AUTHOR : EMILY PATHAK

DATE : 23 / 10 / 2023

Introduction

In the contemporary era of digital advancements, the manner in which financial transactions are carried out has undergone a profound and also revolutionary transformation. Whether you run an e-commerce business or simply want to make online purchases, payment gateways play a crucial role in ensuring the smooth flow of money in the virtual world. In this article, we’ll explore the world of payment gateways, their significance, and also how they simplify online transactions.Payment Gateway Demo

What is a Payment Gateway?

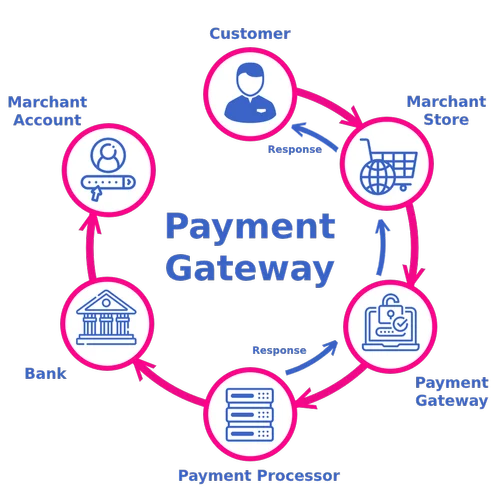

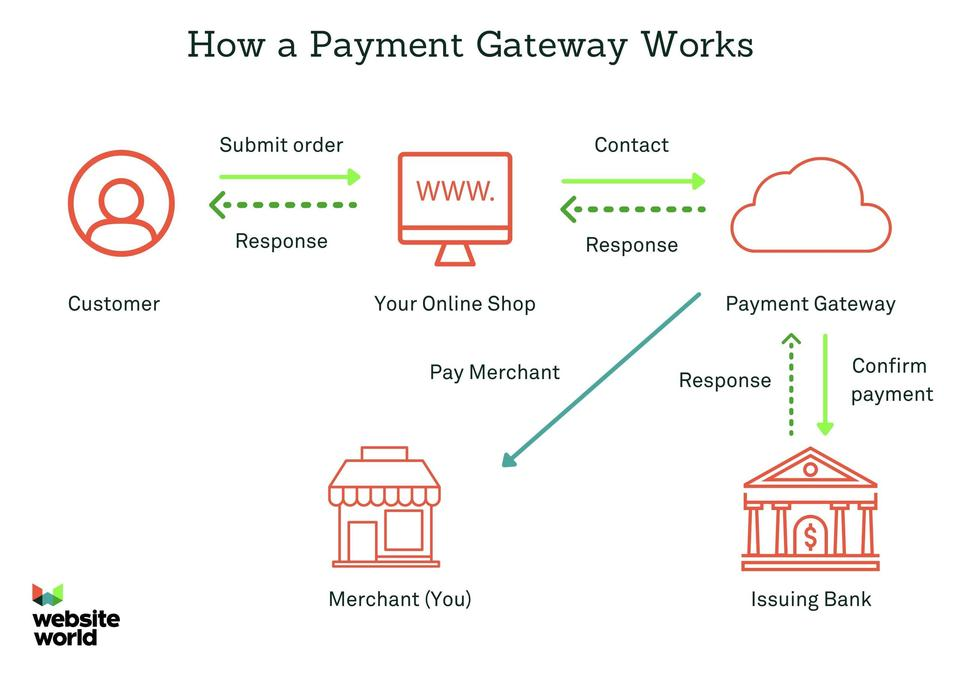

A payment gateway is a technology that facilitates online transactions [1]by acting as an intermediary between a customer, a merchant, and also the financial institutions involved. It allows customers to securely make payments for products or services on websites or mobile applications. Payment gateways[4] ensure that sensitive financial information[5] is transmitted safely and efficiently.Payment Gateway Demo

How Does a Payment Gateway Work?

Payment gateways function as follows:

- Step 1: The customer initiates a payment on a website.

- Step 2: The payment information is securely transmitted to the payment gateway.

- Step 3: The gateway encrypts and also forwards the data to the financial institution.

- Step 4: The financial institution approves or declines the transaction.

- Step 5: The payment gateway communicates the transaction status to the website, and also the customer receives confirmation.

The Importance of Payment Gateways

Payment gateways are vital for both customers and merchants[1]. They provide:

- Security: Customers can trust that their payment information is safe.

- Convenience: Payments are quick and also hassle-free.

- Global Reach: Merchants can accept payments from customers worldwide.

- Transaction Records: A history of transactions is maintained for reference.

Benefits of Using Payment Gateways

- Reduced Risk: Payment gateways reduce the risk of fraud and also chargebacks.

- Increased Sales: Easy payment options can lead to higher conversion rates.

- Enhanced User Experience: Streamlined transactions improve customer satisfaction.

