment gateways recognize this diversity and provide support for a wide range of payment options, such as credit cards, debit cards, bank transfers, and also digital wallets. This flexibility ensures that businesses can accommodate the payment preferences of their global customer base.

The Future of Payment Gateways

Seamless Integration with

As the Internet of Things (IoT) continues to grow, payment gateways are looking to seamlessly integrate with IoT devices. Imagine making payments directly from your smart refrigerator or wearable device. This integration not only enhances convenience but also opens up new avenues for connected commerce.

Enhanced Customer Authentication

To combat fraud and also enhance security, payment gateways are working on implementing stronger customer authentication methods. This includes biometric authentication like fingerprint recognition and facial recognition, ensuring that only authorized individuals can make transactions.

Conclusion

In the digital age, payment gateways have revolutionized the way we conduct online transactions. They have not only simplified the payment process but have also enhanced security and also accessibility. As the e-commerce landscape continues to evolve, payment gateways will play a pivotal role in shaping the future of global commerce.

Frequently Asked Questions (FAQs)

- Are payment gateways safe to use for online transactions?

- Yes, payment gateways employ advanced encryption and also security measures to ensure the safety of online transactions.

- What are some popular payment gateway providers for small businesses?

- Popular payment gateway providers for small businesses include PayPal, Stripe, and also Square.

- Can payment gateways process international transactions?

- Yes, many payment gateways support international transactions, allowing businesses to cater to a global audience.

- Are mobile payment solutions secure?

- Mobile payment solutions are designed with security in mind, using technologies like tokenization to protect user data.

- How can businesses choose the right payment gateway for their needs?

- Businesses should consider factors like transaction fees, compatibility with their e-commerce platform, and the range of payment options offered when choosing a payment gateway.

Get In Touch