AUTHOR : MICKEY JORDAN

DATE : 12/12/2023

In the age of digital transformation, mobile applications have become an integral part of businesses. Whether it’s for e-commerce, subscriptions, or service-based platforms, payment gateway[1] for applications has become a must-have feature to ensure smooth, secure, and efficient transactions. This guide explores everything you need to know about payment gateway for applications[2], including its functions, benefits, integration, and frequently asked questions.

What is a Payment Gateway for Applications?

A payment gateway for applications is a technology that enables mobile apps to securely process online payments[3]. This tool acts as a bridge between a mobile application, the customer, and the payment processor (such as a bank or financial institution). When a user makes a purchase within the app, the payment gateway securely handles the transaction by encrypting the payment data and verifying the payment method[4]. Once the transaction is authorized, the payment gateway processes[5] the payment and transfers the funds to the merchant’s account.

Importance of Payment Gateways for Applications

In today’s fast-paced world, users expect a seamless and secure payment experience while using mobile apps. A well-integrated payment gateway for applications ensures smooth transactions, building customer trust and satisfaction. Whether you’re offering products, services, or subscriptions, having a reliable payment gateway is essential for business success.

Key Features of an Ideal Payment Gateway for Applications

When selecting a payment gateway for an certain features are non-negotiable. Security measures, such as encryption protocols and fraud prevention, are paramount. Payment Gateway for Applications Additionally, the gateway should offer robust integration capabilities, allowing for a smooth connection between the application and various methods. Customization options, tailored to the specific needs of the application, further enhance the user experience.

Popular Payment Gateway Options

Several payment gateways dominate the market, each with its unique features and advantages. From industry giants like PayPal and Stripe to specialized gateways, understanding the comparative analysis of these options is crucial. Factors such as transaction fees, supported payment methods, and global reach should guide the choice based on the application’s requirements.

Choosing the Right Payment Gateway for Your Application

Selecting a requires a thorough evaluation of the nature, size, and target audience. Consideration of cost factors, including transaction fees and subscription models, is essential. A careful analysis of the fee structure in relation to the expected transaction volume ensures a sustainable and cost-effective solution for the long term.

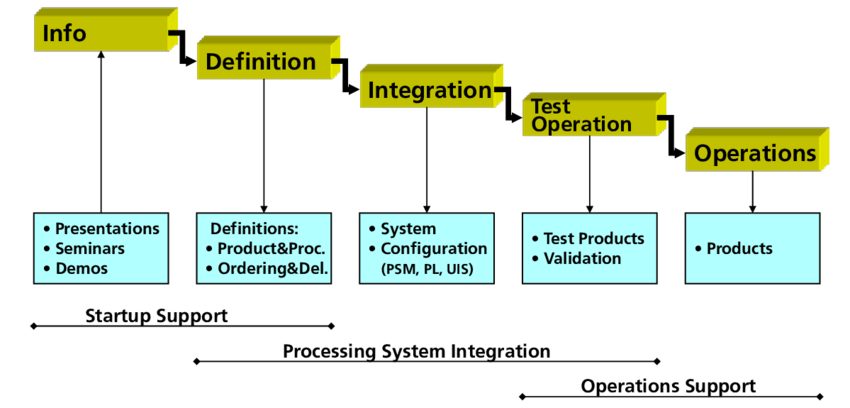

Integration Process

Integrating a payment gateway may seem daunting, but a step-by-step guide can simplify the process. From creating accounts to API integration, understanding the intricacies involved ensures a smooth implementation. Common challenges, such as compatibility issues and debugging, can be addressed with proactive problem-solving strategies.

Ensuring Security in Transactions

Security is paramount in online transactions, and a reliable payment gateway must prioritize data protection. The importance of SSL certification and encryption cannot be overstated. Users must feel confident that their financial information is safe, fostering trust in the application and the payment process.

User-Friendly Interfaces

A seamless user experience is integral to the success of any application. The payment gateway’s interface should be intuitive and user-friendly, guiding users through the transaction process effortlessly. Design considerations, such as a responsive layout and clear instructions, contribute to a positive user experience.

Mobile Payment Solutions

With the increasing prevalence of mobile usage, payment gateways must adapt to this trend. Integrating mobile-friendly solutions ensures a broader reach and convenience for users. Applications that prioritize mobile payments cater to the evolving preferences of consumers, fostering increased engagement and satisfaction.

Keeping Up with Technological Advances

Staying ahead in the digital landscape requires an understanding of emerging technologies. From blockchain to artificial intelligence, payment gateways should evolve to incorporate these innovations. Future-proofing your chosen gateway ensures its relevance and effectiveness as technology continues to advance.

Customer Support and Reliability

Reliable customer support is a landscape of a successful payment gateway. Real-world examples of exceptional customer support experiences the importance of prompt and effective assistance. The reliability of the gateway directly impacts the reputation and user trust.

Regulatory Compliance

Navigating the legal landscape is crucial when dealing with financial transactions. Paymentmust adhere to industry standards and comply with relevant regulations. Understanding the legal requirements and regulatory compliance the application from legal complications.

Mistakes in selecting and implementing payment gateways can have detrimental effects. Identifying common pitfalls, such as inadequate security measures or choosing a gateway for the application’s needs, allows for proactive measures to prevent these issues.

Conclusion

Incorporating a payment gateway for applications is essential for businesses looking to provide a secure and seamless payment experience to their customers. From increased sales and improved user experience to better security and fraud prevention, the benefits are vast. By understanding how these gateways work and choosing the right one for your business, you can ensure that your mobile application provides a smooth, reliable, and secure payment system for users.

FAQs

- What factors should I consider when choosing a payment gateway for my application?

- Consider the nature of your business, transaction volume, security features, and cost factors.

- How can I ensure the security of transactions through my application’s payment gateway?

- Prioritize gateways with SSL certification, encryption protocols, and robust fraud prevention measures.

- What role does customer support play in the effectiveness of a payment gateway?

- Reliable customer support is crucial for addressing issues promptly and maintaining user trust.

- Are there specific mobile payment solutions that work best for applications?

- Choose mobile-friendly gateways that align with the preferences and behaviors of your target audience.

- What steps can I take to future-proof my chosen payment gateway for emerging technologies?

- Stay informed about technological advances and choose gateways that are adaptable to new innovations.

Get In Touch