AUTHOR : SAYYED NUZAT

DATE : 26-10-2023

In today’s fast-paced digital age, mobile applications have become an integral part of our lives. They offer convenience, efficiency, and accessibility, allowing us to perform a multitude of tasks at our fingertips. Mobile apps have revolutionized how we make payments, shop, and also conduct business transactions. In India, a crucial aspect of this digital transformation is the payment gateway for mobile apps. This article delves into the world of payment gateways, their significance, and their role in facilitating seamless financial transactions in the Indian mobile app ecosystem.

Introduction

Mobile apps have taken India by storm, simplifying various aspects of our daily lives. From ordering food to booking cabs and also shopping online, mobile apps have made transactions more convenient. However, the backbone of these transactions is the payment gateway, which ensures the security and smooth flow of funds.

The Rise of Mobile Apps in India

India’s mobile app ecosystem has witnessed exponential growth in recent years. With affordable smartphones and widespread internet access, millions of Indians have embraced mobile apps for various services, from banking and also e-commerce[1] to entertainment and healthcare.

Understanding Payment Gateways

A payment gateway is a technology[2] that facilitates transactions between a mobile app[3] and a bank. It ensures that sensitive financial information is securely transferred between the user, the app, and the bank.

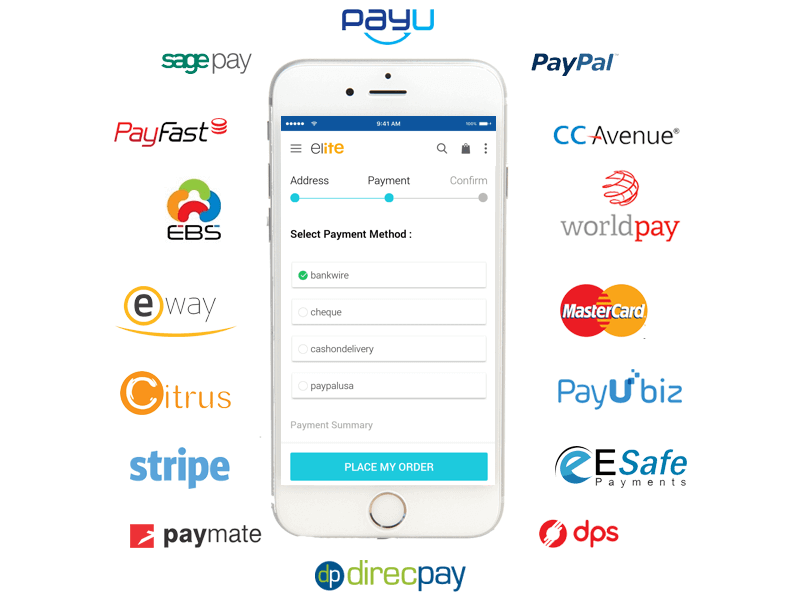

Key Players in the Indian Payment Gateway Market

The Indian payment gateway market is competitive, with several major players vying for dominance. Companies like Razorpay, PayU[4], and CCAvenue have made significant strides in simplifying digital payments.

How Payment Gateways Work

Payment gateways work seamlessly to provide users with a hassle-free payment experience[5]. When a user makes a transaction, the payment gateway encrypts and securely transmits the data to the bank. Once the bank approves the transaction, the payment gateway sends a confirmation to the app and the user.

Benefits of Using Payment Gateways in Mobile Apps

The integration of payment gateways in mobile apps offers numerous advantages, including enhanced security, faster transactions, and a wide range of payment options.

Challenges and Security Concerns

While payment gateways have revolutionized digital transactions, they also face challenges and security concerns. This section explores these issues in detail.

Regulations and Compliance

Payment gateways must adhere to strict regulations and compliance standards set by the Reserve Bank of India (RBI) to ensure the safety and security of users’ financial data.

Popular Payment Gateways in India

India boasts a variety of payment gateways, each with unique features and offerings. We’ll take a closer look at some of the most popular ones.

Factors to Consider When Choosing a Payment Gateway

For businesses and app developers, selecting the right payment gateway is crucial. This section provides insights into the key factors to consider.

Integration of Payment Gateways in Mobile Apps

The seamless integration of payment gateways in mobile apps is essential for a user-friendly experience. Learn how to incorporate payment gateways effectively.

User Experience and Mobile Payments

A smooth and efficient payment process significantly impacts user experience. We’ll discuss the importance of an intuitive payment interface.

Future Trends in Mobile Payment Gateways

The world of payment gateways is constantly evolving. Discover the future trends that will shape the industry.

The Role of UPI and Digital Wallets

UPI (Unified Payments Interface): UPI is a real-time payment system developed by the National Payments Corporation of India (NPCI). It allows users to link their bank accounts to a mobile application and make seamless peer-to-peer (P2P) transactions. UPI has gained immense popularity due to its simplicity and convenience. Users can send money, pay bills, and make online purchases with just a few taps on their mobile phones.

Digital Wallets: Digital wallets, also known as e-wallets, are virtual repositories for users’ money. These wallets can be loaded with funds from a bank account, debit card, or credit card, and the balance can then be used for various transactions. Popular digital wallets in India include Paytm, PhonePe, and Google Pay. They offer a wide range of services, from recharging mobile phones to booking tickets and even investing in mutual funds.

Conclusion

Payment gateways for mobile apps in India have revolutionized the way we transact in the digital landscape. As technology continues to advance, the role of payment gateways is expected to become even more significant. Embracing these technologies is key to the success of businesses and the convenience of users.

Frequently Asked Questions (FAQs)

- What is a payment gateway, and how does it work in mobile apps?A payment gateway is a technology that facilitates secure financial transactions in mobile apps by encrypting and transmitting data between the user, the app, and the bank.

- Which payment gateways are popular in India?Some of the popular payment gateways in India include Razorpay, PayU, and CCAvenue.

- What are the key challenges faced by payment gateways in India?Payment gateways in India face challenges related to security, compliance, and the ever-evolving landscape of digital transactions.

- How can businesses choose the right payment gateway for their mobile apps?Businesses should consider factors such as security, transaction speed, user experience, and compliance when selecting a payment gateway.

- What role do UPI and digital wallets play in mobile payments in India?UPI and digital wallets have played a pivotal role in simplifying and popularizing digital payments in India, offering users convenience and versatility.