AUTHOR : ADINA XAVIER

DATE : 21/09/2023

In today’s digital age, businesses of all sizes are expanding their online presence and seeking efficient ways to process payments securely. Payment Gateway APIs have emerged as indispensable tools, offering seamless transactions and enhanced user experiences. In this article, we will delve into the world of payment gateway APIs, exploring their benefits, functionalities, and, most importantly, how you can access them for free.

1.Introduction

In the rapidly evolving landscape of online commerce, businesses strive to provide customers with convenient, secure, and swift payment options. This quest has led to the widespread adoption of Payment Gateway APIs. In this comprehensive guide, we will demystify these APIs, explore their advantages, also unveil the top free options available for your business.

2. What is a Payment Gateway API?

A Payment Gateway API, in essence, is a digital bridge that connects an online store or application to a payment processor. It facilitates the transfer of payment information between the customer, the merchant, also the bank. This process ensures that transactions are swift, secure, and accurate.

3. Why Are Payment Gateway APIs Crucial?

Payment Gateway APIs play a pivotal role in the success of online businesses. They enable:

- Secure transactions that protect sensitive customer data.

- Streamlined payment processes[1], reducing cart abandonment rates.

- Access to a global customer base.

Now, let’s explore the different types of Payment Gateway APIs.

Types of Payment Gateway APIs

4.1 Hosted Payment Gateways

Hosted payment gateways redirect customers to a third-party page to complete their transaction. While this option is convenient, it may lead to a less seamless user experience.

4.2 Self-hosted Payment Gateways

Self-hosted payment gateways[2] allow customers to complete transactions without leaving your website. They provide more control over the checkout process but require additional security measures.

4.3 API-Only Payment Gateways

API-only payment gateways offer the highest level of customization. They integrate directly into your website or application, providing a seamless payment experience.

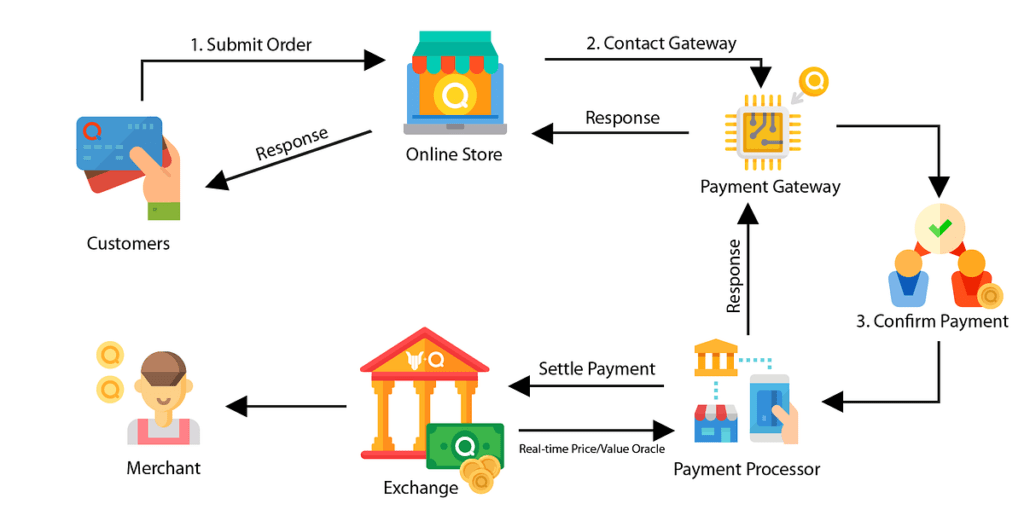

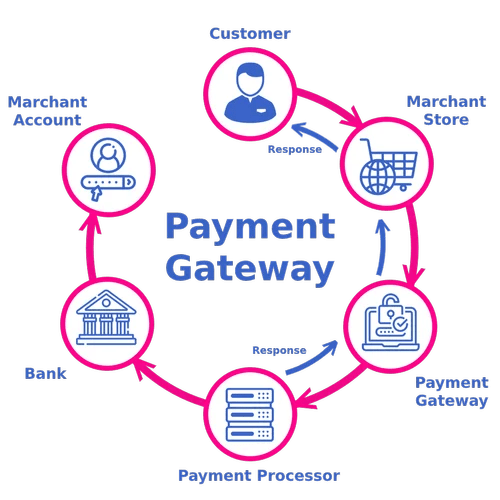

5.How Do Payment Gateway APIs Work?

