AUTHOR : HANIYA SMITH

DATE : 25/10/2023

In the digital age, where convenience is king, having a reliable and efficient payment gateway is vital for businesses of all sizes. In Denmark, a country known for its rich history and innovative spirit, the need for seamless payment processing has never been more important. This article explores the world of payment gateways in Denmark, delving into the landscape, benefits, challenges, and also how businesses can thrive by embracing these digital payment solutions.

Introduction

In the modern business landscape, the ability to process payments efficiently and securely is crucial. Denmark, with its tech-savvy population and also strong e-commerce presence, is no exception. Payment gateways act as the bridge between online businesses and their customers, ensuring smooth transactions while safeguarding sensitive financial information.

The Significance of Payment Gateways

Payment gateways are like digital cashiers for your online store. They facilitate transactions by encrypting and transmitting payment data between the customer, the merchant, and the financial institutions. This process ensures that payments are processed securely, reducing the risk of fraud and also providing peace of mind to both buyers and sellers.

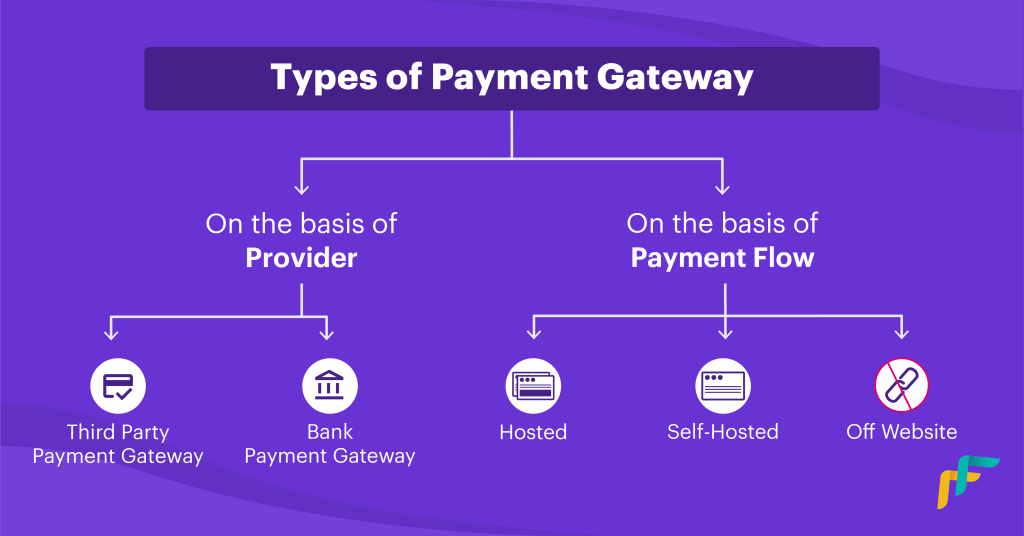

Types of Payment Gateways

Hosted Payment Gateways

Hosted payment gateways redirect customers to a secure payment page managed by a third-party provider. This method is user-friendly and also often preferred by small businesses.

Self-Hosted Payment Gateways

Self-hosted gateways allow businesses to have more control over the payment process. This flexibility is beneficial for larger enterprises looking to customize their payment flow.

Why Denmark Needs Payment Gateways

As Denmark increasingly embraces online shopping, the need for efficient and also secure payment gateways becomes evident. The convenience of online transactions has pushed businesses to adapt, and payment gateways are the key to this transformation.

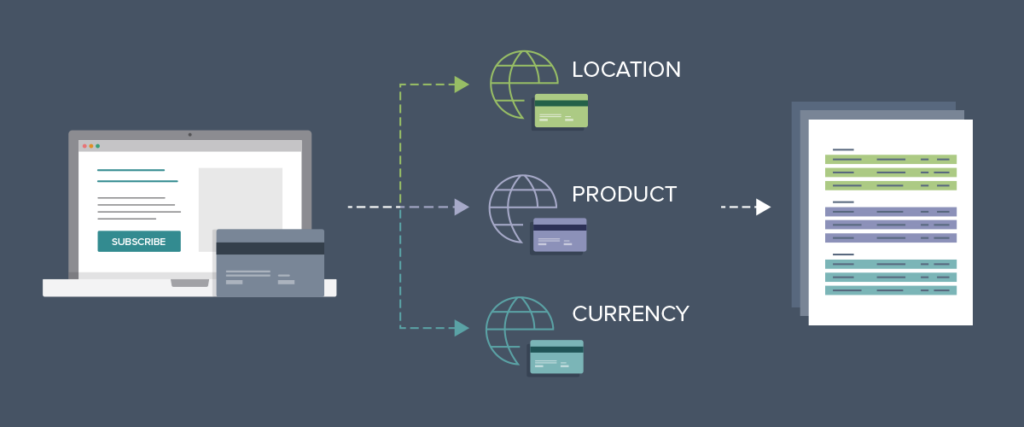

The Advantages of Using Payment Gateways

- Global Reach: Payment gateways enable businesses to accept payments from customers worldwide, breaking down geographical barriers.

