AUTHOR : HANIYA SMITH

DATE : 25/09/2023

In the world of commerce, businesses come in all shapes and sizes. From the local mom-and-pop store to the multinational conglomerate, there’s a diverse range of enterprises out there. However, not all businesses are created equal, and some find themselves in a category known as “high risk.” These businesses often face unique challenges, particularly when it comes to payment processing. In this article, we will delve into the world of high risk businesses and explore the crucial role of payment gateways tailored to their specific needs.

Understanding High Risk Businesses

What Defines a High Risk Business?

- Industry: Certain industries, such as adult entertainment, online gambling, and pharmaceuticals, are inherently riskier.

- Chargeback Rates: A high number of chargebacks can flag a business as high risk, as it indicates customer dissatisfaction or potential fraud.

- Credit History: Poor personal or business credit histories can also push a business into the high risk category.

- International Operations: Businesses that operate internationally face additional risks, such as currency fluctuations and regulatory complexities.

The Significance of a High-Risk Payment Gateway

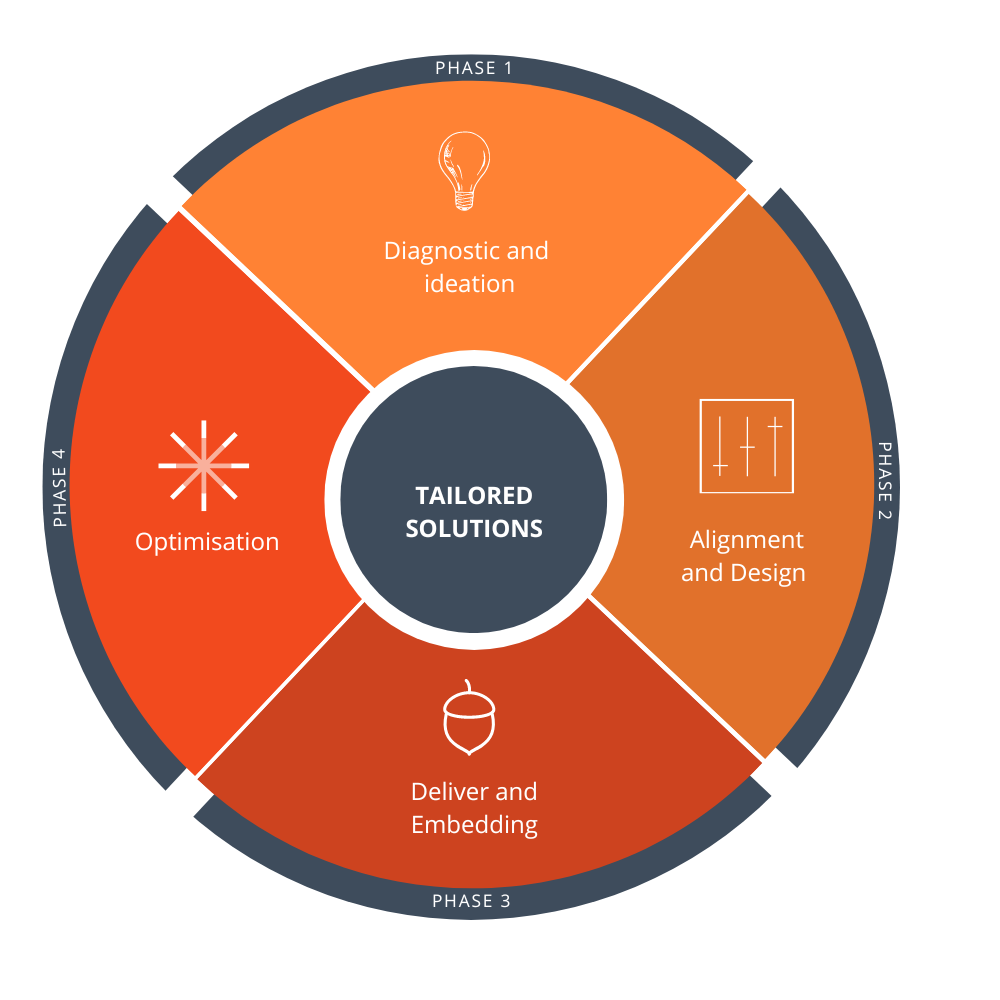

Tailored Solutions

High risk businesses need payment processing solutions that are tailored to their unique circumstances. This is the point at which high-risk payment gateways step into the picture.

Customized Risk Assessment

Unlike standard payment processors, high risk payment gateways understand the specific risks associated[1] with these businesses. They employ customized risk assessment tools that take into account industry-specific challenges and fluctuations.

Fraud Prevention

High risk payment gateways incorporate advanced fraud prevention measures to protect both the business and the customer. These include real-time monitoring, machine learning algorithms, and stringent authentication protocols.

Regulatory Compliance

Operating in high risk industries often means navigating a complex web of regulations. A reliable high risk payment gateway will help businesses stay compliant with local and international laws, reducing the risk of legal complications.