Payment Gateway APIs function as intermediaries that facilitate secure data transfer between the customer’s browser, the merchant’s server, also the payment processor. The process involves several steps:

- Customer initiates payment.

- Merchant’s server sends payment data to the payment gateway.

- Payment gateway encrypts and securely transmits data to the payment processor.

- Payment processor verifies the transaction with the bank.

This intricate process ensures the security and accuracy of online payments.

Benefits of Using Payment Gateway APIs

6.1 Enhanced Security

Payment Gateway APIs employ robust encryption protocols, safeguarding sensitive customer information. This reassures customers also builds trust.

6.2 Improved User Experience

Smooth, hassle-free transactions enhance the overall shopping experience, reducing cart abandonment rates and encouraging repeat business.

6.3 Global Reach

Payment Gateway APIs allow businesses to accept payments from customers worldwide, breaking down geographical barriers[3].

6.4 Streamlined Payment Processing

Efficient payment processing minimizes delays and ensures that funds are transferred promptly to the merchant’s account.

Top Free Payment Gateway APIs

Now, let’s explore some of the top free Payment Gateway APIs that can supercharge your online business:

7.1 PayPal REST API

PayPal offers a versatile REST API that allows businesses to accept payments online, in-app, or in person. With its extensive documentation also developer-friendly features, PayPal is a popular choice.

7.2 Stripe API

Stripe is known for its developer-centric approach. Their API simplifies online payments[4], subscription billing, also much more. It’s a go-to choice for startups also established businesses alike.

7.3 Square Payment API

Square provides a robust Payment API that seamlessly integrates with websites and applications. It’s especially suited for businesses with physical and digital storefronts.

How to Integrate a Payment Gateway API

8.1 Sign Up for an API Key

To get started with any Payment Gateway API, you’ll need to sign up for an API key or account credentials.

8.2 API Documentation

Thoroughly review the API documentation provided by your chosen payment gateway. It will guide you through the integration process.

8.3 Integration Steps

Follow the step-by-step integration instructions provided in the documentation. Ensure that you test your integration thoroughly before going live.

Customizing Payment Gateway Integration

9.1 Branding

Tailor the payment gateway integration to match your brand’s aesthetics, providing a consistent user experience.

9.2 Payment Methods

Select the payment methods that best suit your customers’ preferences also needs.

9.3 Currency Support

Ensure that the payment gateway supports the currencies you intend to transact in, especially if you have a global customer base.

Testing Your Payment Gateway

10.1 Sandbox Environment

The majority of payment gateways provide a dedicated sandbox environment for conducting testing also experimentation. Use this to simulate transactions[5] also ensure that your integration works flawlessly.

10.2 Real Transactions

Before going live, conduct real transactions with small amounts to verify that everything is functioning as expected.

Conclusion

In this article, we’ve explored the world of Payment Gateway APIs, understanding their importance, benefits, and how to integrate them seamlessly into your business. By choosing the right payment gateway API and following best practices, you can enhance the payment experience for your customers and boost your online business.

FAQs

1. Are Payment Gateway APIs secure?

Yes, Payment Gateway APIs prioritize security through data encryption also compliance with industry standards like PCI DSS.

2. Can I use multiple payment gateway APIs on my website?

Yes, you can integrate multiple payment gateway APIs to offer diverse payment options to your customers.

3. Are there any fees associated with using free Payment Gateway APIs?

While these APIs are free to integrate, they may have transaction fees that vary based on your usage.

4. How do I choose the right Payment Gateway API for my business?

Consider your specific needs, such as accepted payment methods, currency support, and integration flexibility when selecting the best API for your business.

5. What is the future of Payment Gateway APIs?

The future holds exciting possibilities, including enhanced security features, improved user experiences, and broader global reach for businesses.

Get In Touch