- Faster Transactions: With a few clicks, payments can be processed, making the checkout process quick and seamless also.

- Enhanced Security: Robust encryption and also fraud prevention tools keep sensitive information safe.

- Reduced Cart Abandonment also : A user-friendly payment experience minimizes cart abandonment rates.

Security Concerns

Despite the convenience they offer, payment gateways raise concerns about security. To address this, it’s essential to choose a reliable provider with strong security measures in place. Always prioritize the safety of your customers’ data.

Choosing the Right Payment Gateway

Selecting the right payment gateway can be a game-changer for your business. Factors to consider include transaction fees, ease of integration, and the provider’s reputation for security and also support.

Popular Payment Gateways in Denmark

Denmark boasts a variety of payment gateways to choose from. Let’s take a closer look at some of the highly favored choices.”

MobilePay

MobilePay is a mobile payment system that has gained immense popularity in Denmark. [1]It allows users to make payments using just their mobile numbers, making it incredibly convenient.

Nets Easy

Nets Easy offers a seamless payment experience with a strong focus on security. It supports various payment methods, including credit cards and also online bank transfers.

Setting Up a Payment Gateway

The process of setting up a payment gateway can vary depending on the provider and also your specific needs. However, it generally involves creating an account, configuring your payment settings, and integrating the gateway into your website or app.[2]

Integration and Compatibility also

For a smooth user experience, it’s crucial to ensure that your chosen payment gateway is compatible with your e-commerce platform or website. Integration should be seamless to avoid technical hiccups.

Mobile-Friendly Solutions

Given the increasing use of mobile devices for online shopping, having a mobile-friendly payment gateway is a must. Mobile optimization ensures a consistent experience for all customers.

The Role of Payment Gateways in E-commerce

E-commerce continues to grow in Denmark, and also payment gateways play a significant role in this expansion. They enable online businesses to thrive by providing the tools necessary to accept payments and manage transactions.

Future Trends and Innovations also

The payment gateway landscape is continually evolving. Emerging technologies,[3] such as blockchain and also biometric authentication, are likely to shape the future of payment processing in Denmark.

Mobile-Friendly Solutions

The mobile revolution is in full swing, and also Denmark is no exception. To cater to the growing number of mobile shoppers, it’s vital to choose a payment gateway that offers a seamless mobile experience. Responsive design and optimized mobile payment processes are vital.

Benefits of Payment Gateways in Denmark

1. Global Expansion

Payment gateways open the doors for Danish businesses to expand also globally. By accepting international payments, businesses can cater to a wider customer base.

2. Streamlined Checkout

The convenience of payment gateways leads to a streamlined and also hassle-free checkout process. This, in turn, reduces cart abandonment rates, a common issue in the e-commerce industry.

3. Enhanced Security

Security is a top priority for Danish consumers. Payment gateways come equipped with robust encryption and anti-fraud measures, which provide peace of mind to both businesses and also customers.

Conclusion

Payment gateways [4]are the unsung heroes of online transactions, ensuring that payments are processed securely and also efficiently. As Denmark’s e-commerce industry continues to flourish, the role of payment gateways in simplifying transactions cannot be overstated.

FAQs

- Are payment gateways secure for online transactions?

- Yes, reputable payment gateways use advanced encryption and also security measures to protect sensitive data.

- Which payment gateway is best for small businesses in Denmark?

- MobilePay is an excellent choice for small businesses due to its simplicity and also popularity.

- What fees are associated with using payment gateways in Denmark?

- Transaction fees vary depending on the provider, so it’s essential to compare options and also choose one that suits your budget.

- Can payment gateways be integrated with popular e-commerce platforms in Denmark?

- Yes, most payment gateways offer plugins and also integrations for common e-commerce platforms.

- What does the future hold for payment gateways in Denmark?

- The future will likely see continued innovation in security and also mobile payment options, making transactions even more seamless for Danish businesses and consumers.