AUTHOR : EMILY PATHAK

DATE : 30 – 09 – 2023

In today’s digital age, where e-commerce[1] is thriving and online transactions are becoming the norm, website developers[2] play a crucial role in ensuring seamless payment experiences for businesses and consumers. Creating a user-friendly, secure, and also efficient payment gateway[3] is a paramount concern for developers. In this article, we will delve into the world of payment gateways for website developers,[4] exploring what they are, how they work, and the key considerations to keep in mind when implementing one.

Payment Gateway Types

Hosted Payment Gateways

Hosted payment gateways guide users to a protected payment page that is hosted by an external service provider. This type of gateway[5] is easy to implement and also reduces the merchant’s PCI compliance requirements. However, it can sometimes lead to a less integrated user experience.

Integrated Payment Gateways

Integrated payment gateways allow customers[1] to complete transactions without leaving the merchant’s website. While they offer a seamless user experience, they require more development effort and compliance with stringent security standards.

Payment Gateway Providers

When developing a payment gateway, developers[2] must choose a reliable payment gateway provider. Among the well-favored options are:

- Stripe : Known for its developer-friendly tools and also robust security features, Stripe is a preferred choice for many developers. It supports various payment methods and also offers a range of customization options.

- PayPal : PayPal is a household name in online payments[3]. Integrating PayPal as a payment gateway allows businesses to accept payments from customers with PayPal accounts or credit/debit cards.

- Square : Square provides payment processing solutions that are especially popular among small businesses. It offers a range of APIs for developers to create custom payment experiences.

- Authorize.Net : Authorize.Net is known for its reliability and extensive features. It supports a wide range of payment methods and is well-suited for e-commerce businesses.

Payment Gateway Testing and Optimization

Test Transactions

Before launching a website with a payment gateway, thorough testing is essential. Developers should conduct test transactions to ensure that all payment processes[4], from initiation to confirmation, work flawlessly.

Performance Optimization

Optimizing the payment gateway’s performance is critical for a smooth user experience. Minimize load times, optimize code, and ensure that the gateway can handle high traffic loads during peak periods.

A/B Testing

A/B testing can help developers fine-tune the payment process. By comparing different versions of the payment gateway, developers can identify which elements lead to higher conversion rates and better user satisfaction.

Legal and Compliance Aspects

PCI DSS Compliance

Payment Card Industry Data Security Standard (PCI DSS) compliance is non-negotiable. Developers must ensure that their payment gateway adheres to these standards to protect customer data.

Privacy Regulations

Developers should also consider data protection regulations, such as GDPR or CCPA, depending on their target audience. Compliance with these regulations is essential to avoid legal issues.

Understanding Payment Gateways

What is a Payment Gateway?

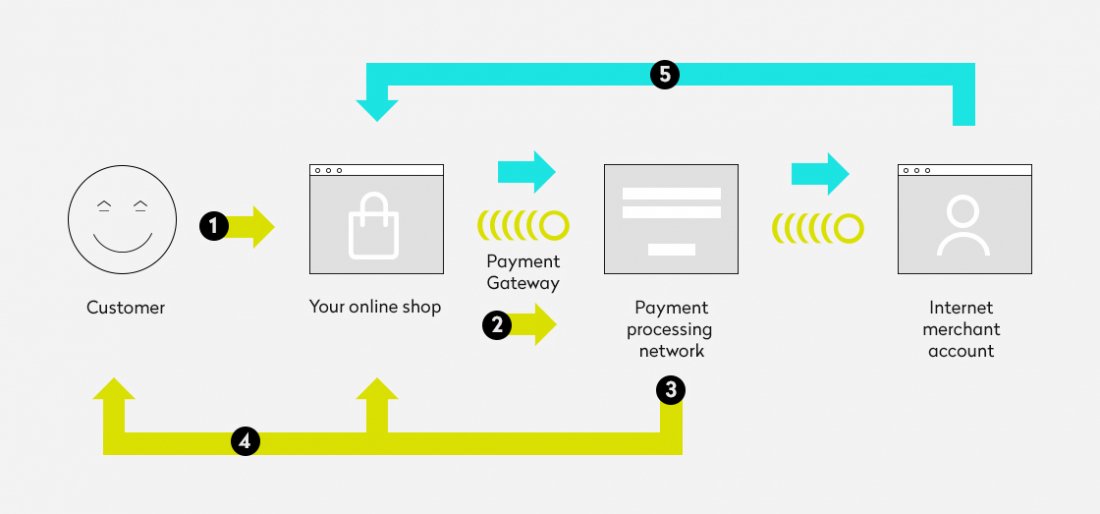

A payment gateway is a technology that facilitates the transfer of funds from a customer to a merchant when making online purchases. It acts as an intermediary that securely processes credit card transactions and ensures that sensitive financial data is kept safe.

How Does It Work?

- Customer Initiation : When a customer makes a purchase on a website, they are directed to the payment gateway.

- Encryption : The gateway encrypts the customer’s payment information to protect it from unauthorized access.

- Authorization : The payment gateway sends the encrypted data to the payment processor for authorization.

- Transaction Approval : Once approved, the payment processor sends a confirmation back to the gateway.

- Transaction Completion : The gateway informs the customer and merchant of the successful transaction.

Importance of Payment Gateways for Websites

Building Trust

In the digital landscape, trust is paramount. An efficient payment gateway instills confidence in customers, assuring them that their financial data is secure. This trust factor can significantly impact a website’s conversion rates.

Expanding Market Reach

A well-implemented payment gateway allows businesses to reach a global audience. It enables them to accept payments from various credit cards and even digital wallets, accommodating a wide range of customers.

Reducing Cart Abandonment

A cumbersome or unreliable payment process can lead to cart abandonment, where customers abandon their shopping carts before completing a purchase. An intuitive payment gateway can help reduce this problem and increase sales.

Key Considerations for Website Developers

Security Measures

Security should always be a top priority when developing a payment gateway. Employ encryption protocols, PCI DSS compliance, and robust authentication mechanisms to protect sensitive data.

User-Friendly Interface

A user-friendly interface is essential for both customers and merchants. Ensure that the payment process is straightforward, with clear instructions and error messages.

Mobile Optimization

With the rise of mobile shopping, it’s crucial to optimize the payment gateway for mobile devices. Responsive design and mobile-friendly features are a must.

Integration Options

Website developers should consider the ease of integration with various e-commerce platforms. Compatibility with popular content management systems like WordPress and Shopify can save time and effort.

Conclusion

In conclusion, payment gateways are the backbone of online transactions, and website developers play a pivotal role in creating seamless and secure payment experiences. By prioritizing security, user-friendliness, mobile optimization, and integration options, developers can ensure that businesses thrive in the digital marketplace.

For any inquiries or assistance in setting up a payment gateway for your website, feel free to contact us.

FAQs

1. What is the role of a payment gateway in e-commerce?

A payment gateway facilitates the secure transfer of funds from customers to merchants when making online purchases.

2. Guaranteeing the security of your payment gateway is paramount.

To ensure security, use encryption protocols, comply with PCI DSS standards, and implement strong authentication measures.

3. Why is a user-friendly interface important for a payment gateway?

A user-friendly interface enhances the customer experience and reduces the likelihood of cart abandonment.

4. Is mobile optimization necessary for a payment gateway?

Yes, with the increasing use of mobile devices for online shopping, mobile optimization is crucial for a payment gateway.

5. Can a payment gateway be integrated with popular e-commerce platforms?

Yes, payment gateways can be integrated with popular e-commerce platforms like WordPress and Shopify for seamless transactions.