Choosing the Right High Risk Payment Gateway

Factors to Consider

Selecting the right payment gateway is crucial for the success and security of a high risk business. [2]Consider these key elements as you navigate your decision:

Reputation and Reliability

Look for payment gateways with a proven track record in serving high risk industries. Check for client testimonials and industry reviews to gauge their reputation.

Security Features

Ensure the payment gateway offers robust security features, including encryption, tokenization, and secure data storage. The safety of customer data is paramount.

Pricing Structure

Compare pricing structures and fees among different high risk payment gateways. Pay attention to any hidden costs that could impact your bottom line.

Integration Options

Consider the ease of integration with your existing systems, such as your website or point-of-sale system. A seamless integration can save time and also reduce technical headaches.

The Advantages of High Risk Payment Gateways

Expanded Market Access

One of the primary advantages of using a high risk payment gateway is the ability to access a broader customer base. High risk businesses often operate in niche markets or offer unique products and also services. Without a suitable payment gateway, these businesses risk losing out on potential customers who may prefer alternative payment methods or are located in different parts of the world.

Reduced Risk of Payment Failures

High risk payment gateways are equipped with advanced technology and also security measures to reduce the risk of payment failures. This includes robust fraud detection systems that can identify suspicious transactions in real-time, reducing the chances of financial losses due to fraudulent activities.

Enhanced Customer Trust

In the world of e-commerce, customer trust is invaluable. High risk payment gateways[3] prioritize data security and compliance with industry regulations. When customers see that a business is using a reputable high risk payment gateway, it instills confidence and also reassures them that their financial information is safe, which can lead to increased sales and customer loyalty.

Common Industries That Benefit from High Risk Payment Gateways

Online Gambling and Gaming

The online gambling and also gaming industry is notorious for its high risk nature. With fluctuating regulations and a potentially volatile customer base, businesses in this sector rely heavily on specialized payment gateways to manage transactions securely and efficiently.

Adult Entertainment

The adult entertainment industry, which includes websites, streaming services, and also subscription-based content, faces unique challenges in processing payments. High risk payment gateways are tailored to handle the discreet and sensitive nature of these transactions.

Cryptocurrency and Forex Trading

The world of cryptocurrency and forex trading operates 24/7 on a global scale. High risk payment gateways enable traders to execute transactions swiftly and securely, considering the rapid market fluctuations and also international nature of these industries.

Conclusion

In the world of commerce, high risk businesses[4] face unique challenges, particularly when it comes to payment processing. However, with the right high risk payment gateway, these businesses can navigate these challenges effectively while ensuring the security of their transactions. When choosing a payment gateway, prioritize reputation, security, pricing, and also integration options to make an informed decision.

FAQs

1. Can a high risk business ever become a low risk one?

While it’s challenging, it’s not impossible. Improving credit history, reducing chargebacks, and maintaining compliance can help a high risk business eventually transition to a lower risk category.

2. Are high risk payment gateways more expensive?

High risk payment gateways may have slightly higher fees due to the added risk they take on. However, the cost is typically justified by the specialized services and also added security they provide.

3. What’s the difference between a payment gateway and a merchant account?

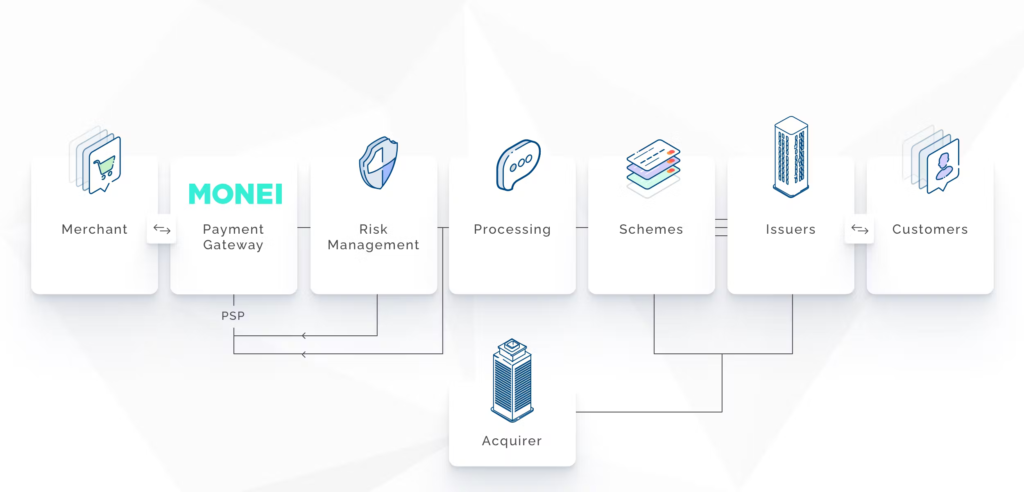

A payment gateway facilitates the transfer of transaction data between a business’s website and also the payment processor. A merchant account is a specific type of bank account that allows a business to accept payments.

Get In Touch