AUTHOR : ADINA XAVIER

DATE : 26/09/2023

In today’s digital age, where online transactions have become the norm, payment gateways play a pivotal role in facilitating secure and efficient financial transactions. Whether you’re running an e-commerce business or providing online services, comprehending payment gateway fees in India is essential for managing your financial operations effectively. In this article, we’ll delve into the intricacies of payment gateway fees, breaking down the various components also helping you make informed decisions for your business.

Introduction

Payment gateway fees in India have a significant impact on businesses, especially those operating in the digital realm. As consumers increasingly prefer online payment methods, understanding the costs associated with payment gateways becomes paramount. This article aims to demystify payment gateway fees, providing you with the knowledge needed to navigate this financial landscape confidently.

What Is a Payment Gateway?

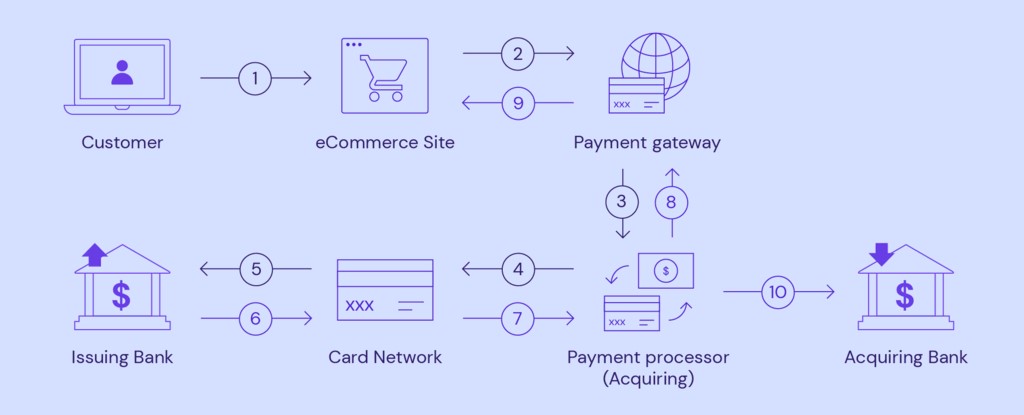

A payment gateway is a technology that facilitates the transfer of funds from a customer’s bank account to the merchant’s account. It acts as a bridge between the customer, the merchant, and the bank, ensuring that transactions are secure and smooth.

The Importance of Payment Gateways

Payment gateways[1] are the backbone of online transactions. They offer several crucial advantages, including

- Security: Payment gateways employ advanced encryption also security protocols to protect sensitive customer data.

- Convenience: They enable customers to make payments from anywhere, at any time.

- Global Reach: Businesses can cater to customers worldwide by accepting various payment methods.

- Efficiency: Transactions are processed swiftly, reducing the risk of cart abandonment.

Common Payment Gateway Providers in India

In India, several payment gateway providers offer their services to businesses. Some of the prominent names include:

- Paytm Payment Gateway

- Razorpay

- CC Avenue

- Instamojo

- PayU India

Each of these providers comes with its unique fee structure, making it essential to compare them before making a choice.

Types of Payment Gateway Fees

Setup Fees

Setup fees are one-time charges associated with the initial setup of a payment gateway. They vary from one provider to another, and some may even offer a waiver for small businesses or startups.

Transaction Fees

Transaction fees[2] are charges incurred for each successful transaction processed through the gateway. These charges may manifest as a set sum or a proportion of the transaction’s total value.

Annual Maintenance Fees

To maintain the functionality and security of the payment gateway, providers may charge an annual maintenance fee. This fee ensures that your payment gateway stays up to date with the latest security standards.

Currency Conversion Fees

If your business deals with international customers, you may encounter currency conversion fees. These fees apply when a transaction involves currency exchange.

Factors Affecting Payment Gateway Fees India

Several factors can influence the fees associated with payment gateways:

- Transaction Volume: High transaction volumes may lead to reduced transaction fees.

- Business Type: The nature of your business can affect the fees, with some providers catering to specific industries.

- International Transactions: Dealing with international customers[3] may result in additional fees.

- Customization: Tailoring the payment gateway to your specific needs can impact setup fees.

Comparing Payment Gateway Providers

When selecting a payment gateway, it’s crucial to compare providers based on your business requirements, transaction volumes, and budget constraints. Look beyond the fees and consider factors like security, customer support, also integration options.

How to Reduce Payment Gateway Costs

To minimize payment gateway expenses, consider the following strategies:

- Negotiate Fees: Some providers may be open to negotiation, especially for high-volume businesses.

- Optimize Payment Flows: Streamline your payment processes to reduce the number of transactions.

- Monitor Transactions: Keep an eye on your transactions to identify and address any irregularities.

Security Concerns and Compliance

Ensuring the security of customer data is paramount. Choose a payment gateway provider that complies with the Payment Card Industry Data Security Standard (PCI DSS) to safeguard sensitive information.

Tips for Choosing the Right Payment Gateway

- Assess your business needs and volume of transactions.

- Compare fees and additional charges.

- Prioritize security and compliance.

- Consider integration options with your website or platform.

- Seek recommendations and read user reviews.

Case Studies: Real-World Examples

Explore real-world case studies of businesses that have successfully optimized their payment gateway[4] usage to cut costs also boost efficiency.

The Future of Payment Gateway Fees

As technology evolves and consumer preferences change, payment gateway fees are likely to undergo transformations. Stay updated with industry trends to adapt your payment strategy accordingly.

Conclusion

Payment gateway fees in India are an integral part of online business operations. By understanding the different types of fees, factors affecting costs, also strategies for optimization, you can make informed decisions for your business. Remember that the right payment gateway can not only enhance the customer experience but also contribute to your bottom line.

Frequently Asked Questions (FAQs)

1. Are there any hidden fees associated with payment gateways? No, reputable payment gateway providers are transparent about their fees. However, it’s essential to read the terms and conditions carefully to avoid any surprises.

2. Is it feasible to employ several payment gateways to facilitate my business operations? Yes, you can integrate multiple payment gateways[5], but it’s crucial to assess whether it aligns with your business needs and budget.

3. How can I ensure the security of customer data during transactions? Choose a payment gateway provider that complies with PCI DSS and follows strict security protocols.

4. What should I do if I face technical issues with my payment gateway? Contact the provider’s customer support immediately to resolve any technical glitches.

5. Is it possible to change payment gateway providers after initially setting up one? Yes, it’s possible to switch providers, but it may involve some technical adjustments. Evaluate your reasons for switching carefully.

Get In Touch