AUTHOR : ADINA XAVIER

DATE : 25/10/2023

In the fast-paced world of e-commerce and online businesses, ensuring seamless payment transactions is paramount. Customers expect a secure and efficient payment process, and businesses rely on reliable payment gateways. But how can you be sure that your payment gateway is up to the task? This article will guide you through the intricacies of payment gateway checking, providing you with a comprehensive understanding of this critical aspect of online commerce.

Introduction

The Role of Payment Gateways

Before delving into the intricacies of payment gateway checking, let’s understand the fundamental role of payment gateways. Payment gateways act as intermediaries between the customer and the merchant, facilitating secure transactions. They encrypt and transmit sensitive financial data, ensuring a safe and efficient process for both parties.

The Significance of Reliability

The reliability of a payment gateway directly impacts the success of your online business. An unreliable gateway can lead to frustrated customers, lost sales, and damage to your reputation. Therefore, regularly checking and monitoring your payment gateway is of utmost importance.

Understanding Payment Gateway Checker

Regular Testing

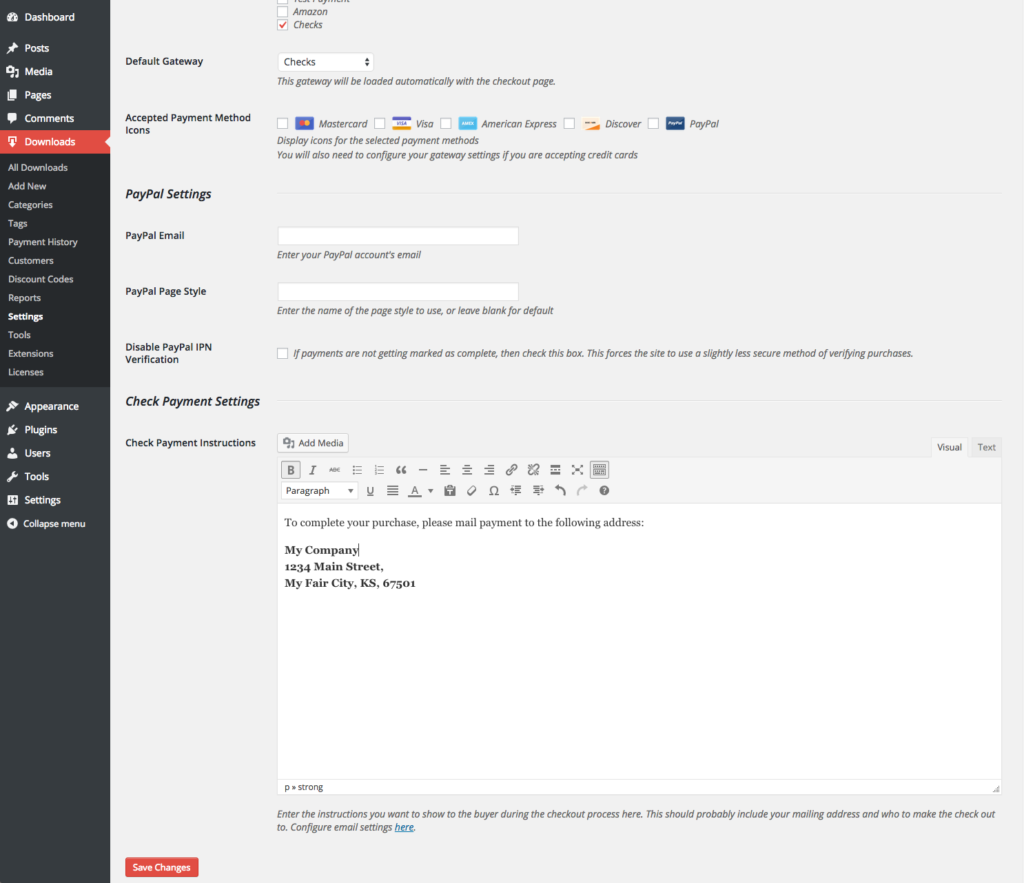

Testing your payment gateway[1] should be a routine practice. It involves simulating transactions, both successful and unsuccessful, to ensure the gateway can handle a variety of scenarios. This testing helps identify and resolve any issues before they impact your customers.

Security Assessments

Security is a primary concern when it comes to payment gateways. Regular security assessments and audits are essential to identify vulnerabilities and ensure that your customers’ data remains protected. This includes evaluating the gateway’s adherence to industry standards and regulations.

Compatibility Checks

Compatibility checks ensure that the gateway works effectively with your website or application. Any glitches or incompatibilities must be addressed promptly.

Common Issues and Solutions

Downtime

Downtime is a nightmare for any online business. Payment gateway[2] downtime can result from various factors, such as server issues or maintenance. To mitigate this, have a backup gateway in place and keep your customers informed about any planned downtime.

Slow Processing

Slow processing can lead to cart abandonment and frustrated customers. Optimize your gateway for speed, and consider using a Content Delivery Network (CDN) to reduce latency.

Payment Failures

Payment failures can occur due to a range of issues, including insufficient funds or declined cards. Implement clear error messages to guide customers, and provide alternative payment methods.

Best Practices for Payment Gateway Checker

Automate Testing

Utilize automated testing tools and scripts to regularly check your payment gateway. Automation ensures consistency and saves time.

Stay Informed

Keep abreast of industry trends and regulations[3] to ensure your payment gateway remains compliant and secure.

Monitor User Feedback

Pay attention to customer feedback and complaints. They can be early indicators of payment gateway issues that need addressing.

The Importance of Customer Trust

Building Customer Confidence

An efficient and secure payment gateway not only prevents issues but also builds trust among your customers. When customers feel confident that their financial information is safe, they are more likely to complete transactions. Trust is the foundation of customer loyalty in the world of e-commerce.

The Impact of Data Breaches

Data breaches and security lapses can lead to the exposure of sensitive customer data. Such incidents can have severe consequences, including legal liabilities and a tarnished reputation. Regular checks and robust security measures are essential to prevent data breaches.

A Holistic Approach to Payment Gateway Checker

User Experience Assessment

Consider the user experience when checking your payment gateway. The user interface should be intuitive, and the payment process[4] should be quick and straightforward. A complicated or lengthy payment process can deter customers.

Mobile Compatibility

With the increasing use of mobile devices for online shopping, it’s vital that your payment gateway is mobile-friendly. Ensure that it functions seamlessly on various screen sizes and operating systems.

Customer Support

A responsive and helpful customer support system can assist customers facing payment-related issues. It’s crucial to have well-trained staff available to provide assistance and guidance.

Conclusion

In the world of e-commerce, a smooth and reliable payment process is the backbone of your business. Regularly checking and maintaining your payment gateway is not just a best practice; it’s a necessity. By ensuring that your gateway is secure, efficient, and compatible, you can provide your customers with a seamless payment experience that builds trust and loyalty.

Frequently Asked Questions (FAQs)

- How often should I test my payment gateway? Regular testing is crucial; consider monthly checks and additional testing during peak seasons.

- What should I do if my payment gateway experiences downtime during a sale event? Have a backup gateway in place and inform customers of the temporary downtime to manage expectations.

- Are there specific security standards for payment gateways? Yes, Payment Card Industry Data Security Standard (PCI DSS) is a set of security standards designed to ensure that all companies that accept, process, store, or transmit credit card information maintain a secure environment.

- What can I do to prevent payment failures? Provide clear error messages, alternative payment methods, and offer assistance to customers facing issues.

- How do I go about selecting the most suitable payment gateway for my company? Research and select a payment gateway that aligns with your business needs, including scalability, security, and customer support.