- Enhanced Efficiency: Automated procedures not only conserve valuable time but also diminish the occurrence of errors, contributing to a smoother and also more precise operation

There are various types of payment gateways, including hosted gateways, integrated gateways, and self-hosted gateways. Each type caters to different business needs and also preferences.

How to Choose the Right Payment Gateway

Selecting the right payment gateway is essential for a successful online business. Factors to consider include transaction fees, security measures, and also compatibility with your e-commerce platform.Payment Gateway Demo

The setup process varies depending on the gateway chosen. Merchants typically need to register, provide necessary documentation, and also integrate the gateway with their website or app.

Security Measures in Payment Gateways

Security is a top priority for payment gateways[3]. They employ encryption, tokenization, and also other technologies to safeguard sensitive data.

Integration with E-commerce Platforms

Payment gateways are often designed to integrate seamlessly with popular e-commerce platforms like Shopify, WooCommerce, and also Magento, making it easier for businesses to accept online payments.

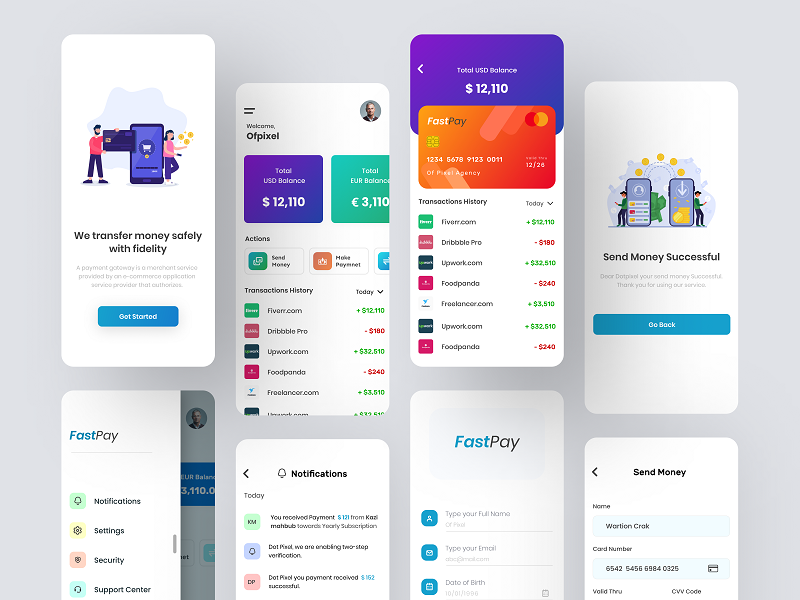

Mobile Payment Gateways

With the rise of mobile commerce, mobile payment gateways[1] have become essential. They cater to customers who prefer making purchases via smartphones and also tablets.

Challenges in Payment Processing

While payment gateways offer numerous benefits, challenges such as technical issues, fraud, and compliance with international regulations must be addressed.

Future Trends in Payment Gateways

The future of payment gateways includes innovations like biometric authentication, blockchain technology, and enhanced data analytics to improve security and also user experience.

The Evolution of Payment Gateways

Over the years, payment gateways [4]have evolved significantly. The initial iterations were basic and also had limited features, but with the rapid growth of e-commerce, they have become more sophisticated. Today, modern payment gateways offer various payment methods, subscription billing, recurring payments, and also seamless integrations with a wide range of platforms.

Payment Gateway Integration

One of the crucial factors for businesses is how smoothly a payment gateway integrates into their existing systems. Many gateways offer APIs (Application Programming Interfaces) and plugins that make integration a breeze. This ensures that businesses can start accepting online payments with minimal disruption.

Mobile Payment Gateways

As mobile devices have become the preferred choice for online browsing and shopping, mobile payment gateways have gained prominence. These gateways are optimized for mobile interfaces, making it easy for customers to make purchases using their smartphones. Mobile wallets and QR code payments are just some of the innovations in this space.

Conclusion

Payment gateways have revolutionized the way we handle online transactions. They provide the security and also convenience needed for e-commerce businesses and also consumers to thrive in the digital world. As technology continues to advance, we can expect even more secure and efficient payment solutions.

FAQs

1. Are payment gateways safe to use?

Payment gateways incorporate multiple security layers to ensure the safety of transactions, establishing them as a secure choice for online payments.

2. Can I use the same payment gateway for my e-commerce website and also mobile app?

Yes, many payment gateways are compatible with both websites and also mobile applications, providing a seamless payment experience for customers.

3. What is the typical cost associated with using a payment gateway?

The cost of using a payment gateway varies depending on the provider and also the specific features you require. It may include setup fees, transaction fees, and monthly subscription costs.

4. Are there payment gateways that support international transactions?

Yes, many payment gateways support international transactions, allowing businesses to reach customers around the world.